In short the answer is NO.

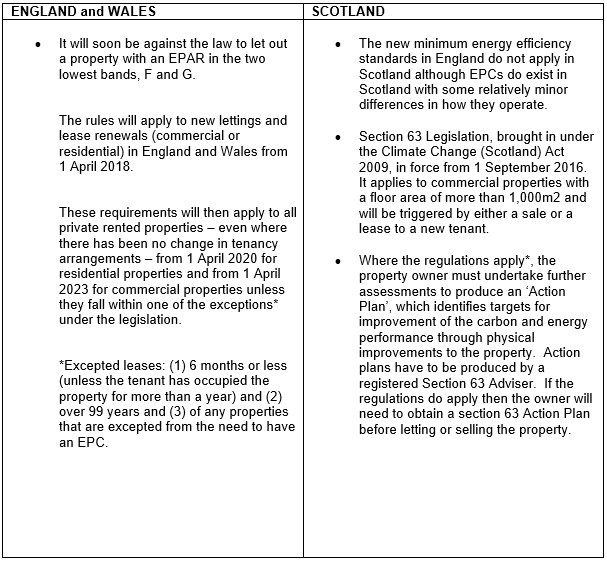

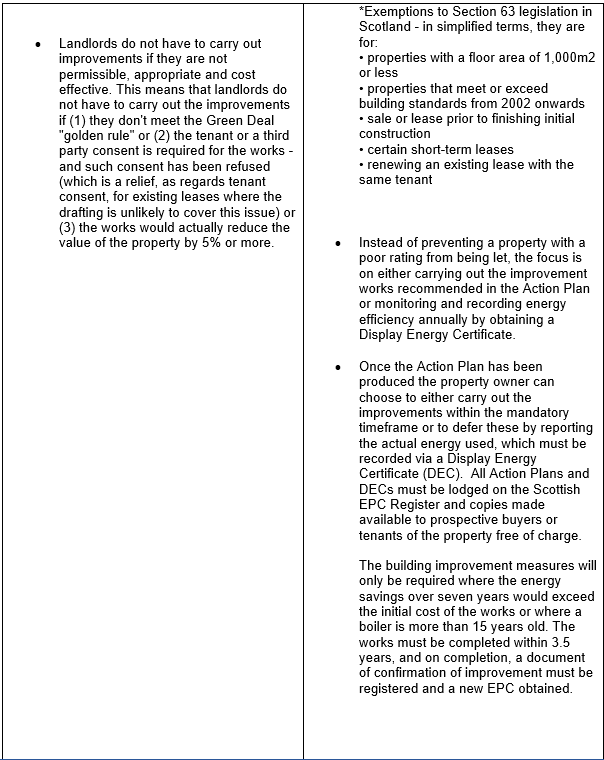

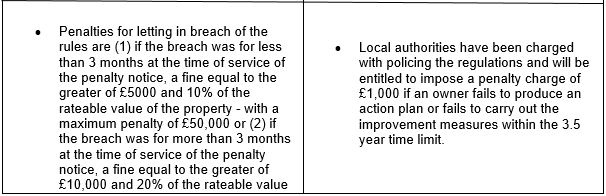

In England and Wales, regulations which are due to come into force on 1 April 2018 will potentially affect the ability to let out properties and the market value (and marketability) of those properties. The regulations will prevent private Landlords from letting either residential or commercial properties with an Energy Performance Asset Rating (EPAR) lower than E (unless they can point to a specific exemption).

The equivalent regulations for buildings in Scotland do not impose a minimum EPC rating requirement but other measures apply that are already in force for commercial properties.

Landlords, investors, developers and lenders should take note of the differences and not assume energy efficiency policies are the same throughout the UK.

*Non Domestic EPC Register for England and Wales

*EPC Register for Scotland

Registers can be searched using the property’s postcode so the easiest way to determine whether or not a valid EPC exists for your property is to check online: Non Domestic EPC Register for England and Wales or EPC Register for Scotland.

If you have any queries regarding energy efficiency requirements for properties, please get in touch with your usual contact in the Property team at Blackadders.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in November 2017 was £145,992 – an increase of 3.6 per cent on November in the previous year and an increase of 1.1 per cent when compared to the previous month.

This compares to a UK average of £226,071, which was an increase of 5.1 per cent on November in the previous year and an increase of 0.1 per cent when compared to the previous month.

The volume of residential sales in Scotland in September 2017. was 9,323 – a decrease of 2.5 per cent on September 2016 and a decrease of 0.5 per cent on the previous month. This compares with annual decreases in sales volumes of 14.8 per cent in England, 6.6 per cent in Wales and 8.6 per cent in Northern Ireland (Quarter 3 – 2017).

Registers of Scotland Business Development and Information Director Kenny Crawford said: “Average prices in Scotland continued their upward trend in November with an increase of 3.6 per cent when compared to November 2016. Average prices have been steadily increasing each month since March 2016, when compared with the same month of the previous year.

“Residential sales volumes decreased in September. The annual decrease of 2.5 per cent when compared with September 2016 in Scotland is in the context of greater decreases across the rest of the UK. The cumulative volume of sales. for Scotland for the financial year to date – from April to September 2017 – was 54,893. This is an increase of 9.1 per cent on the equivalent year to date position for September 2016.”

The top five local authorities in terms of September sales volumes were the City of Edinburgh (1,124 sales), Glasgow City (1,067 sales), Fife (706 sales), South Lanarkshire (595 sales) and North Lanarkshire (451 sales).

Average price increases were recorded in three quarters (24) of all local authorities in November 2017, when comparing prices with the previous year. The biggest price increases were in West Dunbartonshire, East Lothian and the City of Edinburgh, where the average prices increased by 10.3 per cent to £106,216, 8.1 per cent to £217,106 and 8.0 per cent to £246,508 respectively. The biggest decreases were recorded in Aberdeen City and Argyll and Bute where prices fell by 4.2 per cent to £163,489 and 3.9 per cent to £127,373 respectively.

Across Scotland, most property types showed an increase in average price in November 2017 when compared with the same month in the previous year. Flat or maisonette properties showed the biggest increase, rising by 7.2 per cent to £108,881. The average price of detached properties showed a decrease of 3.6 per cent to £235,744.

The average price in November 2017 for a property purchased by a first time buyer was £121,574 – an increase of 6.5 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £169,670 – an increase of 0.7 per cent on the previous year.

The average price for a cash sale was £135,641 – an increase of 4.0 per cent on the previous year – while the average price for property purchased with a mortgage was £150,733 – an increase of 3.5 per cent on the previous year.

Blackadders are delighted to announce a new display window within London Road, Edinburgh.

Blackadders are delighted to announce a new display window within London Road, Edinburgh.

Property Services Director, Martin Paterson commented: “This will be a great addition to Blackadders Estate Agency having a further display window within a main arterial route”.

Edinburgh Property Manager, Scott Whigham is optimistic about the year ahead: “The signs for the Edinburgh market are good in 2018. I am anticipating a similar year to last year where I think prices above Home Report value will be achieved on a regular basis. This is undoubtedly down to fewer houses being on the market and it really is about supply and demand at the moment. Over the past couple of years I have seen a change in the market from it being a buyer’s market to it now being very much in the seller’s favour.

Previously, when the stock levels were higher, buyers had their pick of properties and could, to a certain degree, dictate the price they were willing to pay. Closing dates are now being set on almost every property we sell and buyers are having to put their best offers in to secure the home they want.

To sum up, I believe 2018 will be a great year to maximise the full value of your home”.

If you would like to arrange a Free, No Obligation, Marketing Appraisal of your home please give our Property Sales Team a call on 0131 202 1868 (7 days).

Welcome to the first property blog of 2018! Rest assured that this year will see more property blogs.

Welcome to the first property blog of 2018! Rest assured that this year will see more property blogs.

I predict that 2018 will be a very interesting year for the property market. Before I give you my predictions for 2018 though, how did I get on with my predictions for 2017?

Looking at my blog on the 9th of January last year I predicted a 5% decrease in market activity with a slight increase in house prices averaging around the 2% to 4% mark. Whilst I think I was correct in relation to the general road of travel, the decrease in activity in the property market (especially in the second half of the year) appears to have been steeper than even I had predicted.

As yet, I have not seen the final stats for 2017 and obviously there are geographical differences to take into account, but I would predict that Scotland overall would show a decrease of between 10% and 15% in relation to properties coming on to the market, with a perhaps more significant increase in average house prices, probably around 5%. There have been recent reports advising that November saw the sharpest drop in mortgage approvals for a number of years and as different areas start issuing their stats, I think this general downward trend will be repeated.

On to 2018 and I am actually looking at this year with more optimism than the last year. What is the reason for the optimism? Like a bottle of champagne being constantly shaken, the housing market, with its links to lifestyle choices, will eventually not be contained no matter what the economic background. I suspect that 2018 particularly the second half of the year will show this and although uncertainty around Brexit will continue it will become something that we live with. As economic uncertainty fades and as general lifestyle requirements kick in, I think we will see an increase in activity in the housing market.

I also think that developers sensing the lack of supply and price inflation, have now started to increase their build output. I believe that this will be the oil that greases the wheels of the property market especially if the developers offer part exchange and other incentives.

In relation to specific areas, I would comment as follows:-

- ABERDEEN & ABERDEENSHIRE– I am starting to see green shoots of activity coming through the Aberdeen property market and whilst it will take some time for the extra stock to clear, I do believe that Aberdeen is on the cusp of recovery. Although we will not get back to the highs of pre 2010, we will over the next 18 months move very quickly towards some form of normality and a free flowing market.

- DUNDEE– As the V&A moves towards its opening and Dundee Council carry on with their exciting plans for the development of the waterfront area and the city in general, I do think that Dundee is on the cusp of very exciting times in relation to the property market. In particular watch this space in relation to flats down at the waterfront which are looking very reasonably priced and very attractive for investors and also residents.

- ANGUS– The Angus market continues to prove robust and as Aberdeen continues to improve expect more of this heat to work its way down the coast, in particular Montrose, Brechin, Arbroath, etc.

- PERTH & PERTHSHIRE– This market is proving very difficult as its driver in the early 2000s was the heat from the Edinburgh market. Unfortunately, I cannot see a big increase in the Perth property market, although I do predict more stability and a slight increase in activity.

- FIFE– This also appears to be a difficult market, however with some hot spots, St Andrews in particular proving very popular and prices continuing to exceed expectations. Again, I predict a degree of stability in the Fife market.

- EDINBURGH– I see potential for further growth in the Edinburgh market. I think that the developers will continue to produce stock for this market and as such, I am anticipating some significant growth, both in terms of activity and prices in 2018.

- GLASGOW & the WEST– Again, I am seeing positive signs and think that in particular the second half of 2018 will show significant increases in activity in the Glasgow market fuelled by a mixture of newbuild development.

Overall, I am predicting a slightly quiet first three months for 2018 with a steady increase in activity for the remainder of the year culminating in activity levels being up by 10% and prices increasing by 5%. As always, watch out for the first quarter figures as this will be a good indication. The phrase “more optimistic than last year” probably sums up my feelings.

I will continue to provide blogs on aspects of the property market and also watch out for some interesting additions, including “dinners for winners” – my take on the late, Michael Winner’s weekly column in the Sunday Times.

Finally, I would wish all readers a happy and prosperous 2018.

A new Code of Practice is being introduced in January 2018, regulating the way letting agents deliver their services in Scotland

On 31 January 2018 anyone who undertakes residential letting agency work in Scotland must ensure their service delivery is fully compliant with The Letting Agent Code of Practice (Scotland) Regulations 2016. The Code has been designed to follow the lettings process from start to finish and regulates the activities of an agent, from signing up landlords to taking instructions and managing the agreement to ensuring adequate protection of clients’ money and holding appropriate insurance.

Who is affected by the new rules?

The new rules apply to “every person who carries out letting agency work”, meaning it could impact on a number of organisations and businesses which may not generally be considered as letting agents.

In the Act, letting agency work is defined as work which is:

• undertaken on behalf of a private landlord who wants to let their property out to a tenant; or

• undertaken to manage a property (including collecting rent, inspecting the property and arranging for repairs and maintenance) which is either currently or is intended to be rented out to a tenant.

This definition is wide and it may not be obvious whether or not your activities could be considered ‘letting agency work’, and in unusual cases the determining factor will be the circumstances of the arrangement you have in place. Sometimes scenarios involving rural estates and multi-function organisations could fall into this category.

When do I need to register by?

It will also be mandatory for individuals and organisations undertaking letting agency work in Scotland to be registered by 31 September 2018. All those applying to be on the register will need to meet standards as laid out in a ‘fit and proper person test’ and comply with the necessary training requirements in order to be accepted.

Failure to comply and operating as a non-registered letting agent will be a criminal offence and the courts could impose a maximum fine of up to £50,000 and prison sentences of up to 6 months for those convicted.

How do I get ready?

If you work in the private letting sector you should be familiar with the Code of Practice and consider revising your Terms of Business, internal policies and procedures in preparation for the Code coming into force. It is likely the register will start accepting applications in early 2018, so applications should be made as soon as possible to avoid unforeseen delays.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in October 2017 was £143,544 – an increase of 2.8 per cent on October in the previous year and a decrease of 0.7 per cent when compared to the previous month.

This compares to a UK average of £223,807, which was an increase of 4.5 per cent compared to October in the previous year and a decrease of 0.5 per cent when compared to the previous month.

The volume of residential sales in Scotland in August 2017 was 9,282 – an increase of 7.4 per cent on August 2016 and an increase of 5.3 per cent on the previous month. This compares with annual decreases in sales volumes of 12.0 per cent in England, 3.4 per cent in Wales and 8.6 per cent in Northern Ireland (Quarter 3 – 2017).

Registers of Scotland Operations Director and Accountable Officer Janet Egdell said: “Average prices in Scotland continued their upward trend in October with an increase of 2.8 per cent when compared to October 2016. Average prices have been steadily increasing each month since March 2016, when compared with the same month of the previous year.

“Residential sales volumes increased in August. The annual increase of 7.4 per cent when compared with August 2016 in Scotland compares to decreases across the rest of the UK. The cumulative volume of sales for Scotland for the financial year to date – from April to August 2017 – was 45,152. This is an increase of 9.9 per cent on the equivalent year to date position for August 2016.”

The top five local authorities in terms of August sales volumes were the City of Edinburgh (1,190 sales), Glasgow City (1,109 sales), Fife (632 sales), South Lanarkshire (553 sales) and North Lanarkshire (448 sales).

Average price increases were recorded in 29 out of 32 local authorities in October 2017, when comparing prices with the previous year. The biggest price increases were in Dumfries and Galloway and City of Edinburgh, where the average prices increased by 10.5 per cent to £129,885 and 8.5 per cent to £247,568 respectively. The biggest decreases were recorded in Inverclyde and Aberdeen City where prices fell by 4.0 per cent for both to £94,985 and £164,655 respectively.

Across Scotland, all property types showed an increase in average price in October 2017 when compared with the same month in the previous year. Semi-detached properties showed the biggest increase, rising by 4.2 per cent to £151,131. The average price of detached properties showed the smallest increase, 0.9 per cent to £248,482.

The average price in October 2017 for a property purchased by a first time buyer was £116,042 – an increase of 3.4 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £172,056 – an increase of 2.3 per cent on the previous year.

The average price for a cash sale was £132,489 – an increase of 2.9 per cent on the previous year – while the average price for property purchased with a mortgage was £148,669 – an increase of 2.8 per cent on the previous year.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in September 2017 was £144,924 – an increase of 3.1 per cent on September in the previous year and a decrease of 1.3 per cent when compared to the previous month.

This compares to a UK average of £226,367, which was an increase of 5.4 per cent on September in the previous year and an increase of 0.4 per cent when compared to the previous month.

The volume of residential sales in Scotland in July 2017 was 8,725 – a decrease of 5.7 per cent on July 2016 and a decrease of 18.3 per cent on the previous month. This compares with annual decreases in sales volumes of 17.1 per cent in England, 11.3 per cent in Wales and 8.6 per cent in Northern Ireland (Quarter 3 – 2017).

Registers of Scotland business development and information director Kenny Crawford said: “Average prices in Scotland continued their upward trend in September with an increase of 3.1 per cent when compared to September 2016. Average prices have been steadily increasing each month since March 2016, when compared with the same month of the previous year.

“Residential sales volumes declined in July. The annual decrease of 5.7 per cent on July 2016 in Scotland was the smallest across the UK. The cumulative volume of sales for Scotland for the financial year to date – from April to July 2017 – was 35,484. This is an increase of 10.5 per cent on the equivalent year to date position for July 2016.”

The top five local authorities in terms of July sales volumes were the City of Edinburgh (1,145 sales), Glasgow City (1,018 sales), Fife (607 sales), South Lanarkshire (510 sales) and North Lanarkshire (436 sales).

Average price increases were recorded in 30 out of 32 local authorities in September 2017, when comparing prices with the previous year. The biggest price increase was in the City of Edinburgh, where the average price increased by 9.0 per cent to £248,702. Decreases were recorded in Aberdeenshire and Aberdeen City, where prices fell by 2.0 per cent to £192,292 and by 3.5 per cent to £165,275 respectively.

Across Scotland, all property types showed an increase in average price in September 2017 when compared with the same month in the previous year. Flatted properties showed the biggest increase, rising by 4.2 per cent to £105,398. The average price of semi-detached properties showed the smallest increase, 2.1 per cent to £149,616.

The average price in September 2017 for a property purchased by a first time buyer was £117,510 – an increase of 3.1 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £173,160 – also an increase of 3.1 per cent on the previous year.

The average price for a cash sale was £133,783 – an increase of 2.9 per cent on the previous year – while the average price for property purchased with a mortgage was £150,085 – an increase of 3.2 per cent on the previous year.

Ryden has secured the Old Ambulance Station at 77 Brunswick Street, just off Leith Walk in Edinburgh, on behalf of the Trust established to preserve the artistic legacy of renowned painter Wilhelmina Barns-Graham.

Ryden has secured the Old Ambulance Station at 77 Brunswick Street, just off Leith Walk in Edinburgh, on behalf of the Trust established to preserve the artistic legacy of renowned painter Wilhelmina Barns-Graham.

A 10-year lease at a rent of £12 per sq ft was agreed for the 231 sq m (2,482 sq ft) two-storey property which had been used previously as a creative venue for various exhibitions from new artists.

The Wilhelmina Barns-Graham Trust will use the space for its office facilities, to house any art not currently being exhibited and as an educational centre where private viewings can be arranged by appointment for individuals to study and learn more about Wilhelmina’s art.

The Trust was previously located in St Andrews, where Wilhelmina was born, but appointed Ryden to find new suitable accommodation after their facility at Balmungo House was sold. The Trust was keen to locate in Edinburgh given the strength of art and culture in the city, the presence of the National Galleries and the fact that Wilhelmina attended the Edinburgh College of Art.

Peter I’Anson, partner at Ryden who secured the new accommodation for the charity, comments: “I was delighted to work with the trustees to find a new suitable home that met the charity’s requirements and the Old Ambulance Station provided the ideal space. Restoration works have now completed at the property and the Trust has relocated to its new facility.”

Wilhelmina Barns-Graham’s artwork is to be found in public galleries and museums across the UK and internationally, including institutions such as the Tate, Scottish National Gallery of Modern Art, the V&A Museum and Aberdeen Art Gallery.

Lambert Smith Hampton advised the private landlord in the transaction.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in June 2017 was £144,253 – an increase of 2.9 per cent on June in the previous year and an increase of 0.1 per cent when compared to the previous month.

This compares to a UK average of £223,257, which was an increase of 4.9 per cent compared to June in the previous year and an increase of 0.8 per cent when compared to the previous month.

The volume of residential sales in Scotland in April 2017 was 7,908 – an increase of 16.0 per cent on April 2016 but a decrease of 14.2 per cent on the previous month. This compares with annual increases in sales volumes of 1.6 per cent in England, 9.9 per cent in Wales and 5.0 per cent in Northern Ireland (Quarter 2 2017).

Registers of Scotland business development and information director Kenny Crawford said: “Average prices in June continued their upward trend when compared with June 2016. There have been increases in every month since March 2016 when compared with the same month of the previous year.”

“Sales volumes figures for April 2017 showed an increase in Scotland of 16.0% when compared with April 2016. However, volumes in April 2016 were lower than usual, a possible effect of the introduction of changes to the Land and Buildings Transaction Tax that came into effect on 1 April 2016.”

The top five local authorities in terms of sales volumes were the City of Edinburgh (964 sales), Glasgow City (868 sales), Fife (543 sales), South Lanarkshire (511 sales) and North Lanarkshire (411 sales).

Price increases were recorded in 29 out of 32 local authorities in June 2017 compared to the previous year. The biggest price increase was in Glasgow City where the average price increased by 8.5 per cent to £123,609. The biggest decrease was again in the City of Aberdeen, where prices fell by 10.0 per cent to £163,847.

Across Scotland, all property types showed an increase in average price in June 2017 when compared with the same month in the previous year. Flatted properties showed the biggest increase, rising by 4.3 per cent to £104,289.

The average price in June 2017 for property purchased by a first time buyer was £116,315 – an increase of 2.5 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £173,088 – an increase of 3.1 per cent on the previous year.

The average price for a cash sale was £136,785 – an increase of 5.1 per cent on the previous year – while the average price for property purchased with a mortgage was £149,192 – an increase of 2.6 per cent on the previous year.

Following a competitive tender process against two rival firms, Ryden has secured a prestigious three-year contract with Edinburgh Airport to provide a property database management service to manage leases, legal documentation and billing support for a portfolio of 170 leases.

Following a competitive tender process against two rival firms, Ryden has secured a prestigious three-year contract with Edinburgh Airport to provide a property database management service to manage leases, legal documentation and billing support for a portfolio of 170 leases.

The firm’s ability to provide a bespoke service, offer access to local senior-level surveying and accounting teams and its proven track record of managing unique portfolios were key factors cited by Edinburgh Airport as to why Ryden was the ideal choice to service their instruction.

This is the latest appointment Ryden has secured with Edinburgh Airport, having previously won contracts to provide a property asset valuation service and a reinstatement cost assessment for the airport’s portfolio.

Clare Edgar, associate in Ryden’s Property Management team and project lead, said: “This is no ordinary management mandate given the specialist nature of the portfolio. Our team is therefore looking forward to getting started and providing a first-class service. We’ll be collaborating closely with the airport and implementing a robust asset management system that evolves with our client’s requirements.”

Judy George, Head of Property and Commercial Transport from Edinburgh Airport, commented: “Having access to a bespoke software system aligned to our portfolio requirements as well as being supported by the experienced team at Ryden will allow us to accelerate the delivery of our dynamic property strategy.”

Ryden’s property management team manages over 6 million sq ft of property throughout Scotland and the north of England, with over 1,300 tenants on a rent roll of over £54 million.