The ScotRail Alliance is advising those heading to the TRNSMT festival this weekend to make their travel plans now.

Music fans heading to see the likes of Radiohead, Kasabian and Biffy Clyro are warned that trains to and from Glasgow will be busier than normal all weekend, and those planning to attend are encouraged to travel early in the day where possible.

The ScotRail Alliance will be adding extra carriages to services through Bridgeton, and on key routes to and from Glasgow wherever possible all day on Saturday and Sunday. There will also be extra carriages on late evening services on Friday.

The last trains on many routes will depart before, or very shortly after, the event ends each night. Fans are urged to double-check the times of their last trains, and make alternative arrangements to get home if they plan on staying later.

With huge numbers expected to attend, queueing systems will be in place at key stations across the network and extra staff will be on hand to help things goes smoothly.

Top five tips

1. Buy your ticket before you board. You’ll need a valid ticket for travel, and checks will be in place at many stations.

2. Check your train times. Remember to leave time to catch any connecting services that you need.

3. Listen up! We’ll have extra staff on the ground to help things go smoothly. To help them help you, please listen to their instructions.

4. Download the ScotRail app. You can use it to buy tickets, check train times, and see live service information.

5. Don’t leave it too late – services will be busy, and you might not be able to board your first choice of train.

Communications director Rob Shorthouse said: “The new festival is an exciting event, and we will be doing everything we can to help make it a success.

“Thousands of people will be travelling to the event, so we will be adding extra carriages to services right across the central belt and the west of Scotland to try to make things a bit easier for people.

“But trains will be much busier than usual, so we encourage people to plan their journey in advance and make sure they have their ticket before boarding.”

Founded in 2003, Lugo is a Scottish IT company which provides robust IT systems and support for businesses throughout Scotland with Solid Strategies, Customer Centric advice & State of the Art Technologies.

They are proud to partner with market leaders, including Microsoft, Dell and SonicWALL, and truly value the loyalty of their accountancy customers over the past 14 years.

Role: Senior Technical Support Analyst

Location: Edinburgh City Centre

Closing date: 14 July 2017

Lugo have certified support technicians based all over the country with offices in Edinburgh, Glasgow, Dundee and Inverness, providing local support to a variety of business sectors.

They passionately believe in supporting their people to perform to the best of their abilities. To this end, they are provided with 1-2-1 coaching for a full day every fortnight. This is supported with personal development meetings every 60 days and the opportunity to work with new technology and further their own abilities, to keep their knowledge relevant to the ever-changing industry.

Due to continued growth, Lugo require an experienced Senior Technical Support Analyst to join the busy, highly professional team. Your core hours would be 9am-5pm. The successful candidate will have knowledge of forthcoming tech developments and industry considerations, such as cyber essentials and GDPR. There would be the option to be based from the Glasgow or Edinburgh office. They are looking for someone with a genuine passion for IT – it’s not just a job for you!

http://www.s1jobs.com/job/it-telecommunications/support/edinburgh/660010168.html

Glasgow and Edinburgh become UK pioneers for new G.fast technology

Glasgow and Edinburgh become UK pioneers for new G.fast technology

Thousands of people in parts of Edinburgh and Glasgow can now get some of the fastest broadband speeds in the country as Openreach has begun switching on the pilot areas for its new ultrafast broadband network.

Around 16,900 households and businesses in parts of Sighthill, Gorgie, Corstorphine, Murrayfield, Fountainbridge, Craiglockhart, the Meadows and Morningside in Edinburgh and parts of Linn and Rutherglen in Glasgow are set to benefit from the new ultrafast service, known as G.fast, which provides download speeds of up to 330Mbps – more than 10 times the UK average.

The faster speeds that ultrafast broadband brings means a two hour HD film can be downloaded in just 90 seconds, a 45 minute HD TV show in just 16 seconds and a nine hour audio book in just three seconds.

People living in the pilot areas who want to try the new service should contact their internet service provider to see if they’re offering a service, and to find out more about availability and pricing.

Andrew Hepburn, Openreach fibre programme director for Scotland, said: “A huge amount of effort and substantial investment has already taken place in the development of this exciting new technology. So I’m delighted to announce that we can now start connecting the first people in Scotland to this new technology.

“These pilot schemes are hugely important to us and to the local households and businesses, which will be able to benefit from G.fast. Whether you are somebody aiming to work more efficiently or grow your business, or a household going online for shopping, entertainment or studies, fast access to the internet has never been more important. We know the technology works and can be a major benefit for customers, but these pilots will now help us test and improve all the factors involved in rolling out G.fast on a national scale.”

Kim Mears, Openreach managing director for infrastructure delivery, added: “The UK is ahead of its major European neighbours when it comes to superfast broadband but technology never stands still – that’s why we’re building on our existing fibre network and leading the way in deploying ultrafast speeds.

“We need to stay ahead in order to meet the evolving needs of our customers. G.fast will allow us to do that by building on the investment we have made in fibre to date. It will transform the UK broadband landscape from superfast to ultrafast, and it will reach the largest number of people in the quickest possible time.”

Engineers have spent recent months upgrading the network in several parts of Edinburgh and Glasgow to prepare for the arrival of the G.fast broadband pilot scheme.

The cities were announced as pilot locations for G.fast in October 2016, as part of Openreach’s ambition to make ultrafast broadband available to 12 million UK homes by the end of 2020.

G.fast technology changes the way today’s broadband is transmitted, delivering ultrafast speeds that have previously required fibre to be run all the way to the premises (FTTP). This is significant as G.fast will enable Openreach, the local network business which is part of BT Group, to make ultrafast fibre available to a much larger number of homes and businesses and more quickly than if it had focused on FTTP alone.

It builds on the success of the rollout of superfast broadband, which has already reached more than 442,000 homes and businesses in Glasgow and Edinburgh.

Overall, more than nine out of ten premises across the UK can access superfast speeds today with around another 17,000 homes and businesses being enabled each week.

Following the early trials of G.fast in Cambridgeshire, Gosforth and South Wales, the 17 pilot areas have extended that reach even further – already reaching more than 100,000 homes across the UK.

People wanting to take advantage of the new ultrafast technology can find out more about which providers offer this service by visiting www.openreach.co.uk/buyultrafast

Capital Document Solutions is delighted to be exhibiting at the SFHA annual conference at the invitation of the Scottish Federation of Housing Association.

This year’s conference is at the DoubleTree by Hilton, Glasgow on the 1st and 2nd of June.

Delegates, exhibitors and speakers from central government and also housing sectors throughout Scotland are expected to attend this SFHA conference.

Capital will be exhibiting as a guest of the SFHA. They will be part of the Interactive Hub in the ballroom foyer, a new feature for the conference aiming to offer an opportunity for presenters to show off their work and to get insightful feedback, and for delegates to see and try out some of the latest technological developments. It will also be where the SFHA Registration Desk & Information Desks is.

Alister Watt and Fraser Robertson, procurement contract managers, will be there to informed attendees on the very latest technology. Furthermore, Will Glass of ArtSystems will also be on hand to give the latest news and demonstrations on Makerbot 3D printers, as well as guidance on how CDS can assist businesses and organisations to make substantial cost savings, improve document processes, increase security and minimise their impact on the environment.

Housing the future

“The SFHA annual conference is the place to join fellow innovators to spark ideas and push boundaries to ensure the sector has a future that shines like a beacon of light”.

The conference will explore their chance to lead on a renewed ambition which is especially relevant for the next generation.

This year’s speakers includes Neil McLean of the Social Enterprise Academy. The Academy has continued to grow throughout the world. Consequently they now have locations with partners in Australia, South Africa and Malawi.

Najimee Parveen, who is the director of positive action training in housing of PATH. PATH mentors and also coaches trainees to access employment in the Housing Sector.

The SFHA is the national representative body for Scotland’s housing associations and co-operatives. Established in 1975. The SFHA exists to support the work of housing associations and co-operatives by providing services, advice and policy guidance.

• The Barclays UK Property Predictor reveals Glasgow’s suburbs set to increase by almost a quarter, followed by City of Edinburgh and Stirling

• Property prices across Scotland will rise by almost 6% in the next five years, bringing the average property value to almost £180,000

Glasgow’s suburbs are predicted to see the largest increase in average house prices in Scotland by 2021 according to new research released today (24 May 2017), the Barclays UK Property Predictor.

Affluent areas in Glasgow’s outskirts, East Renfrewshire and East Dunbartonshire, are set to rise by almost a quarter (23.8% / 22.5% respectively) over the next five years. Hot on its heels is City of Edinburgh (20.2%) and Scotland’s central belt hotspot, Stirling (19.1%).

Over the next five years, high employment rates, growth in private housing market levels and an increase in rates of average earnings will contribute to rising property prices across Scotland. The country is expected to see an overall average increase of almost 6% across the next five years, making it the fifth highest performing region across the UK, behind London (11.88%), East of England (9.38%) the South East (8.74%) and the Midlands (6.28%).

The Barclays UK Property Predictor provides a three-to-five year forecast of investment hotspots on the residential property market, revealing the areas across the UK where house prices and rental incomes are expected to rise. The research uses factors including rental trends, employment levels and commuter behaviour as well as current house prices to create an index of property hotspots. The research also surveyed high net worth investors from across the UK, to reveal where and why they plan to purchase property in the future.

According to the research, and despite an uncertain economic and political climate, the UK property market remains buoyant with prices in areas across the UK set to rise by an average of 6.1% by 2021, bringing the average value of a UK property to almost £300,000.

East Renfrewshire

Predicted to see the biggest property price increase in Scotland is Glaswegian suburb East Renfrewshire, the only destination in Scotland to rank within the top 20 areas of highest growth across the UK behind Westminster (31.9%), Cotsworld (31.8%) and Warwick (29.5%).

East Renfrewshire has long been considered an ideal place for aspiring young families to set up home. Up-market retailer, Whole Foods, opened its first Scottish store in Giffnock, while Newton Mearns and Clarkston are typified by excellent schools and high house prices. There is also a high proportion of highly qualified residents in East Renfrewshire, with 53% of the population educated to degree level or higher. These qualifications are linked to higher potential earnings and a related upwards pressure on housing prices.

East Dunbartonshire

Similarly, East Dunbartonshire, situated north of Glasgow, has ranked second in the Scottish regions and is expected to rise by 22.5%. Home to two of Scotland’s most well-heeled suburbs, Milngavie and Bearsden, they have some of the country’s best schools which are regularly ranked in Scotland’s top ten as well as being a sought after location for retirees.

With easy commuting distance from Glasgow, the research suggests that the once desired busy city life has been ditched for a more relaxed suburban lifestyle as parents are keen to escape the hustle and bustle of city centres to set up home in the outskirts.

City of Edinburgh

Home to five of the top ten most visited attractions in Scotland, City of Edinburgh has long been one of the most expensive places to live in Scotland. It is perhaps no surprise that that the city ranks within the Scottish top three, with prices expected to rise by a fifth (20%) by 2021.

The financial and tourism capital is also expected to experience one of the highest levels of short to medium term employment growth in Scotland over the 2017-2021 period (growth of 2.8%), and at the same time, the city is expected to see one of the highest population growth rates over the next five years at 4.5%, which will increase pressure on housing.

Edinburgh is also experiencing the highest rate of business start-ups per capita in Scotland (with nearly 88 businesses set up each year per 10,000 working age population).

Stirling

One of Scotland’s most historic cities, Stirling, is also expected to see prices rise by almost a fifth (19%) across the next five years. Abundant in rich heritage with its own castle and Wallace Monument, the traditional market town in the farmlands has become one of the country’s most desired locations.

Stirling recently secured a City Deal, thought to be worth around £500m, which focuses on the creation of a digital district, city park and regeneration of the harbour and River Forth. The project is predicted to create 3,000 new jobs and increase tourism by 25% to turn the city into a digital technology, food and drink hub.

The economic and employment growth opportunities in Scotland are pushing up house prices in many areas of the country, with Stirling being one of them. East Renfrewshire, East Dunbartonshire and Stirling all enjoy populations with high earnings, ranging from 6% to 28% higher than the UK national average.

Scottish property investment

The research from Barclays also reveals that investors in Scotland own three properties on average, bringing the average total value of a property portfolio in Scotland to £818,093. Across all UK respondents, one in 10 (11%) own property/properties in Scotland and over a third (39%) are being used for rental income. Over a third (36%) of investors in Scotland are planning to buy new property/ properties in the next three to five years.

Calum Brewster, Managing Director, Barclays, Wealth & Investments, North Region, Barclays, said:

“It’s encouraging to see that property is still viewed as an important part of the investment portfolio in Scotland with high net worth investors typically owning three properties and over a quarter planning to buy property because they believe that it offers long-term investment security.

“There is also increasing confidence among property investors in Scotland, as many are taking a long-term view when it comes to putting money into property. It’s also interesting to see from our research how investment prospects are emerging outside of the established property heartland of London and the South of England into Scotland, with economic growth and employment opportunity fuelling growth in hotspots across the UK.

“We are here to support our clients at various stages of their investment journey and we can help by offering a range of innovative and personalised mortgage solutions to meet their individual needs, whether they are a seasoned investor or a millennial looking to increase their income.”

The ScotRail Alliance is advising all customers who use Glasgow Central to check their journey before they travel on Scottish Cup Final day.

Trains will be considerably busier than usual, and extra services will be running to and from Hampden. Additional carriages will be added on key services to destinations across Glasgow, Ayrshire and Inverclyde.

As with all major events on the network, alcohol bans and queueing systems will be in place.

Celtic supporters are advised to use King’s Park station before and after game, while Aberdeen fans should use Mount Florida.

To allow for additional services to run to and from the game, many trains using the high level stations will depart from a different platform than usual, and may also arrive or depart at slightly different times. Affected routes include (in both directions):

• Glasgow – Ayr

• Glasgow – Barrhead/Kilmarnock/Carlisle

• Glasgow – East Kilbride

• Glasgow – Neilston/Newton

• Glasgow – Wemyss Bay

A ScotRail Alliance spokesperson said: “Don’t score an own goal, leave plenty of time to get to the game. Extra staff will be around to help – please follow their instructions to ensure that everything goes smoothly.”

“The last trains of the night are going to be very busy, too – so please plan to catch an earlier one.”

Bookings are open for upcoming training events with Arts & Business Scotland, Introduction to Fundraising (Tuesday 13 June in Edinburgh) and A General Tax Guide for Arts and Heritage Organisations (Wednesday 21 June in Glasgow and Friday 23 June in Perth).

Introduction to Fundraising

Tuesday 13 June 2017 | Arts & Business Scotland, Edinburgh

Registration: 9:15am | Event: 9:30am-4.30pm

This popular one day course is aimed at individuals in Arts and Culture organisations who are new to or starting to fundraise. The day provides an overview of the current funding landscape in Scotland and creating an effective case for support.

Full details, address and booking here: http://www.aandbscotland.org.uk/events/2017/06/13/introduction-to-fundraising-edinburgh/

A General Tax Guide for Arts and Heritage Organisations

Arts & Business Scotland are pleased to be running this new event twice, with one in Glasgow and one in Perth.

Wednesday 21 June 2017 | Scott Moncrieff office, Glasgow and Friday 23 June 2017 | Perth Concert Hall, Perth

Registration: 8.30am | Event: 9am-12.30pm followed by lunch and general discussion

Speakers: Kirsty Murray (Tax Director) and Scott Craig (VAT Partner), Scott Moncrieff This new half-day seminar is a must for all financial or budget holding staff and anyone who wants to know how tax affects (and can benefit) arts and heritage organisations and individuals. This session will highlight available tax savings and cover corporate tax, VAT, gift aid, basic rules, common issues and opportunities.

Full details, address and booking:

Glasgow: http://www.aandbscotland.org.uk/events/2017/06/21/a-general-tax-guide-for-arts-and-heritage-glasgow/

Perth: http://www.aandbscotland.org.uk/events/2017/06/23/a-general-tax-guide-for-arts-and-heritage-organisations-perth/

Edinburgh outranks Glasgow to secure second place in Barclays Digital Safety Index

• Bank account fraud is the most common type of fraud in both cities

• Rural dwellers show greater levels of awareness and caution in how they behave online compared with those living in cities

• All regions outperformed London on the digital safety score

• Across the UK, only 17% of people can correctly identify basic digital safety threats such as social media messages intended to trick users into sharing personal details or downloading malware

• Barclays is spearheading a new £10m nationwide drive to increase the public’s awareness and is launching an online quiz to give everyone free digital safety scores and tips

• New debit card choices will allow customers to turn ‘on’ and ‘off ‘remote spending and change ATM limits at the touch of a button

Monday 8 May 2017: Edinburgh has outranked Glasgow to be named as one of the most ‘digitally safe’ cities in the UK, behind only Liverpool, according to a new study from Barclays which has scored the nation’s susceptibility to online scams and fraud.

Launched today, the Barclays Digital Safety Index score is based on the ability of 6,000 UK adults to protect data, devices, accounts, and to spot digital threats. Respondents in Edinburgh and Glasgow were asked to complete a digital safety test − similar to the hazard perception tests encountered by people taking driving theory exams − and answer questions about the steps they take to protect their devices from online threats.

On average, people from Edinburgh scored 6.25 in the test, lower than the national average score of 6.27, but higher than Glasgow which scored 6.05. With scores ranging from 1-10, (10 being the maximum safety score), there is plenty Scots could be doing to improve their digital safety.

DIGITAL SAFETY SCORE BY UK REGION

(scores from 1-10)

East Midlands – 6.46

Yorkshire & Humber – 6.39

North West England – 6.35

South West England – 6.33

East of England – 6.33

South East England – 6.33

Scotland – 6.29

Wales – 6.28

UK – 6.27

West Midlands – 6.22

North East England – 6.16

Northern Ireland – 6.12

London – 5.85

DIGITAL SAFETY SCORE BY UK CITY

(scores from 1-10)

Liverpool – 6.31

UK – 6.27

Edinburgh – 6.25

Sheffield – 6.21

Manchester – 6.21

Leeds – 6.14

Glasgow – 6.05

All major cities – 6.02

Birmingham – 5.85

London – 5.85

Bristol – 5.83

In Edinburgh, 12% of respondents had experienced bank account fraud, one in ten had been a victim of a purchase scam and just under 10% had fallen foul of a safe account scam where fraudsters claiming to be from their bank call and advise them to move their cash because of an issue with their account.

In Glasgow, bank account fraud again topped the poll with more than one in ten people affected. 11% of respondents had experienced scams in relation to an online shopping account while 10% has been targeted through payment accounts.

Overall, city dwellers are more at risk of cybercrime than those living in the country, 20% of rural residents claim to have experienced an online scam or fraud in the past three years, compared with a UK average of 25%. Behaviour also plays a key role. Rural dwellers in general show more awareness and caution in how they behave online, scoring more highly in our Digital Safety Index as well – averaging a 6.49 score compared with city average score of 6.02.

Across the UK as a whole, digital familiarity may be fueling online complacency, with the survey also revealing a generational ‘digital safety gap’ between younger and older respondents. On average, people scored 6.27 in the test, but digital awareness scores for the oldest age bracket (over 65s) were some 25% higher than the youngest age group tested (18-24 year olds), putting to bed the notion that older people are more at risk of being “duped” by cyber criminals. Furthermore, only 17% of all respondents were able to score full marks in the question asking them to correctly identify digital safety hazards: from online pop-ups and games, spam or “phishing” emails and “smishing” texts or social media messages that trick users into sharing personal details or downloading malware that leave devices vulnerable to hackers.

To encourage the nation to consider its own digital vulnerability, Barclays is calling for the public, police and businesses across the UK to unite and tackle this growing issue of public concern and has today launched a multi-million pound Digital Safety drive.

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

“The Barclays Digital Safety Index identifies the UK’s most vulnerable to cybercrime for the first time.

“With Scotland lagging behind in the Digital Safety Index and residents most commonly falling victim to bank account fraud, it’s evident that more needs to be done to improve awareness of both cybercrime and cybersecurity in this area.

“This is why we are encouraging everyone, even the most confident of digital users, to take our test and learn how they can stay safe in our digital age.”

Under the new Digital Safety drive:

• In a UK high street bank first, Barclays is giving customers new levels of control over when, where and how their debit card works, offering customers the choice to instantly turn ‘on’ and ‘off’ whether their card can be used to make remote purchases, and even set their own daily ATM withdrawal limits on their Barclays Mobile Banking app.

• A new online quiz is available to everyone in the UK from today. By answering simple questions people can assess their own digital safety level, and receive useful tips on how to strengthen their defences at barclays.co.uk/security. Barclays aims to help at least 3 million people to boost their digital safety levels by using the test.

• A new £10m national advertising campaign is being launched across national TV, print, online and billboards. It will alert people to the risk of fraud unless they take proper precautions, and will include content targeted towards younger people and those in urban areas.

• Barclays will be hosting regular fraud awareness takeovers on its online and mobile banking sites, prioritising fraud prevention over products.

• Barclays’ nationwide force of 17,000 Digital Eagles will provide digital safety teach-ins to people, and free support clinics for the 1 million UK SMEs we serve. Barclays LifeSkills is also launching new Digital Safety learning content specifically designed for younger people.

• Barclays is also leading industry efforts to prevent instances where customers are duped into withdrawing all their cash from branches and handing it to a scammer posing as a trusted person, through a new police hotline for branch colleagues to call.

Barclays estimates that if people implemented these three top tips we could help to cut levels of fraud by up to 75 per cent.

1. Never give out your full Online Banking PIN, Passcode or Password to anyone, even a caller claiming to be from the police or your bank.

2. Do not click on any link or open an attachment on any e-mail you receive which is unsolicited.

3. Avoid letting someone you do not know have access to your computer, especially remotely.

To find out how digitally safe you are, take the new quiz at the Barclays Digital Safety Hub www.barclays.co.uk/security or simply search for “Barclays Digital Safety”.

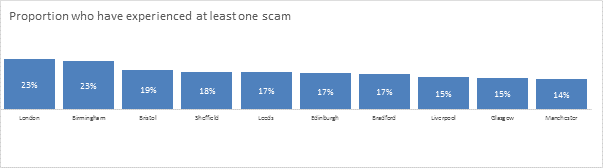

City rankings by proportion of residents to have suffered from scams in the past 3 years:

The ScotRail Alliance is advising rugby fans heading by train to Murrayfield for the European Rugby Champions Cup Final on 13 May to plan their journey in advance.

To help ensure everyone gets to the game on time, passengers should allow extra time for travel – as well as purchasing tickets in advance. ScotRail will be adding carriages to services all day between Edinburgh and Glasgow Queen Street, and on key services to Tweedbank, Glenrothes, Helensburgh and Milngavie.

Customers should be aware queuing systems will be in place at Haymarket station after the match, and that the last trains of the night are expected to be busy. Where possible, fans should plan to catch an earlier train to avoid disappointment.

A ScotRail Alliance spokesperson said: “It’s going to be a big weekend of rugby in the capital.

“We’ll be using every train at our disposal to add extra carriages to services towards Edinburgh, however, trains are expected to be very busy.

“Make sure to check your train times on our website or app and leave plenty of time for travel. Buying tickets in advance will also help reduce your queuing time.”

ScotRail will have extra staff on the ground to assist fans, and as with most large events alcohol bans will be in place.

At Scott-Moncrieff we are passionate about SMEs. When it comes to companies of this size, their opportunities, the issues they face, and the overall business landscape, we know our stuff and we want to share it with you.

At our upcoming seminars in Glasgow and Edinburgh, we’ll cover the importance of embracing technology, looking at the need to adopt ‘Making Tax Digital’ and detailing the benefits of Cloud accounting. We’ll also discuss succession planning and will explain how Scott-Moncrieff can help you take your business to the next level.

You can see the full details, including the agenda, here.

If you’d like to attend, please email the following information to sm.events@scott-moncrieff.com:

Name:

Company:

Job title:

Seminar (please delete as appropriate): Edinburgh / Glasgow

Note that spaces are limited and will be provided on a first-come, first-served basis.