For the third consecutive year, staff at Cruden Group have come together to collect vital food, toy and cash donations to give back to local communities across Scotland at Christmas. Cruden’s annual foodbank campaign was launched in November. Since then, staff members working on site and in office across Glasgow and Edinburgh have shown their kindness and embraced the season of giving by donating gifts and household items for those struggling this Christmas.

On 16 December, a total of 7000 food items, equating to over six tonnes, were collected and distributed across 8 community foodbanks with the help of The Trussell Trust. A cash donation of £11,000 has also been raised to help those in need over the winter months, of which £5000 was donated by the Cruden Foundation.

Samantha Stapley, Chief Operating Officer at the Trussell Trust, said: “We’re extremely grateful for the ongoing support that we have received from Cruden Group. With the current cost of living crisis, times are harder than ever for everyone, but even more so for those who are already unable to afford necessities like food and heating. The donations that our network of foodbanks have received from Cruden will provide a lifeline to many and help to shine a ray of light on local families who would otherwise be struggling at this time of the year. Thanks to all of the team for their generosity.”

Steven Simpson, Group Managing Director at the Cruden Group, said: “Our Christmas foodbank campaign, in partnership with The Trussell Trust, had a huge impact on local lives last year. This year, amid the cost of living crisis, we wanted to once again do our utmost to support the communities we work in over the festive period and make an even bigger impact.

“The generosity, sheer determination and community spirit of our team, our customers and our supply chain partners has been humbling. I’d like to say a big thank you to everyone who contributed for the kindness they have shown, and to The Trussell Trust for helping us to widen our impact where it’s needed most. It’s heartwarming to see so many of our staff members committed to helping others and this embodies the Cruden Group’s ongoing dedication to creating social positivity in the communities we serve.”

MM Search has a role at the moment with their client SHS Trading, an excellent opportunity for a European Expansion Manager which we are keen to fill asap.

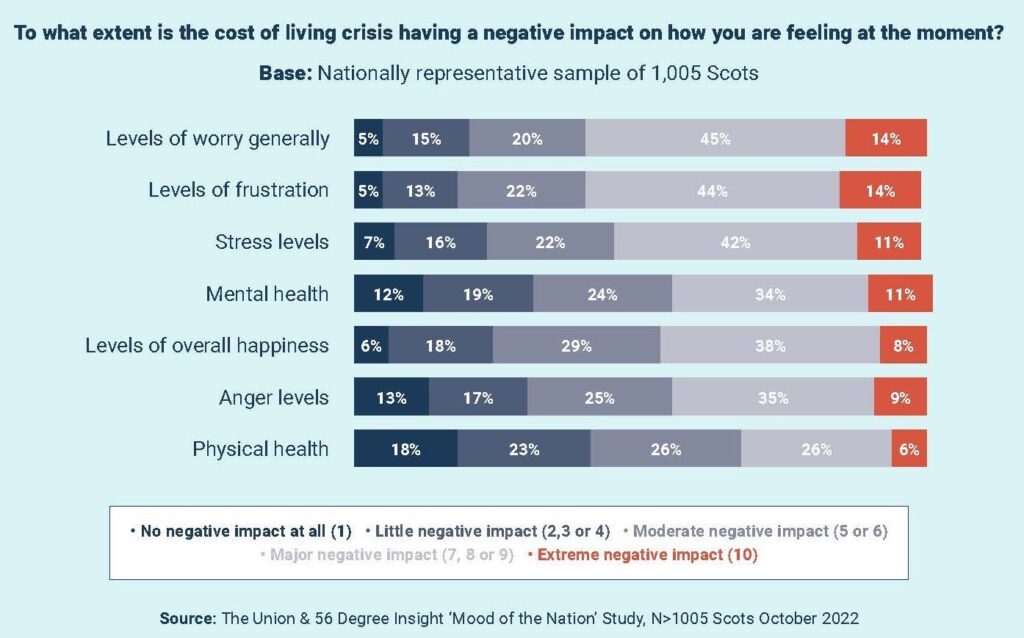

A new ‘Mood of the Nation Report’ published today by The Union has set out to capture how the cost of living crisis is impacting on people living in Scotland. Focused on their feelings, fears, priorities and coping mechanisms, it is a striking snapshot as the nation looks ahead to what will be an incredibly tough winter for many.

The study, conducted in partnership with research company 56 Degree Insight, shows biggest shift in Scottish consumer confidence in living memory with nine out of ten Scots seriously concerned by the cost of living crisis.

The findings make for sober reading, indicating that perhaps there is a disconnect between the reality of public sentiment and the current consensus amongst legislators, retailers and consumer brands.

The report strongly suggested that there is now a sense of ‘permacrisis’ taking hold amongst the general population; the pandemic, Brexit, inflation, Ukraine, Westminster instability and the energy crisis have all created a poisonous, potent and toxic cocktail for the average Scot.

The key findings

- Spike in national anxiety and stress: 89% of people living in Scotland expressed serious concerns about the cost of living. 69% reported economic anxiety impacting on mental health including more than a third struggling to sleep at night.

- Scots having less fun?: Scots are drinking less as they cut back, by almost 25%, and 21% are gambling less. Interestingly, 26% of Scots report that they are having less sex. It would seem this economic crisis really is a buzz killer.

- A nation consumed by worry: 54% Scots worrying to a major extent on how to pay bills and over four in ten significantly worried on how to put food on the table.

- Cut-backs and delays: Families are significantly cutting back, with 88% of households earning £30-£40K the most concerned by rapid increases in outgoings. Cost cuttings include spending less on new clothing (55%), delaying holiday decisions (45%) and eating out less (57%). 39% expect to spend less on Christmas gifts.

- Personal care takes a hit as wallets tighten: 37% will get their hair cut less and less cosmetic procedures like botox and fillers (11%, rising to 21% in image conscious Southern Scotland).

- Changing behaviour: 80% of women were changing shops (some or all of the time) and 88% are shifting to less expensive products and brands.

Conducted in the aftermath of the autumn’s mini-budget and economic crisis by 56 Degrees Insight, it is the largest specific survey of its kind solely focused on people living in Scotland. The survey of over 1,000 people, found the cost of living crisis had a shockingly negative impact on Scots.

Shifts in attitudes and behaviour

In fact, the data is so pronounced that it indicates the single biggest shift in consumer anxiety and shopping behaviours in living memory. Because, unlike the pandemic, people can’t, or are too fearful, to splurge.

For instance, people report impacts to their stress levels (75%), mental health (69%) and levels of optimism about the future are now 57% lower than during the depressing resurgence of the pandemic in 2021.

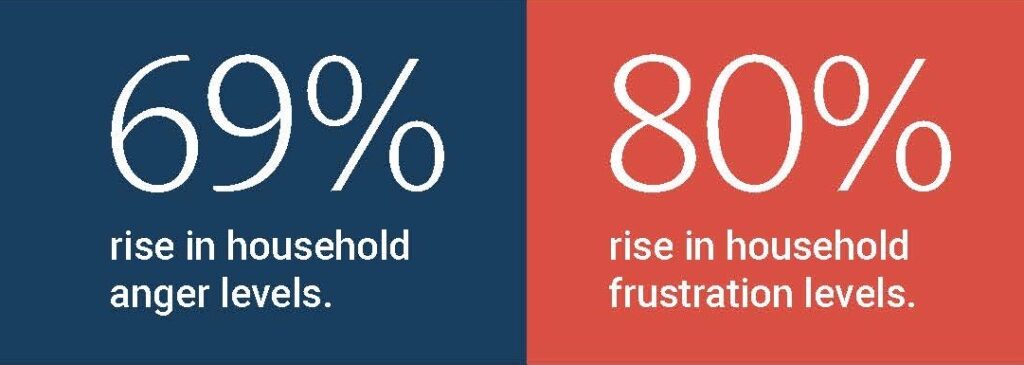

Anger and frustration on the rise

Worryingly for many households, especially with vulnerable women and children, levels of ‘anger’ (69%) and ‘frustration’ (80%) have skyrocketed due to the recent crisis. It follows that this could lead to a spike in domestic abuse, especially during Christmas, which is going to be markedly more tense and frugal this year.

With anger comes blame, and there are many targets for blame, including energy companies, the UK Government, war in Ukraine, banks and global recession.

Worry about paying bills

Of those surveyed, economic anxiety is acutely affecting families on low to medium incomes, with a whopping 88% reporting feeling the brunt of the financial crisis.

Over half of Scots worry about paying bills (54% to a major extent) and six in ten people are worrying about being able to put food on the table (63%). It’s set to be an anxious Christmas for many, with 57% of lower income families saying they have to cut back on family Christmas gifts.

Over a third (36%) have major worries about being able to pay their rent or mortgage and similarly a third of people worry about loans and credit cards (35%). Recent negative headlines mean just under half of Scots are anxious whether their “pensions will be OK” (47%).

Women taking charge

However, adversity also brings out resilience. Almost nine in ten people (87%) are delaying or cutting back on purchases, particularly leisure, dining, clothing, personal care, in addition to the big ticket items like travel, cars, houses.

The data also shows that a significant number of people, especially women, are strategically changing how money gets spent. 80% of women are changing where they shop (some or all of the time), compared to 34% of males, who have not changed where they shop at all.

Similarly 88% of women have switched brands, compared to only 67% of men. Women were also more likely to have switched to more inexpensive brands’. This is a massive change in national shopping behaviours and is sobering news to marketers and retailers, apart from a few clear winners: ASDA, Lidl and Aldi.

Comment

Adam Swann, Chief Strategy Officer, The Union, said:

“This report throws light on the real human impact of the recent economic turbulence. It’s not just about news headlines, it’s millions of people worrying about putting food on the table or not having money to buy gifts at Christmas. It’s also about how a whole nation of people have had to change their spending behaviours to cope, and the role women in particular play in that. It shows how people are adapting to having less money; they are being canny and devising coping mechanisms, women especially”.

“Collectively, this data reveals the biggest change in mass spending and shopping behaviours we’ve seen. And for brands and businesses it should be a wake-up call to really think about how they communicate to people right now, and how to better serve the consumer. We don’t expect all these behaviours to ever reset, there will be a ‘new normal’. Those businesses and brands that support people now will win preference longer term when the crisis abates.”

For more information and/or a copy of the full report, please contact Ali Liddy on ali.liddy@union.co.uk or enter your email below and we’ll send it directly to you.

Advertising market demonstrates further resilience; improved outlook for STV Studios

- Total advertising revenue for the full year 2022 expected to be down only c.2% on 2021’s record year and up 8% on 2019

- Strong audience performance boosts advertising in November and December, driven by I’m a Celebrity and FIFA World Cup 2022

- STV Studios’ growth momentum continues, with £50-55m revenue now secured for 2023

- STV Group plc today announces that it expects Total Advertising Revenue (TAR) to be down c.2% for the full year 2022, delivering a resilient performance, and growth of c.8% compared to the pre Covid year of 2019.

- Within that STV expects regional advertising to perform broadly in line with national advertising for the year and VOD advertising on STV Player to continue to deliver good growth.

- 9-month TAR was -3%, in line with expectations, and Q3 TAR -17% as UK economic uncertainty led to caution in the advertising market. As anticipated, Q4 has seen a stronger performance, boosted by I’m a Celebrity and the FIFA World Cup 2022, and is forecast to be down c.1% against tough comparators from 2021 (Q4 2021 TAR: +16%). Within that October TAR was down 13%, November up 3% and December is expected to be up around 6%.

- On screen, STV has had a very strong finish to the year, with I’m a Celebrity the most watched TV series across all UK TV channels in 2022, and STV Player’s most streamed series ever with over 3m streams. England’s World Cup quarter final defeat to France delivered STV the highest peak-time audience in Scotland across all channels this year of 1.6m viewers. The tournament is already STV’s most streamed event ever with over 6m streams so far, over 50% ahead of last year’s Euros.

- STV Studios continues to make excellent progress, with over 30 new commissions secured this year (FY 2021: 15) and previous full year 2022 guidance confirmed of £20-25m in revenues and at least £1m operating profit.

- Additionally, STV confirms improved STV Studios guidance for 2023, with secured revenues now at £50-55m, significantly ahead of our target to quadruple revenues to £40m by 2023.

STV Chief Executive Simon Pitts said:

“STV has performed strongly in 2022 with advertising revenues expected to finish only 2% behind 2021’s record performance and 8% ahead of 2019.

On screen we have enjoyed an excellent end to the year, with I’m a Celebrity proving to be the biggest TV series of 2022, ahead of Strictly Come Dancing, and the World Cup STV’s most streamed event ever with over 6m streams.

While we remain mindful of the ongoing macroeconomic uncertainty, we are becoming a more resilient and diversified business that is well placed to take advantage of the growth in demand for streaming and global content.

Our recently announced partnership with ITV significantly strengthens our STV Player content and advertising proposition, while STV Studios continues to make great progress towards its goal of becoming the UK’s leading nations and regions production company. With over 30 new shows commissioned this year we have already secured £50-55m in revenues for 2023, significantly ahead of our target, and our commissioning pipeline continues to show good momentum.”

Upcoming events

There is a site visit for investors at STV’s offices in Glasgow scheduled for 25th January 2023. Please contact Kirstin Stevenson to register (details below). A date will be confirmed in the New Year for the next in our series of Capital Markets presentations, which will focus on STV’s Digital division, and provide further detail on the recently announced streaming partnership with ITV.

Not many house buyers have the opportunity to walk into a new home that is fully furnished and beautifully decorated, but that’s what’s on offer at Cruden Homes’ Meadowside development in Aberlady, where the show house is now on sale.

The popular ‘Catesby’ house has four generous bedrooms, two public rooms and comes complete with all furniture, flooring and fittings. The interior has been styled by top interior design specialists, block interiors, with a soft nordic and scandi look that delivers a light and airy feel, while the colour palette of white and grey, with hints of duck egg blue, soft teal and coral, along with a range of different natural furniture finishes, gives the home a contemporary feel.

The Catesby has a generous lounge and a fabulous well-equipped kitchen, dining and family area with direct access to the rear garden. The designer German kitchen by Leicht features quality appliances by Siemens, including an integrated single oven and combi-microwave, five-zone induction hob with glass splashback, integrated fridge freezer and dishwasher.

A separate dining room is situated at the front of the property and gives homeowners the option to use the room as a study, playroom or guest bedroom.

Upstairs, the master bedroom features an en-suite and built-in wardrobes. There are three additional good size bedrooms and a family bathroom.

Other interior specification features include stylish white sanitary ware, chrome mixer taps and a two zone heating system with programmable controls for ground and upper floor.

The house has generous parking, a double garage and the rear garden is laid to lawn, with mature plants.

Meadowside is in a picturesque location in the village of Aberlady, close to the beaches and countryside of East Lothian and within easy reach of Edinburgh.

Hazel Davies, sales and marketing director of Cruden Homes (East), said: “Meadowside is a prestigious development, set within an established community and it has been hugely popular with home buyers who want to enjoy all the benefits of living in East Lothian but with easy access to Edinburgh. The show home is a stand-out property and we expect it to generate a lot of interest.”

The Catesby show home is on sale at £480,000. Please call 01875 666002 or email longniddryvillage@crudenhomes.co.uk for more information or visit the website for cruden-homes.co.uk

The ability to find and retain the best talent to accelerate your digital journey, remains a challenge to all businesses.

At this online event, the second in our Digital Greatness series, join our panel of industry experts Sean Allen, Head of Talent Acquisition at The Very Group; Susan Quain, Digital Employee Experience Director at Fidelity International; Claire Bacall, Chief for People Evolution at AND Digital and Chris Clarke, Consulting Practice Lead AND Transport Nerd at AND Digital, who will explore the importance and core ingredients of attracting, retaining AND growing your talent in challenging times.

Topics include:

- The benefits to organisations of becoming a magnet for talent

- The core ingredients to achieve this

- How to attract and retain the best digital talent

- How to equip teams with human digital skills like teaming, problem solving and creative thinking

- How to overcome barriers

Where – Online

When – 25th January 2023, 12:00 PM – 01:00 PM

The Bank of England has raised UK interest rates to their highest level for 14 years in a bid to tackle rising living costs.

Interest rates were increased for the ninth consecutive time since December last year, increasing rates by half a percentage point to 3.5%.

The Bank of England said “further increases in Bank Rate” may be required to tackle what it fears may be persistent domestic inflationary pressures from prices and wages, but no further announcements are expected before 2 February 2023

“The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response,” the Bank of England said.

How will the latest interest rates rise affect homeowners?

Mortgage rates have generally been rising with the BoE’s consecutive rate rises since last December but how much payments increase will depend on the type of mortgage you have.

Tracker mortgages are linked to the BoE base rate – which means you will see an immediate impact on your mortgage repayments after the BoE rate hike. The average mortgage payment is expected to rise by about £73.49 monthly for the average tracker mortgage, and £46.22 for the average standard variable rate (SVR) mortgage.

However, while the UK is already believed to be in recession, the Bank of England believes the economy performed better than expected between October and December.

It now expects the economy to shrink by 0.1% in the final quarter of the year, compared with previous expectations of a 0.3% fall.

What does it mean for the housing market?

Paul Hilton, CEO of ESPC, explains: “This increase in interest rates was expected and has already been priced into many mortgage products.

“While it has been reported that we could see a downturn in the property market, the market in Scotland has remained relatively consistent, and we expect that demand for quality local housing stock will remain, albeit at a calmer pace than has been seen recently.

“It is encouraging that the Bank of England said the economy performed better than expected between October and December, which may give some reassurance to buyers and sellers.

“The full effects of this remain to be seen but owning a home is a good long-term investment and seeking expert advice is crucial.

“When it comes to buying or selling, ESPC’S solicitor estate agents are duty bound by the Law Society of Scotland to do their very best by their client. It’s never too early to talk to your solicitor estate agent about your plans.”

Seek expert advice

If you want to sell your home, expert advice from your ESPC solicitor estate agent on property types and the long-term value of home ownership coupled with monthly affordability advice from ESPC Mortgages is key.

ESPC mortgages offer expert independent mortgage advice in Edinburgh. Whether you are looking for first time buyer mortgage advice, are interested in finding out more about buy-to-let mortgages or would like to re-mortgage, get in touch with the team on 0131 253 2920 or fsenquiries@espc.com

The information contained in this article is provided in good faith. Whilst every care has been taken in the preparation of the information, no responsibility is accepted for any errors which, despite our precautions, it may contain.

The initial consultation with an adviser is free and without obligation. Thereafter, ESPC Mortgages charges for mortgage advice are usually £350 (£295 for first time buyers). YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER LOANS SECURED AGAINST IT.

The Financial Conduct Authority does not regulate buy-to-let mortgages.

Councillors in Edinburgh have today approved the appointment of two chief officer roles into the Council’s senior leadership team.

Dr Deborah Smart will join as Executive Director of Corporate Services and Derek McGowan as Service Director Housing and Homelessness.

Deborah is joining from Dorset Council where she is currently Corporate Director with responsibility for Digital; Strategic Change and Delivery; Policy, Insight and Risk; Organisational Development; Learning and Development; Well-being and the Dorset Shared Care Record (joint with NHS).

Derek McGowan is currently the Chief Officer Early Intervention and Community Empowerment at Aberdeen City Council.

Council Leader Cammy Day said:

“I was pleased that Deborah and Derek’s appointment was backed by councillors today. I’m confident that they will both add great value to our team and I look forward to working closely with them to deliver on our strategic priorities.”

Dr Smart said:

“I am thrilled to be taking on this role. Edinburgh is my home and I am so excited to be moving back. I look forward to working closely with my new colleagues, members and partners bringing my experience and expertise to deliver on our ambitions for the city.”

Derek McGowan said:

“I am delighted to be coming back to Edinburgh in this role, and I am looking forward to working with new colleagues on preventing homelessness in the city. The provision of quality housing is a key public health priority, and my focus will be on achieving this for current and future tenants.”

ENDS

Contact Information

Nathan Lockwood

Media and Social Media Officer

The City of Edinburgh Council

nathan.lockwood@edinburgh.gov.uk

Eye-watering energy prices and rocketing inflation means this winter will be incredibly difficult for many of those we support.

As a supporter of Cyrenians, you already know that home is so much more than just a roof over your head. It needs to be somewhere you feel safe, comfortable and supported.

That’s why we work to support those excluded from Home, Community, Family, Work, Health and Food, because we all need each of these elements combined to truly thrive.

Our Home for Christmas appeal will raise vital funds for our projects on the frontline of tackling the causes and consequences of homelessness.

Our appeal is sharing stories throughout December of how the current Cost of Living crisis is piling pressure on those we support. Keep up to date with them here.

With your help, we are creating more hopeful, positive futures for more people this Christmas, and year round.

Thank you for all your support this year – we look forward to tackling homelessness together with you into 2023.

Have a wonderful festive break when it comes,

Cyrenians Fundraising Team

Welcome the New Year with a winter warming feast at Harvey Nichols and enjoy three-courses with a St-Germain Spritz for £28 per person, available from 16th January.

The chefs at Harvey Nichols Edinburgh have created a cheerful menu using seasonal ingredients with three starters, three mains and three desserts for guests to choose from. In the Forth Floor Brasserie customers can decide between an array of sumptuous dishes, from roasted pumpkin hummus served with pumpkin seed, maple crumb, harissa and lemon dressing and flatbread, to Salchicha sausages served with soft Parmesan polenta, mushroom and beer gravy, and sticky toffee pudding served with toffee sauce and salted caramel ice cream. To compliment the hearty dishes, an exclusive St-Germain cocktail will be served alongside the menu, made with St‑Germain Elderflower Liqueur, Harvey Nichols Prosecco, a splash of soda water and garnished with a twist of lemon.

The Harvey Nichols Winter Dining menu will be available from 16th January until 31st March 2023. Customers can also soak up some of the best views in London by dining the menu at OXO Tower Restaurant, Bar & Brasserie for £35 per person in the Brasserie or £40 in the Restaurant.

To book please email forthfloor.reservations@harveynichols.com or simply head online to our website

or Sevenrooms.