Aberdein Considine has strengthened both its private client and banking litigation teams with the appointment of a new partner and new associate.

James MacKinnon has joined the firm as Partner and Head of Private Client for Edinburgh. He was previously Legal Director at Gillespie Macandrew LLP.

James has almost 15 years’ experience providing advice on wills, powers of attorney and the administration of executries and trusts. James specialises in providing clients with tax efficient solutions in passing on wealth to future generations, both in lifetime and on death. He provides expertise in all aspects of the formation, administration and termination of trusts, including the legal and tax implications of the use of trusts in succession planning and asset protection.

He provided guidance on the implications of the Foreign Account Tax Compliance Act (FATCA) on trustees which was adopted by the Law Society of Scotland and he continues to provide advice to trustees, including charitable trustees, on their reporting obligations under the Common Reporting Standard (CRS).

He is a member of STEP, serving as secretary on their Scottish Branch Committee. He has also tutored on the Private Client Course of the Diploma of Legal Practice at the University of Edinburgh.

Jacqueline Law, Managing Partner, Aberdein Considine said: “James is one of the foremost experts in his field, and his knowledge and experience is highly regarded.

He will be a huge asset to both the firm and our clients and we’re delighted to have him join our existing Private Client team.”

In addition to James, the firm has appointed John Di Paola as an Associate in the banking litigation team.

John joins the firm’s Lender Services Practice Group from the Ascent Performance Group.

He will be based at Aberdeen Considine’s flagship Waterloo Street office in Glasgow and brings with him extensive experience in litigation.

He specialises in the recovery of heritable property, banking litigation and debt recovery, has appeared regularly in the Sheriff Courts throughout Scotland and also has experience in the Sheriff Appeal Court and Court of Session.

Myra Scott, Head of the Lender Services Practice Group at Aberdein Considine said: “We’re delighted to have someone of John’s calibre and expertise joining the team as an Associate. He will be a great asset as we continue to support our clients in a continually changing and complex area of the law.”

The Lender Services Practice Group, which deals with banking litigation, represents the majority of the UK’s banks and financial institutions, including Royal Bank of Scotland, Nationwide Building Society and Lloyds Banking Group.

Aberdein Considine announced the appointment of two new partners, Myra Scott and Laura Browne, to the Lender Services Practice Group in February 2018.

Shepherd and Wedderburn’s banking and finance team has reported a strong year for deals activity, with a 41% rise in the number of completed deals and a 12% increase in the overall value of transactions.

The team, whose clients include banks, funds, financial institutions, local authorities, corporate borrowers and sponsors, completed 162 deals in the year to April 30, with a combined value of £132 billion, up from 144 deals with a combined value of £93.4 billion the previous year.

Transactions completed in the year included a number of sizeable real estate debt refinancings; residential mortgage and car loan securitisations; funding and refinancing of major infrastructure and energy projects; and financing and refinancing corporate loan facilities to companies ranging from blue chip plcs to owner-operated, small to medium-sized enterprises (SMEs).

Notable deals completed by the banking and finance team in the 2017/18 financial year included:

-acting as Scots Counsel for a syndicate of lenders on $700 million loan facilities to North Sea oil and gas explorer and producer INEOS UK E&P Holdings Ltd and its subsidiaries;

-acting on the Scottish aspects of Volkswagen Financial’s £10 billion Driver UK Master C2 Programme Update and Issuance;

-acting for a bank club on a £680 million debt refinancing to onshore wind energy provider Ventient Energy, covering 35 UK wind farms;

-acting for PSA Finance UK Ltd on Scottish aspects of its £400 million Auto ABS UK Loans 2017 receivables programme issuance;

-acting for Nord LB on the £56 million Inverurie Community Campus Hub Project, spanning design, build, finance and maintenance services for a new community campus, secondary school for 1,600 pupils and special school facility for 100 pupils; and

-acting for property investment group ICG-Longbow on the £50 million senior bridge and mezzanine refinancing of the Cornbow Shopping Centre in Halesowen, West Midlands.

Fiona Buchanan, Head of Banking and Finance at Shepherd and Wedderburn, said: “Our top-ranked team worked on a variety of complex deals across a range of sectors and we are increasingly partnering with clients on pathfinder projects combining our legal expertise with cutting-edge technologies.

“The banking landscape continues to change at pace and this has been reflected during the past 12 months in the proliferation of our client base to include new market entrants, as well as established financial institutions.

“The growth in our financial regulatory advisory practice is ensuring we meet the varying demands of these diverse market participants.”

The INSEAD Alumni Association Germany visited Gilmerton House for the opening dinner to their Annual Conference 2018 in Edinburgh from 14 – 16th of September. The group of INSEAD alumni and their partners, mainly from Germany, arrived by coach from Edinburgh and were welcomed by the skirl of the bag pipes.

INSEAD is consistently ranked as one of the best business schools in the world. It has more than 57,000 Alumni distributed across 175 countries.

The team of conference organizers from the INSEAD Alumni Association Germany answered a few questions about their experience at Gilmerton House.

Why did you choose Gilmerton House for your event?

“It was the most suitable venue in the Edinburgh region for the size of group we were planning for, as approx. More than 80 guests were expected. Other venues were either too large or too small, or didn’t seem to have the setting we were looking for.

“Gilmerton House was the first choice after our internet research and stayed in this position after having seen it and quite a few other locations.

“The Gilmerton House team was very efficient and competent.

“Our guests all loved the venue and entertainment.”

How would you describe Gilmerton’s ambience?

“Superb – the open fires in the downstairs room made you feel very welcome – like arriving at a friend’s house. A really warm welcome.”

Attempted recruitment in services firms at lowest for 25 years

The British Chambers of Commerce’s quarterly economic survey – the UK’s largest private sector survey of business sentiment, and a lead indicator of UK GDP growth – shows little to be cheerful about as growth flatlines and business confidence weakens.

Key findings:

-Percentage of services firms attempting to recruit is at its lowest level for 25 years

-Of those services firms recruiting, difficulties rose to a record high

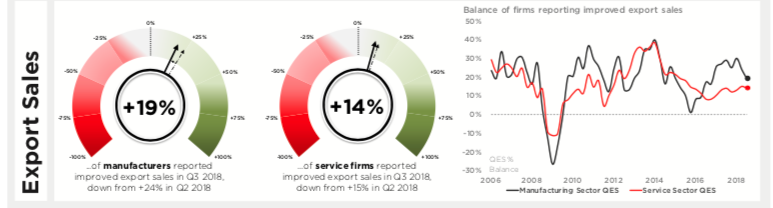

-Exports sales and orders are at their lowest level since the EU Referendum in Q2 2016

The results come as all signs suggest that this year’s annual economic growth is set to be the lowest since the financial crisis. The slowdown in exports in the manufacturing sector, and many services firms seemingly giving up trying to hire new staff, should be cause for concern, warns BCC.

Ahead of the UK’s departure from the EU, the leading business organisation urges the government to use this month’s Budget to deliver bold action to boost investment and confidence.

The survey, of 5,600 businesses, has revealed that the percentage of services firms attempting to recruit is at its lowest level for 25 years, and of the firms in the sector that did try and recruit, the percentage experiencing difficulties rose to an all time high, since the survey began in 1989.

Also, in the services sector, the percentage of firms reporting an increase in domestic and export sales and orders eased slightly in the quarter. Meanwhile in the manufacturing sector, the balance of firms reporting an increase in export sales and orders fell to their lowest in two years. The balance of manufacturers expecting their prices to increase also rose, with 81% citing the cost of raw materials as the driver of cost increases, the highest level for seven years.

Uncertainty over future trading conditions is continuing to act as a brake on business investment in both the manufacturing and services sectors. The balance of firms who looked to invest in either plant and machinery or training fell in both sectors to their lowest level in over a year. Business confidence in turnover and profitability also weakened in the quarter.

Commenting on the results, Suren Thiru, BCC Head of Economics, said:

“These results suggest that the current period of below average GDP growth continued into the third quarter of 2018.

“Activity in the services sector slackened in Q3 with the key indicators of domestic and international activity softening in the quarter. That said, the services sector is still likely to have been the main driver of third quarter growth.

“The manufacturing sector remains a weak spot for the UK economy, with export activity slowing sharply in the quarter. Brexit uncertainty and the increasing cost of imported raw materials is weighing on the UK’s external position – further evidence that the persistent weakness in sterling is doing more harm than good. As a consequence, net trade is likely to have contributed precious little to UK GDP growth in Q3.

“The sharp deterioration of the share of firms attempting to recruit is a concern and reflects both persistent hiring difficulties and heightened economic uncertainty – which if sustained could materially weaken jobs growth.

“Against this backdrop, the Bank of England’s recent decision to raise interest rates continues to look like a misstep. With economic conditions subdued and continued Brexit uncertainty, there should be a greater emphasis on providing increased monetary stability alongside a marked fiscal loosening to lift the UK out of its current low growth trajectory.”

Responding to the survey, Dr Adam Marshall, Director General of the British Chambers of Commerce (BCC), said:

“These figures reinforce what we are hearing from businesses up and down the country – the uncertainty over Brexit, and the lack of bold moves to boost business at home, are starting to bite.

“It should be a matter of grave concern to government that sales and orders both at home and abroad are stagnating. Weaker sterling is no longer proving a boon to many of our exporters, while consumer spending is failing to boost the domestic market.

“We have a vibrant and innovative business community that wants to invest and grow, but we are stuck in limbo while Brexit negotiations rumble on.

“The upcoming Budget must deliver radical, decisive action to boost growth and productivity at precisely the moment that the economy needs it most. There has never been a more important time for the government to bolster business investment, competitiveness and productivity, in the face of significant Brexit headwinds.”

On the warning signs from the labour market findings, Marshall added:

“While fewer companies are trying to recruit, those that are hiring they are finding it increasing challenging to fill vacancies. Many firms are deeply invested in developing homegrown skills and talent within their own communities, however this alone is not enough to fill the skills gaps, at all levels, that businesses face right now, and which are set to get worse post-March 2019.

“The results from BCC’s latest survey support our call for government to drop arbitrary migration caps and targets, and work with business to develop an immigration policy that supports a growing economy. We should not be slamming the door on any of the skills we need for our companies to succeed.”

Key findings in the Q3 2018 survey:

Manufacturing sector:

-The balance of firms reporting increased domestic sales rose two points to +24, while those reporting improved domestic orders fell from +22 to +20

-The balance of firms reporting improved export sales fell five points, from +24 to +19, while the balance of those reporting improved export orders fell sharply from +22 to +14 – both indicators are at their lowest level since Q4 2016

-The percentage of firms expecting to raise prices over the next three months rose from 31% to 38%

-The percentage of firms citing the cost of raw materials as the source of cost pressures has risen sharply from 65% to 81%, the highest since Q2 2011

-The percentage of firms attempting to recruit fell from 77% to 67%, Of these, 75% reported recruitment difficulties. The balance of firms increasing investment in plant/machinery and training fell in the quarter to +15 and +17 respectively

-The balance of firms confident that turnover and profitability to increase in the next 12 months fell, from +47 to +44 for turnover and +35 to +29 for profitability

Services sector:

-The balance of firms reporting increased domestic sales fell slightly, from +23 to +22, while those reporting improved domestic orders rose from +15 to +17

-The balance of firms reporting improved export sales fell slightly, from +15 to +14, while those reporting improved export orders held steady at +12

-The balance of firms expecting to raise prices over the next three months was unchanged at +27%

-The percentage of firms looking to recruit fell from 60% to 47%, the lowest since Q1 1993. Of these, 72% reported difficulties – an all time high for the survey

-Cashflow remains a concern, with a balance of just +8 reporting improved cashflow. Thisfalls to +5 among B2C firms

-The balance of firms looking to increase investment in plant and machinery, and training, fell slightly from +8 to +7 in plant and machinery, and from +16 to +14 in training

-The balance of firms confident that turnover to improve over the next year fell slightly, from +40 to +38, while those expecting profitability to improve rose slightly from +29 to +30

Venue: HSBC Hobart House, 80 Hanover Street, Edinburgh

Thursday 11 October 2018

8.30am-10.00am

(Coffee and morning roll will be served from 8.30am)

Benefits for Employers

What is a Foundation Apprenticeship?

You are invited to attend a Business Breakfast meeting on Thursday 11 October. The purpose of this meeting is to get representation from a variety of experts to help shape and develop the delivery of 2018/20 Foundation Apprenticeship programmes and beyond. Our aim is to ensure the programme meets the needs of employers and young people and we hope to gain support for assistance with work placements.

We look forward to meeting you and hearing your views.

Programme:

R.S.V.P

Via our Eventbrite page by pressing the RSVP button below.

Any questions please contact:

Magda.Wisniewska@edinburghcollege.ac.uk

Deputy First Minister John Swinney opened the latest state of the art new school in Edinburgh at a special ceremony today (Thursday 4 October).

St John’s RC Primary School in Portobello was opened by the Cabinet Secretary for Education and Skills along with Councillor Alison Dickie, Vice Convener for Education, Children and Families at the City of Edinburgh Council.

Special guest of honour at the event was Barbara Service, who retired as head teacher last week, bringing to a close a unique 55 year association with the school as a pupil, teacher, parent and finally head teacher.

The new building is the first primary school in Edinburgh to be built under the Scottish Government’s Schools for the Future programme and is situated on part of the former Portobello High School site. The remainder of the site and the former St John’s site will be made into a park for the local community to use.

The two-stream primary school has a flexible design with both formal and informal teaching areas for each year group and bright open spaces to maximise learning. A nursery offering 40 morning/40 afternoon places forms part of the building and nursery provision for 2-year-olds is due to open in the near future. The school also has an astroturf pitch which can be used by the local community outside school hours.

Cllr Alison Dickie said: “It was great to see the excited faces of the pupils this morning as we officially opened this fantastic school. As a former teacher I know how important it is to embrace innovative ways of improving the learning environment and ensuring that new schools are designed to be inclusive for all pupils.

“St John’s definitely ticks all the boxes with its sensory room, quite nooks in classrooms, breakout spaces and a variety of different furniture to support varying learning styles and learner needs within the school. When pupils are comfortable and happy within these spaces, they will want to engage even more in the amazing learning that is already taking place, which is everyone’s end goal.

“Our £10m investment in the new St John’s demonstrates the Council’s commitment to creating a first class education estate and ensuring all our children have the best possible learning environment in which to flourish.”

Deputy First Minister John Swinney said: “I would like to thank the City of Edinburgh Council for inviting me to officially open the new St John’s Primary School.

“It is a fantastic facility which the entire school community can be proud of and I am pleased that the Scottish Government was able to provide more than £5 million of funding towards its construction as part of our £1.8 billion Schools for the Future programme.

“I wish the school, and everybody in it, all the very best for the future.”

Retired Head Teacher Barbara Service said: “I’m delighted that I was able to see all the pupils and staff successfully move into this fantastic building before I left. Space was an enormous challenge in our old school but now there is the opportunity for more flexibility for teaching and learning, meaning far better opportunities for the pupils to learn in co-operative and innovative ways. The school is embracing 21st Century education, in this purpose-built flagship facility.

“Parental engagement is a key priority so the school will be able to do this more readily in the new environment and the feedback from parents, carers and the community has been extremely positive.”

Secure, on-street bike parking is set to be introduced across the Capital, under recommendations approved today (Thursday).

Members of the City of Edinburgh Council’s Transport and Environment Committee agreed on plans to extend a scheme, which has been successfully trialled in the city’s Southside and West End since 2014.

The covered bike storage containers provide much-needed cycle parking in densely-populated and tenemental areas of Edinburgh, which was the first local authority in Scotland to offer the facility to residents.

One hundred and eighty new units will now be rolled out around the city over the next two years, helping to encourage people to choose cycling as a mode of transport and reducing issues caused by bikes left in tenement and flat stairwells.

Transport and Environment Convener, Councillor Lesley Macinnes, said: “Encouraging cycling as a healthy and sustainable mode of transport is a real priority for us, and we’ve committed to invest in a whole range of bold and exciting projects to get people of all abilities onto two wheels.

“That’s why it’s essential we also get the basics right, like providing somewhere for people to put their bikes – a lack of storage can be a real barrier to anyone deciding whether or not to take up cycling.

“We’ll now be working closely with contractors and communities to make sure units are installed in the most appropriate locations.”

Since beginning in July 2014, bike parking trials have proved extremely popular, with pilot scheme units at full capacity and waiting lists for each site, plus requests for additional storage in more than 200 different streets.

Plans to increase available on-street bike parking were first approved in November 2016, when it was agreed to roll out 20-30 new units a year over three years. The process will now be increased and accelerated to install 180 units over two years.

Following agreement by committee, the Council will issue a contract to supply, manage and maintain the units, with the option of installing additional storage containers after the initial two-year period. Locations will be assessed individually by the Council and the exact costing will be determined once the contract is awarded.

Read the full report, Proposed Increase in Scale of Rollout and Amendment to Contract for On-Street Secure Cycle Parking, on the Council website.

-Despite people in Edinburgh having on average 707 friends online we only have five ‘true and close’ friendships in real life

-New research examining the nation’s take on friendships reveals that more than a quarter are closer to their mates than their relatives (27 per cent) – nearly half are happy to give their best bud their last £10 (46 per cent) and one in four is even willing to donate a kidney

-The ‘shoulder to cry on’ is the most revered member of the friendship group, followed by ‘the organiser’ and ‘the joker’

-Some of the biggest struggles to get the gang together include finding an activity that works within everyone’s budget and bill splitting

More than half (56 per cent) of people in Edinburgh claim to have more online friends now than they did five years ago, with the average person today boasting 707 virtual mates. Yet even in the ‘Golden Age’ of social media, we can count close, ‘real-life’ friendships on just one hand – with only five ‘true and close’ pals in our inner circle.

These figures were released in new research from Pingit – the app that allows for fast, easy payments between friends and family with just a mobile number – that provides a ‘state of the nation’ report on modern British relationships.

The findings reveal two-thirds (65 per cent) of us trust our closest friends more than our own relatives and best buddies are more likely than family to cheer up a quarter (27 per cent) in hard times.

A friend in need is a friend indeed, with over half (55 per cent) saying they would ‘drop everything’ to help a mate. Half claim they’d be happy to have a friend couch surf at their place indefinitely, 40 per cent would tell a white lie and one in ten would tell a whopper. But it’s not just furniture and half-truths that are shared – a quarter would take it a step further and donate a kidney to their cherished chums.

Many of us are also ‘banking’ on the financial generosity of our friends. Nearly half (46 per cent) would give a pal their last £10 and in flush times, they’ve offered a lot more – the maximum amount people in Edinburgh have loaned their buddies is, on average, £1,530.

Finances play a role when getting together with the gang, too. One in five struggle to find an activity that works within everyone’s budget, whilst 16 per cent admit that splitting the bill is a challenge.

Pingit released the findings to highlight how the app, which offers instant, easy payments and features such as bill-splitting capabilities, can help us spend less time sorting our spending and more time bonding with our buddies.

According to the study about friendship groups, the most appreciated person within the ensemble is the ‘shoulder to cry on’ (43 per cent) followed by ‘the organiser’ – who initiates social events, finds the best deals and splits the bill afterwards (21 per cent) – and ‘the joker’ friend who lightens the mood (17 per cent respectively).

And it’s old friends that are the best for Edinburgh locals. The research shows that we’ve been knocking around with the same set of loyal mates for an average of 16 years. Those who constitute our friends for life are school buddies (50 per cent) followed by work colleagues (30 per cent) and those who live just around the corner (30 per cent).

Darren Foulds, Managing Director of Pingit, said: “Even in this golden age of social media, it’s interesting to see many of us consider only a handful of people our closest and most trusted friends. Our research indicates we’d do almost anything for them, but given the busy lives we lead now, it’s no surprise that getting together can sometimes be challenging.

“The rising popularity of meals out, trips together and sharing other experiences means sorting the finances is an inevitable part of modern friendship. Apps like Pingit can help to take away the headache of worrying about the budget, so you can focus on more quality time with your ‘inner circle’.”

Psychologist Honey Langcaster-James, who specialises in analysing group behaviour, said: “The research from Pingit shows just how aware we are that different friends take on different roles within a friendship circle, and crucially, it reveals which of those roles are valued the most.

“Psychological studies have shown that believing you have a reliable and dependable social support network is good for your health – it can even increase your ability to heal and prolong your lifespan. It’s entirely plausible that the dependable friend who you’ve always turned to for support during times of need, could one day save your life just by saying ‘I’ll be there for you’!”

Multi award-winning bid and tender specialist AM Bid has announced a record increase in turnover as it establishes itself as one of the leaders in its sector.

AM Bid achieved £729,000 in sales in the year to 30th September 2018, a 57% increase on 2017. Net profits are likely to remain stable.

Since its launch in 2014, AM Bid has grown both in size and reputation to be an emerging force U.K.-wide in a sector seeing rapid growth. Now with nine permanent members of staff and 15 associates across the U.K. and Republic of Ireland, AM Bid provides bid writing, strategy and training services across more than 20 different sectors.

L-R: David Sole OBE, Non-Executive Chairman and Andrew Morrison, Managing Director.

Founder and AM Bid Managing Director Andrew Morrison, who this year was named the Institute of Directors Scotland’s Emerging Director of the Year, said the Edinburgh-based company was on track to achieve its goal of £1m in revenue by 2019.

“I’m delighted to announce this 57% increase in revenue, which puts us bang on track with our growth plan of £1m in turnover by 2019. What’s more, we are consistently achieving bid win rates of 80% for our clients. With all the signs pointing towards an increase in demand for outsourcing bids and tenders, AM Bid’s future appears to be very bright indeed.”

Andrew added: “The bid process continues to be complex. There are a lot of buyer requirements and it can be a very time-consuming process. Organisations are realising that the time they spend pulling together a bid might be time better spent on running their businesses.

“Our team which is now across the UK and Ireland is hand-picked for their bid writing expertise and knowledge of a wide range of sectors, in particular: construction and renewables, energy and infrastructure, professional services and tech. We are now receiving requests for bid writing from all over the U.K. and abroad, including China and the Middle East.”

AM Bid’s clients include construction industry giant Jewson, Spotless Commercial Cleaning and Orbit, a PR and communications agency. Its non-executive Chairman is David Sole OBE, former Grand Slam winning rugby union captain and now Managing Partner of the School for CEOs.

Paul Motion is currently the only such accredited specialist in private practice

BTO Solicitors LLP has announced that partner Paul Motion, who heads the firm’s Data Protection and Online Reputation teams, has been accredited by the Law Society of Scotland as a specialist in Freedom of Information and Data Protection law.

This is only the second such accreditation to be awarded in Scotland and is the only one outside the public sector at this time.

Paul is one of Scotland’s leading data protection practitioners. He is a civil Solicitor Advocate who has litigated several ground-breaking data protection cases in courts and the First Tier Tribunal. His experience includes leading the only successful UK appeal to date where a fine imposed by the Information Commissioner’s Office for a breach of the Data Protection Act (DPA) was cancelled. Paul has advised colleges, private schools, councils, Registered Social Landlords, law firms, accountants and SMEs on a variety of DPA/GDPR, PECR, Freedom of Information and Environmental Information issues.

After returning from a stint in New Zealand, he has provided data protection advice and comment for almost two decades, advising on a wide range of data protection issues including: telecare, common area surveillance, Subject Access Requests, neighbour complaints and covert CCTV/audio recording of care workers by service users’ families.

Complementing his data protection experience, Paul has a well-known practice in defamation, media and social media law which is increasingly called upon by his clients who have ranged from politicians to record production companies. For the past ten years he has presented an annual event at the Edinburgh Fringe to explain his areas of interest to artist managers, artists, producers and authors.

Paul commented: “For many years, data protection law was perceived as a curiosity which presented little in the way of business risk. Increasingly large fines – particularly the new levels under the GDPR – have heightened awareness of the law. The Data Subject Rights are also now recognised as potentially entailing significant irrecoverable cost to all organisations. Subject Access Requests and FOI requests are commonly used to build evidence for future litigation. To assess and manage the risks, specialist advice is often essential. I hope that our profession will continue to build up a body of expertise in these areas.”