UK Budget Briefing

Edinburgh Chamber of Commerce & Charlotte Street Partners – UK Budget Briefing

Rishi Sunak, Chancellor of the Exchequer, has outlined the UK Budget for 2020/21. Please find a summary and key highlights below.

Coronavirus support

The chancellor pledged that “whatever extra resources the NHS needs, it will get.” For now, this amounts to a £30bn stimulus, including:

- A £5bn NHS Reserve Fund

- A contributory employment and support allowance (ESA) that can be accessed on day one and not day eight

- A minimum floor for universal credit and no unnecessary in-person meetings

- A £500m hardship fund for local authorities to distribute

- Businesses with fewer than 250 employees having statutory sick pay refunded by government in full for 14 days

- A new Coronavirus Business Interruption Scheme offering loans up to £1.2m

- Business rates for retail, leisure and hospitality businesses being abolished for one year A small business grant of up to £3k

Helping growth

Other broader measures, included:

- A projection of the National Living Wage to reach £10.50 by 2024

- The Scotch whisky industry receiving £1m in support to promote it internationally; £10m in R&D funding for distilleries to support “green” initiatives; and no increase in spirit duty

- Fuel duty remaining frozen for another year

- A reduction in entrepreneur relief, though 80% of small businesses remain unaffected

- The Science Institute in Weybridge receiving a £1.4bn funding boost and an extra £900m invested in research into nuclear fusion, space and electric vehicles

Towards a low carbon economy

- The electricity levy is frozen, whilst the gas levy is increased

- A new plastics packaging tax will be introduced

- Red diesel exemption: the agriculture sector will retain it but not other sectors, which now have two years to prepare

- £120m available to fix damage from recent floods and £200m allocated to build flood resilience

- £800m to establish two or more carbon capture storage clusters, creating up to six thousand low carbon jobs across the UK

‘Levelling up’

- £600bn of infrastructure investment over the life of this parliament, with public net investment reportedly at its highest since 1955

- Establishment of Treasury offices in Scotland, Wales and Northern Ireland, in addition to a new government economic campus in the north of England

- £510m of new investment in rural mobile network coverage 22,000 civil servants to be based outside central London

- £27bn spending on roads A £2.5bn pothole fund

Kevin Pringle, Partner, Charlotte Street Partners

Rishi Sunak, the recently installed and until now untested chancellor, delivered the ‘Coronavirus Budget’. And the requirements of dealing with a serious public health issue and political desires of the Conservative government came into fortuitous alignment.

Largely because of the nature of the Brexit debate, Boris Johnson’s government has regularly been characterised as ‘hard’ right. However, its clear desire – bolstered by Tory success in many former Labour heartland areas in December’s general election – is to govern on a more centrist, ‘one nation’ basis. Therefore, being seen to consign the age of austerity to the past was essential in both policy and communications terms.

In other words, the chancellor’s allocation of a £30bn package to help the economy and citizens get through the coronavirus outbreak was part of a wider pattern of significantly relaxing purse strings that were held painfully tight in the aftermath of the financial crash under David Cameron and then Theresa May.

In that sense, this was a budget redolent of the New Labour era of the early to mid-2000s. Or going even further back, the Office for Budget Responsibility (OBR) observed that the chancellor has unleashed the largest fiscal loosening since Norman Lamont’s pre-election budget in 1992. Similarly, this budget is also aimed at laying the foundations of future electoral success, specifically ensuring Johnson’s re-election in the middle part of the decade.

With an eye to the Union, Sunak also announced plans for Treasury offices in Scotland, Wales and Northern Ireland, along with significant uplifts in spending for the devolved administrations. This will be used, in particular, by the Conservatives to apply pressure on the SNP administration in Scotland.

In a continuation of the language of Brexit, the chancellor’s mantra was that he was ‘getting things done’. Whatever it ultimately means for the economy, public services and indeed tackling the Covid-19 crisis, the budget certainly got done the job of moving the narrative of British politics beyond the post-crash era.

Andrew Wilson, Founding Partner, Charlotte Street Partners

Students of public policy know that it is 90% about implementation. Politics, on the other hand – which budget day undoubtedly is – is 100% about the coverage of the announcement.

Rishi Sunak, after only a few weeks as chancellor, took to the despatch box today to spiritedly argue for his government “getting it done” – where “it” may refer to Brexit, the “levelling-up” agenda, winning a general election or otherwise.

But this observer would suggest “getting it done” is not the same as simply “getting it announced”.

The challenge for policymakers starts now, and the pressure on the UK economy has not been this great since the financial crisis of 2008. The impact of a disorderly Brexit process was bad enough. Then came Covid-19.

Bank of England Emergency Interventions

The day began with an impressive show of co-ordinated intervention by the three policy committees of the Bank of England. The firepower they deployed is considerable, having included an emergency cut in the Bank’s base rate to 0.25 basis points, alongside an injection of support for bank lending to SMEs at an estimated impact of £10bn.

The Financial Policy Committee reduced the UK counter cyclical capital buffer rate to zero per cent from one per cent (where it had previously been forecast to rise to two per cent by December). This effectively reduces the extra capital that banks are required to hold in order to allow more cash to flow into the economy – estimated at up to £190bn.

The Prudential Regulation Authority set out a ‘supervisory expectation’ (otherwise described as a raised eyebrow) that banks should not increase dividends to shareholders or other distributions such as bonuses to executives. This is their way of ensuring that public policy support does not lead to a direct return to the recipients’ executives and investors but rather reaches the “real economy”.

The transmission of the Bank’s rate cut to the economy is uncertain and will take time. An additional £300bn in bank lending should, at the very least, help correct growth in risk aversion by the banks. This looks to me like an attempt to correct a negative as much as a positive injection of resource.

The Emergency Budget

At the start of the global financial crisis, the UK government injected £21bn of fiscal stimulus into the UK economy with a myriad of measures led by a cut in VAT. Today, in his response to Covid-19, this chancellor knocked that figure out of the park with support of around £30bn.

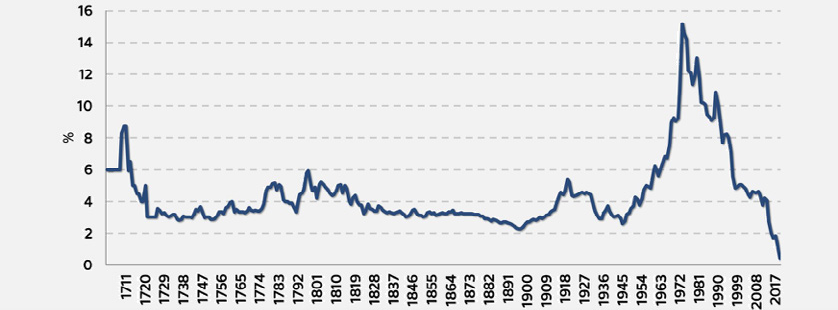

UK LONG TERM GOVERNMENT BOND YIELD

As the above chart from Sky/Bloomberg shows, long term sovereign borrowing has never been cheaper – to the point that it is effectively better than ‘free’ to borrow right now.

One of the lessons most economists take from the austerity budgets of the 2010-19 Conservative governments is that deciding to ‘fix the roof’ in a storm was not a good idea. The strictures became self-defeating as they reinforced sub-trend growth and therefore hit revenues and expenditure in the opposite direction.

The taps are turned on – but will the water work?

It seems that the Johnson administration has learnt the lessons of governments past.

The top line fiscal injections announced today were £176bn over the coming five years. That is a very substantial loosening. The table in the appendix describes how it will be allocated through 76 headline measures.

Will this work? Well, that is a question that economists have been debating since Maynard Keynes was a boy and before. What do we really expect? If the injection turns out to be steroids, it could still be worth it if it helps keep businesses and people afloat during the storm. If it helps strengthen the country’s economic muscle, all the better given the UK’s longer-term productivity performance could be enhanced.

The OBR says the impact of the measures will be to boost economic growth forecasts by 0.5%. They also predict a boost to potential output and therefore productivity of 2.5%.

All this positions the state as the upward driver in trend growth and performance. Whatever would Mrs Thatcher have said about that? If this is true of a spending splurge then presumably the opposite must have been true during the party’s era of austerity?

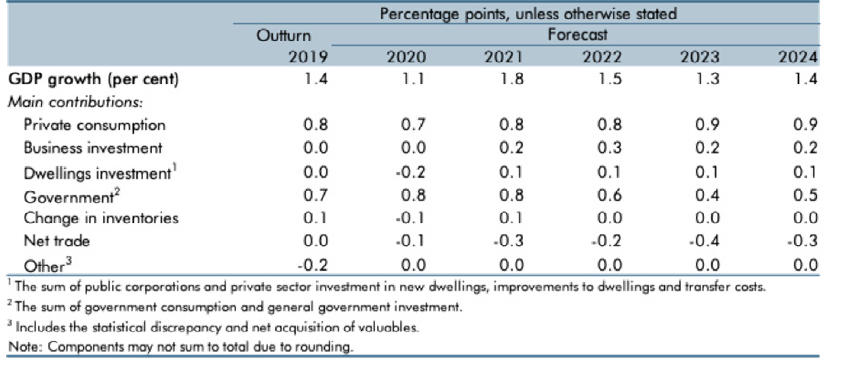

Looking to the growth forecasts of the OBR in the table below, we do see a filip in GDP growth from 1.1% this year to 1.8% in 2021 before drifting back to 1.4% by 2024. By comparison, the UK’s average growth rate over the last quarter century was around two per cent.

Expenditure contributions to real GPD

Within these numbers, it is striking – and fundamentally disturbing – that net trade is set to have a negative effect on growth in the next five years. Business investment will make

zero contribution this year and very little in the subsequent five. The few sources of the UK’s tepid growth will be government spending and investment and consumption. The lesson of economic history is that this may see us through the storm but will do very little to boost the competitiveness of the economy longer term.

But it is easy to be a critic. No one budget is ever enough, necessary or sufficient. The quality of the eventual deal that the government strikes with the EU to “get Brexit done” will be far more important that today’s pronouncements. The road ahead is a long one.

Paul Gray, Consulting Partner, Charlotte Street Partners

Who would have thought that the end of the world would have a name like Covid-19? Because, it doesn’t.

Coronavirus is serious. It’s very serious. It’s spreading, and people are dying. But it’s also being taken very seriously, on a global scale.

Here in Scotland, the Scottish Government Resilience operation is in full swing, as is COBRA at UK level. Ministers, clinicians, scientists and other experts are working closely together, perhaps with new found mutual respect in some cases, to ensure that the country responds as effectively as it can, and to maintain public confidence.

And today, the Chancellor has announced his budget. Some of it is about health, with a guarantee to provide “whatever resources the NHS needs”. Some of it responds more broadly to the current situation, with additional support for business through a range of reliefs, and for employees, through measures such as changes to benefits thresholds. But not all of the budget is about coronavirus. And that is as it should be. Because Covid-19, deadly serious though it is, is going to pass. And sensible organisations will be planning not just for the here and now, but for the tomorrow that will eventually dawn.

That tomorrow may look different from today, economically, societally, environmentally. Will the discovery that it is actually possible for more people to work from home than we thought make a difference to the pace with which we implement flexible working? And what skills will leaders need to gain quickly, to lead a dispersed workforce? Which technology trends will we wish that we had cottoned on to earlier, when we see how digital could have helped us to weather this storm more easily? Has Just in Time had its day? Will the investment in health service provision via video link (in Scotland, we call it NHS Near Me) turn out to be so sensible that we wish we had done it long ago, and will we have a different view of infrastructure priorities as a result?

These learnings will come at a real, tangible, human cost. People are dying, and more will die. While we deal with what is happening – and we must do so carefully, attentively, and without inducing panic – we owe it to every generation to commit to learning from this episode,

and to commit to a future which embraces the lessons it has taught us. Jason Leitch, NHS Scotland’s National Clinical Director, said earlier this week, “Coronavirus isn’t your fault”. He was right – but we are responsible to respond to it wisely, to follow the appropriate public health advice, and to plan now to act later on what this outbreak teaches us.