The Future of Income Tax in Scotland

The thorny subject of income tax is one of the major discussion points in the run up to the May 7th Scottish Parliamentary Elections.

In this article, we’ll digest what the changes to the existing income tax rates in Scotland each party are proposing.

What Tax Powers Does Scotland Have?

In April, 2016, there will be a Scottish Rate of Income Tax. It means that of the 20p now being paid from £1 of basic rate income, 10p of that is going to be levied by the Scottish Parliament and that 10p amount could be varied up or down.

In April 2017, the Scottish Parliament will receive a package of powers. These include:

- Power to set the rates and bands of income tax on non-savings and non-dividend income.

- Half the share of VAT receipts in Scotland being assigned to the Scottish government’s budget.

- Power over Air Passenger Duty and Aggregates Levy.

What are the Main Scottish Political Parties Parties Proposing?

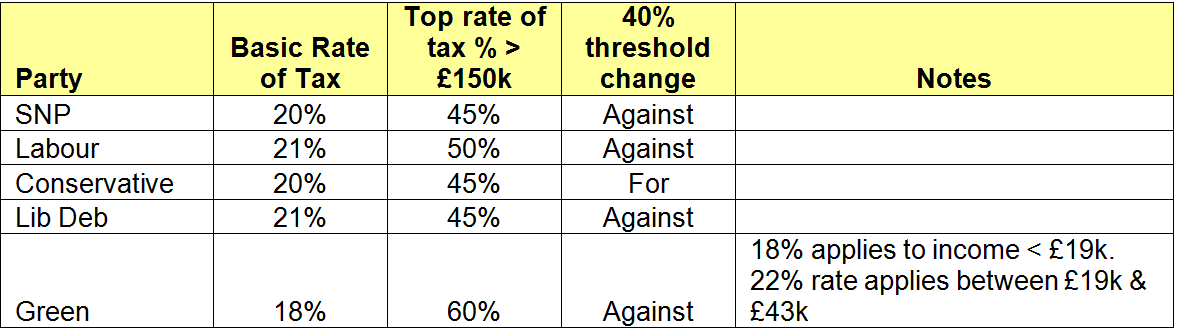

The main areas of Income Tax that may change:

- The basic rate of income tax, paid on income between £11k and £43k.

- The top rate of income tax paid by those with income above £150k p.a.

- Whether the party supports the increase in the 40% tax threshold from £43k to £45k.

April 2017 which was announced for the UK in George Osborne’s March budget.

Closer inspection reveals that the Scottish Conservatives are the only party who are not proposing any deviation from the tax rates and thresholds set by Westminster. Perhaps this is understandable, as they would not choose to impose a new policy separate from their governing colleagues south of the Border. The current SNP government (who are heading for another majority) would make just one change; to the 40% threshold. They would increase the threshold in line with inflation.

Scottish Labour are campaigning for an additional penny on income tax for basic rate taxpayers, and also restoring the 50% rate for those earning above £150k. However, for entrepreneurs it is important to note that Holyrood does not get control over the dividend tax rate. So, any increase in the income tax rate would not apply to dividends which most owner managed businesses pay themselves.

The Liberal Democrats too are proposing a ‘penny on income tax’ to help fund the NHS. Perhaps the most radical proposals come from the Scottish Green Party who are proposing 4 tax rates at 18%, 22%, 43% and 60%. Whatever the result, there is certainly progress being made with Scotland being able to have a direct influence on its own tax rates.

For any inquiries please feel free to contact One Accounting on 01312200152 or visit the website www.oneaccounting.co.uk for more news and information.