The ScotRail Alliance has invested £300,000 to make the railways even safer for customers and staff.

The ScotRail Alliance has invested £300,000 to make the railways even safer for customers and staff.

Over 300 body-worn CCTV cameras are being made available to frontline staff across the country. The devices can be clipped on to the staff member’s uniform, or worn on a lanyard, and are clearly marked as CCTV cameras.

The cameras are capable of recording video and audio in high definition continuously for up to eight hours. The cameras will capture footage when they are activated by a member of staff.

The roll out follows a successful trial, where staff found that people positively changed their behaviour when informed that they were being recorded. Footage from cameras worn by staff has also been used in a number of prosecutions.

The initiative has been delivered in partnership with Transport Scotland and trade unions ASLEF, RMT and TSSA. The aim of the role out is to continue to improve the safety of customers and staff, deter antisocial behaviour, and gather evidence when it does occur.

The devices are produced by Edinburgh-based Edesix, who have designed the cameras so that frontline staff require no specialist training in how to use them. Wearers of the devices have no access to the footage they record, which is downloaded automatically to a secure site.

Alex Hynes, ScotRail Alliance Managing Director, said:

“We are building the best railway that Scotland’s ever had, and a key part of that is continuing to improve the safety of our railway. The safety and security of our staff and customers is our priority.

“Anti-social behaviour will never be tolerated at our stations, or on our trains. These new cameras will improve everyone’s journey by deterring anti-social or criminal behaviour, and help with gathering vital evidence on the rare occasions when it does occur.”

Humza Yousaf, Minister for Transport and the Islands, said:

“The Scottish Government is committed to working with our industry partners to help build the best railway Scotland has ever had.

“Part of this includes investing in measures to target unwelcome behaviour and introducing bodycams will play a role in that.

“Every worker has the absolute right to carry out their duties without the fear of verbal or physical assault, just as every passenger has the right to a safe journey.”

Chief Inspector Sue Maxwell from British Transport Police, said:

“We’re delighted that our colleagues in the ScotRail Alliance will soon be equipped with body worn cameras right across Scotland. In September, BTP rolled out body worn cameras to all our officers meaning that they have an independent witness by their side at every single incident.

“Body worn cameras allows officers to capture essential evidence, help protect officers from malicious complaints and can speed up the justice process. With ScotRail now using these cameras, we’re sure this is another great step towards making Scottish railways a safer place to travel.”

Kevin Lindsay, ASLEF District Organiser, said:

“As a union we welcome these additional body cameras, but we urge all rail passengers to respect rail workers at all times – not just at this festive time.”

Liz Warren-Corney, TSSA Scotland Organiser, said:

“TSSA’s raison d’etre is all about ensuring our members get home safely to their loved ones after a day at work.

“Keeping them safe keeps Scotland’s passengers safe, so we welcome anything that adds to the safety levels and welcome the body cams.”

As the significant new data security regulation, the General Data Protection Regulation (GDPR), comes into force in May 2018, Darren Bird, Head of Technology at Xeretec, explains how businesses can stay compliant.

Irrespective of how security conscious we have become in the digital era, the recent cyberattack on the NHS was a sobering reminder about the online vulnerabilities that all private and public sector organisations are still exposed to. Cyberattacks come in many forms, with many resulting in confidential data either being exposed or compromised.

But security breaches don’t just arise from large scale, high-profile attacks. Sometimes poor internal processes, or a lack of diligence, can result in a breach. In a bid to force companies to be even more proactive in their efforts to protect company and customer data, the EU has announced the GDPR will come into action in May of next year. In the case of a breach, the EU is warning of hefty fines of up to €20m, or 4% of a company’s annual worldwide turnover – whichever is greater.

Here are our recommendations to help avoid GDPR non-compliance:

Implement measures to keep your data safe

The primary objective of the GDPR is to strengthen and unify data protection for all individuals within the EU. This will ensure all organisations provide a broader duty of care to their customers, to prevent their personal details and data from leaking, so it is crucial that businesses start to think about the security measures they will put in place to comply with the GDPR.

The EU specifies that personal data is “any information relating to an individual, whether it relates to his or her private, professional or public life. It can be anything from a name, a home address, a photo, an email address, bank details, posts on social networking websites, medical information, or a computer’s IP address.”

Don’t overlook print from a security perspective

In the context of document imaging and print, it’s well known that unprotected print devices can be a source of data leaks. Private data is still being left unclaimed on devices, even though solutions already exist to mitigate the risks. While May 2018 may seem some time away, now is the time for all organisations to start assessing how ready and able they are to comply with the GDPR. Xeretec ensures that all its clients’ print is secure and has vast experience helping businesses to understand the security vulnerabilities print exposes them to

Find print solutions to comply with GDPR

Xeretec can also provide intelligent print management solutions that enable IT administrators to set up automated workflows. These can detect if documents contain specific patterns relating to data, such as bank or credit card details, personal health information, or sensitive company data. It can then redact any, or all, instances of that pattern in a document. On top of that, it is sophisticated enough to flag up incidents of potential compliance violations to a company’s chief data, security or compliance officer, thereby acting as an early warning system ahead of a potential breach.

Having a secure print function is another way that businesses can help their print comply with the GDPR, as this only allows those authorised to release prints from a device via a secure PIN code or swipe card. This is a powerful way to stop unclaimed documents being left on devices and an effective measure to help prevent security breaches from occurring.

Combined, these solutions can help deliver the type of proactive security management that could easily halt the kinds of security breaches that the GDPR is trying to prevent, therefore helping businesses avoid paying severe fines.

Nowadays, large-scale cyber-attacks are a growing risk to networked devices posed by external hackers.

The recent ransomware attack on the NHS caused severe disruption to hospitals and GP surgeries across England and Scotland, highlighting the need for companies to take their cyber security seriously.

I recently considered the sort of risks that network devices pose internally. This week, I’m looking at the growing risk to networked devices posed by external hackers. Connected devices with web browsers are a great entry point to a company’s network and all the confidential customer and business data held within.

Whether your business is a major brand or an SME, the consequences can be the same – a direct impact to the business, customer concern over a breach of confidential data and an incalculable damage to customers trust in a brand, that can rock its reputation for years.

In my opinion, there is a reason why organisations place a lower priority on print security. Simply put, print as a business function is often overlooked. Companies have only recently started to wake up to the fact that unmanaged print can become a hidden – yet considerable – cost to an organisation.

If print costs are only starting to become a realisation for many companies, then it may take even longer for businesses to appreciate the security vulnerabilities that print and print devices can expose them to.

Another factor could be the fact that cyber security is typically viewed as being a computer or network problem. The data content of these systems are considered extremely valuable to hackers, but all it takes is an innocuous printer in the corner of the office to become a gateway to these robustly protected assets. Therefore, businesses need to realise that it is just as important to protect the potential gateway as it is to protect the assets that cybercriminals want to steal.

One of my concerns centres on whether businesses are simply unaware of the security risks that printers pose. I believe it is Xeretec’s role to ensure that print security is an integral part of our clients IT security policies. This is where our long history of working with clients in sectors where data confidentiality is vital, such as financial services, legal and healthcare, pays dividends.

My colleagues and I are able to apply our security knowledge and experience to ensure that print security is an integral part of a company’s overall security policy. We regularly work with clients to review their device security to ensure that it continues to be fit for purpose. As well as this, we’re able to offer a combined security system from Xerox and McAfee to protect devices against attacks and prevent threats to their confidential data.

Whilst no one knows what 2017 holds, one thing is for sure – hackers will remain as active as ever. Talk to Xeretec to ensure that your devices are as well protected as they can be against internal and external risks. Between us, we can make hackers lives harder whilst protecting your company’s data, brand and reputation.

For more information, contact your local account manager on 0750 000 4563.

– Over 300 new cameras installed

– 76 more stations now covered by cameras

Over 300 new CCTV cameras have been installed across the ScotRail Alliance’s network of 359 stations to improve security for customers and staff.

The work has been undertaken as part of a commitment to improve station facilities across the country. Customers with bikes will be one of the biggest groups to benefit, as additional cameras have been placed at 200 stations to monitor cycle parking areas.

Cameras and monitors have been placed at the entrances to 30 of the network’s busiest stations, as part of a move to highlight the presence of CCTV on trains and stations.

A total of 76 stations previously not covered by CCTV have seen it installed since the start of the present ScotRail franchise in April 2015. The ScotRail Alliance remotely monitors CCTV footage from their two customer service centres in Paisley and Dunfermline, where they also answer calls from station help points.

David Lister, the ScotRail Alliance’s safety and sustainability director, said: “Train travel is safe but that doesn’t mean we take our customers’ safety for granted. With the installation of these additional cameras, we’re sending a clear message that we do not tolerate crime on the railway.

“Footage from our cameras has previously been used by the police to investigate crime, and also to secure prosecutions in court.”

Chief Superintendent John McBride, from British Transport Police, said: “The rollout of these new CCTV cameras by ScotRail Alliance is great news as undoubtedly it will help us further deter and disrupt criminal activity.

“Likewise, this is also great news for staff and railway users, particularly bike users. Thanks to these additional cameras, staff and officers will be able to remotely monitor bike shelters and quickly report suspicious behaviour to police.

“Our priority is the safety of the travelling public, and we will continue to work closely with ScotRail Alliance to achieve this day in, day out. Of course, the public are also the eyes and ears of the network and can report crime and concerns to BTP discreetly by sending a text to 61016.”

Edinburgh outranks Glasgow to secure second place in Barclays Digital Safety Index

• Bank account fraud is the most common type of fraud in both cities

• Rural dwellers show greater levels of awareness and caution in how they behave online compared with those living in cities

• All regions outperformed London on the digital safety score

• Across the UK, only 17% of people can correctly identify basic digital safety threats such as social media messages intended to trick users into sharing personal details or downloading malware

• Barclays is spearheading a new £10m nationwide drive to increase the public’s awareness and is launching an online quiz to give everyone free digital safety scores and tips

• New debit card choices will allow customers to turn ‘on’ and ‘off ‘remote spending and change ATM limits at the touch of a button

Monday 8 May 2017: Edinburgh has outranked Glasgow to be named as one of the most ‘digitally safe’ cities in the UK, behind only Liverpool, according to a new study from Barclays which has scored the nation’s susceptibility to online scams and fraud.

Launched today, the Barclays Digital Safety Index score is based on the ability of 6,000 UK adults to protect data, devices, accounts, and to spot digital threats. Respondents in Edinburgh and Glasgow were asked to complete a digital safety test − similar to the hazard perception tests encountered by people taking driving theory exams − and answer questions about the steps they take to protect their devices from online threats.

On average, people from Edinburgh scored 6.25 in the test, lower than the national average score of 6.27, but higher than Glasgow which scored 6.05. With scores ranging from 1-10, (10 being the maximum safety score), there is plenty Scots could be doing to improve their digital safety.

DIGITAL SAFETY SCORE BY UK REGION

(scores from 1-10)

East Midlands – 6.46

Yorkshire & Humber – 6.39

North West England – 6.35

South West England – 6.33

East of England – 6.33

South East England – 6.33

Scotland – 6.29

Wales – 6.28

UK – 6.27

West Midlands – 6.22

North East England – 6.16

Northern Ireland – 6.12

London – 5.85

DIGITAL SAFETY SCORE BY UK CITY

(scores from 1-10)

Liverpool – 6.31

UK – 6.27

Edinburgh – 6.25

Sheffield – 6.21

Manchester – 6.21

Leeds – 6.14

Glasgow – 6.05

All major cities – 6.02

Birmingham – 5.85

London – 5.85

Bristol – 5.83

In Edinburgh, 12% of respondents had experienced bank account fraud, one in ten had been a victim of a purchase scam and just under 10% had fallen foul of a safe account scam where fraudsters claiming to be from their bank call and advise them to move their cash because of an issue with their account.

In Glasgow, bank account fraud again topped the poll with more than one in ten people affected. 11% of respondents had experienced scams in relation to an online shopping account while 10% has been targeted through payment accounts.

Overall, city dwellers are more at risk of cybercrime than those living in the country, 20% of rural residents claim to have experienced an online scam or fraud in the past three years, compared with a UK average of 25%. Behaviour also plays a key role. Rural dwellers in general show more awareness and caution in how they behave online, scoring more highly in our Digital Safety Index as well – averaging a 6.49 score compared with city average score of 6.02.

Across the UK as a whole, digital familiarity may be fueling online complacency, with the survey also revealing a generational ‘digital safety gap’ between younger and older respondents. On average, people scored 6.27 in the test, but digital awareness scores for the oldest age bracket (over 65s) were some 25% higher than the youngest age group tested (18-24 year olds), putting to bed the notion that older people are more at risk of being “duped” by cyber criminals. Furthermore, only 17% of all respondents were able to score full marks in the question asking them to correctly identify digital safety hazards: from online pop-ups and games, spam or “phishing” emails and “smishing” texts or social media messages that trick users into sharing personal details or downloading malware that leave devices vulnerable to hackers.

To encourage the nation to consider its own digital vulnerability, Barclays is calling for the public, police and businesses across the UK to unite and tackle this growing issue of public concern and has today launched a multi-million pound Digital Safety drive.

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

“The Barclays Digital Safety Index identifies the UK’s most vulnerable to cybercrime for the first time.

“With Scotland lagging behind in the Digital Safety Index and residents most commonly falling victim to bank account fraud, it’s evident that more needs to be done to improve awareness of both cybercrime and cybersecurity in this area.

“This is why we are encouraging everyone, even the most confident of digital users, to take our test and learn how they can stay safe in our digital age.”

Under the new Digital Safety drive:

• In a UK high street bank first, Barclays is giving customers new levels of control over when, where and how their debit card works, offering customers the choice to instantly turn ‘on’ and ‘off’ whether their card can be used to make remote purchases, and even set their own daily ATM withdrawal limits on their Barclays Mobile Banking app.

• A new online quiz is available to everyone in the UK from today. By answering simple questions people can assess their own digital safety level, and receive useful tips on how to strengthen their defences at barclays.co.uk/security. Barclays aims to help at least 3 million people to boost their digital safety levels by using the test.

• A new £10m national advertising campaign is being launched across national TV, print, online and billboards. It will alert people to the risk of fraud unless they take proper precautions, and will include content targeted towards younger people and those in urban areas.

• Barclays will be hosting regular fraud awareness takeovers on its online and mobile banking sites, prioritising fraud prevention over products.

• Barclays’ nationwide force of 17,000 Digital Eagles will provide digital safety teach-ins to people, and free support clinics for the 1 million UK SMEs we serve. Barclays LifeSkills is also launching new Digital Safety learning content specifically designed for younger people.

• Barclays is also leading industry efforts to prevent instances where customers are duped into withdrawing all their cash from branches and handing it to a scammer posing as a trusted person, through a new police hotline for branch colleagues to call.

Barclays estimates that if people implemented these three top tips we could help to cut levels of fraud by up to 75 per cent.

1. Never give out your full Online Banking PIN, Passcode or Password to anyone, even a caller claiming to be from the police or your bank.

2. Do not click on any link or open an attachment on any e-mail you receive which is unsolicited.

3. Avoid letting someone you do not know have access to your computer, especially remotely.

To find out how digitally safe you are, take the new quiz at the Barclays Digital Safety Hub www.barclays.co.uk/security or simply search for “Barclays Digital Safety”.

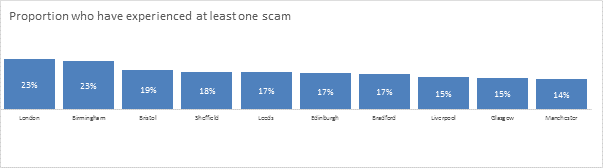

City rankings by proportion of residents to have suffered from scams in the past 3 years:

A report from August 2016 stated that 76 per cent of IT practitioners had reported that their organisation has experienced loss or theft of company data over the past two years.

Does this figure reflect that data theft is simply now commonplace? Or does it highlight the need for companies to do more to minimise the risk of data breaches?

Upon reflection, I think it’s a mix of both. Minimising risk – especially from data breaches – is now a board-level concern, although it is far more difficult to establish to what extent it now filters down into proactive measures to protect against data breaches.

We live in an era where security is a dynamic risk and one that’s constantly evolving, so companies will always need to do more to keep ahead of the curve. Sadly, there is no magic strategy to end all security risks and it’s a job that requires constant attention, not least because cyber criminals are relentless in their efforts to capture confidential and valuable information.

Print infrastructure is, more often than not, one of the weak links in the security chain. Too often it is overlooked by IT professionals, resulting in networked devices being deployed and used without proper safeguards in place. An unsecure print infrastructure is vulnerable to both internal and external risks.

Internally, devices that do not have any secure print measures in place can give rise to situations where confidential documents are printed and left unclaimed on a device. In those scenarios, it’s all too easy for documents to be picked up by those unauthorised to view them. This can be particularly harmful; for instance, a HR team may print a confidential spreadsheet that shows employee salaries and leave it unclaimed on a device used by the sales team. Alternatively, a hospital department could print a patient record and leave it unclaimed on a device that’s accessible to the public, resulting in a serious breach of patient confidentiality.

To prevent such scenarios, we offer a range of Intelligent Print Management solutions that make print more transparent and accountable. Equitrac Print Management– among its many other features – offers access control by adding authentication at the printer to protect devices from unauthorised use of print, scan and fax functionalities. It also provides confidential printing with its authorised user-only, Follow-You print feature, which ensures that prints are only delivered into the right hands and negates the risk that confidential documents could go missing.

Many of our private sector clients, in industries such as financial services, are also required to honour specific regulation and compliance criteria around their customer data, meaning that they must consider their responsibilities in the context of their device and print security policies. The Information Commissioner’s Office applies pressure on companies to do so by imposing hefty fines to public and private sector organisations that have failed in their data privacy duties.

For more information about how to improve your document and data security, contact your local account manager on 0750 000 4563 or visit https://r1.dotmailer-pages.com/p/1HI3-3NL/why-document-security-is-important.