Report ranked five Scottish markets on key points for investors

Report ranked five Scottish markets on key points for investors

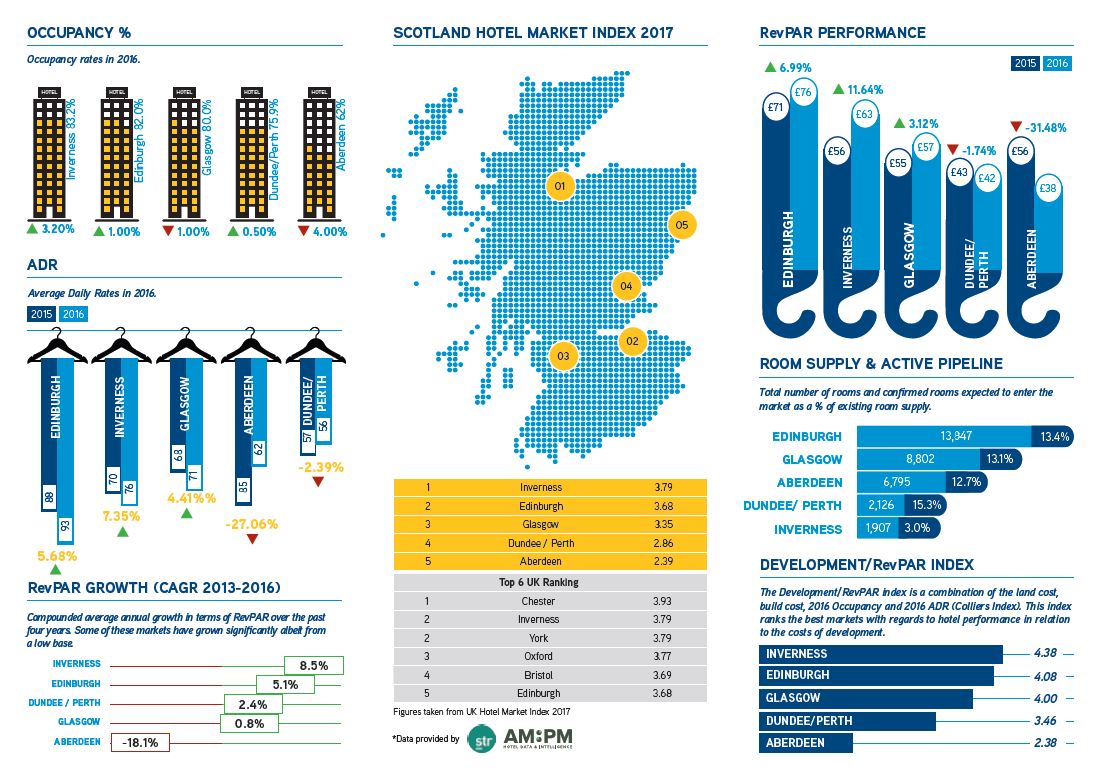

Inverness has emerged as the surprise leader in Colliers International’s inaugural Scottish Hotel Index, as a combination of strong levels of demand; rising Average Daily Rates (ADR); a low active pipeline; relatively low development costs and high occupancy levels, allowed it to beat Edinburgh into second place.

Colliers’ Scottish Hotel Index involves the analysis of five locations across Scotland and ranks them according to nine key indicators, to determine the ‘hot spots’ for hotel development and acquisition across the country. It has found that Inverness is the most attractive market for investors, followed by Edinburgh and then Glasgow, Perth and Dundee, and Aberdeen.

Marc Finney, Head of Hotels & Resorts Consulting at Colliers International, said: “Our Scottish Hotels Market Index shows the changes taking place in the sector. The study in particular, highlights that Inverness is not necessarily the best hotel market north of the border, but it is currently providing the best opportunities in Scotland. Inverness has recorded high levels of demand of around 80% over the past four years, which has enabled ADR to rise by 22% between 2013 and 2016. It is cheap to acquire hotel sites there, providing investors with much better value for money than, say, Edinburgh.”

Alistair Letham, the Scottish director in the UK Hotels Agency team at Colliers International, added: “Crucially the index shows that hotel performance is on an upward trend in Inverness, and there is little new stock of guest rooms in development. Despite being expensive, Edinburgh is also on an upward trend and has one of the highest ADR in Scotland and the UK at £93 at the end of 2016. So the capital rightly deserves its position in the UK top ten.”

Highlights

Inverness scored highly and with an overall rating of 3.79, which would put it joint second in the UK, alongside York and behind Chester. Edinburgh is in 5th place in the UK Index.

Inverness led the way in the RevPAR trend, with growth of 8.5%, and also had the highest occupancy rate in the Scottish market with 83.2%.

The city also had some of the cheapest land, alongside Dundee and Perth, and Aberdeen, the smallest active pipeline at under 3% of current room supply, and relatively modest build costs. This allowed Inverness to top the table despite being rated as having only ‘moderate investor appeal’.

Due to data limitations, Dundee and Perth have been analysed as one city, and ranked fourth.

Edinburgh was second with the highest hotel KPIs in Scotland and a ‘very sought after’ investment location, helping it beat Glasgow into third. But its high land price, considerable active pipeline and lower RevPar trend kept it below Inverness for overall investment appeal.

Aberdeen was rated the lowest in Scotland with occupancy rate of 62% and a negative RevPar trend weighing against the Granite City. This is mainly due to the collapse of the oil prices and a large number of new hotel projects.

Mr Finney concluded: “Aberdeen was once the most thriving hotel market in Scotland and the UK but the downturn in oil prices and subsequent offshore activity has hit it hard. It is therefore suffering from a degree of oversupply and tough comparators from previous years. However, that is not to say that it does not have appeal to investors given the market’s potential to improve along with the fortunes of the city’s biggest industry.”

TOP SIX Scottish Hot Spots For Hotel Investment and Development:

1. Inverness

2. Edinburgh

3. Glasgow

4. Dundee/Perth

5. Aberdeen

Methodology

Colliers’ Scottish Hotel Index uses nine Key Performance Indicators (KPIs) to score each of the locations a figure from one to five (one being the lowest and five being the highest). The determining indices include land site prices; build costs; market appetite; valuation exit yields; room occupancy; average daily rate; room occupancy rates; four-year revenue per available room trend (RevPAR); active pipeline as a percentage of current supply and construction costs. The ratings are then consolidated into a single figure and ranked to show the markets that are ‘hot’ and those that are not, in terms of a desirable location for investors to acquire an existing hotel or develop a new one.

Sixty per cent of organisations in the renewables sector believe the Scottish Government is likely to achieve its target of meeting half of Scotland’s energy needs from renewable sources by 2030, according to a survey by Brodies LLP.

The survey, which canvassed the views of organisations and individuals active in the renewables sector, found that a substantial majority believe the target is achievable, despite challenges including recent changes to the UK Government’s renewable electricity subsidies regime and the absence of any subsidy regime of similar scale in the heat sector.

Asked to identify the policy measures that the Scottish Government should take to help it achieve its target and overcome the current challenges facing the sector, respondents identified giving priority to new developments such as energy storage, encouraging the development of district heating and the continued deployment of the most efficient onshore wind technologies.

Earlier this year the Scottish Government published a draft Energy Strategy for the period up to 2030. It sets out a vision for a low carbon economy that is to be achieved by transitioning away from oil and gas and placing greater reliance on renewable energy sources. The strategy also proposes a shift away from electricity being the primary focus to one in which all energy sectors contribute, by setting an “all-energy” target.

More than three-quarters of respondents (77%) identified storage technologies as the priority to “keep the lights on” by balancing the supply and demand for electricity produced from renewable sources as part of a new “energy mix”, which aims to cut carbon dioxide emissions. Energy storage can provide back-up power to meet peak demand and boost supply when renewables output falls due to weather conditions. Eleven per cent of respondents said low carbon peaking plants should be the priority, followed by gas fired plants (8%), and coal fired plant and importing electricity from England (both 2%).

One of the principal areas of focus of the Scottish Government’s draft Energy Strategy is moving the agenda on from electricity to the decarbonisation of heat, which still accounts for more than 50% of Scotland’s energy supply. This could be achieved in a number of ways, however the only approach over which the Scottish Government currently has policy control is district heating. Asked which single policy measure might facilitate the creation of new district heating schemes, half of respondents said requiring developers to install district heating in new developments, 18% said requiring energy consumers to connect to such schemes, 15% said providing business rates relief for developments with district heating schemes, 13% said public sector capital contributions and 4% said granting developers the power to compulsorily purchase land for networks.

The Scottish Government’s strategy also sets out an ambition for Scotland to be the first part of the UK in which onshore wind energy schemes thrive without subsidy. Asked to identify the single most useful change that the Scottish Government could make to promote onshore wind development, respondents identified three key policies which the Scottish Government could introduce: public sector power purchase agreements, facilitating increased turbine tip heights and introducing a legal presumption in favour of re-powering existing sites (28%, 24% and 24% respectively).

Commenting on the survey results, Keith Patterson, Co-Head of Renewables at Brodies LLP, said: “The energy sector is accustomed to change – it has lived with it for the past decade. Economic and technological changes are transforming the electricity sector, seemingly by the day. Much of this change has been spurred by policies seeking to drive the decarbonisation of our energy supply. Yet, despite all the change, we have only touched the surface of what is required if we are to decarbonise our energy supply –Scotland is transforming its electricity supply but we are only at the starter’s gun as far as decarbonising transport and heat are concerned.

Commenting on the survey results, Keith Patterson, Co-Head of Renewables at Brodies LLP, said: “The energy sector is accustomed to change – it has lived with it for the past decade. Economic and technological changes are transforming the electricity sector, seemingly by the day. Much of this change has been spurred by policies seeking to drive the decarbonisation of our energy supply. Yet, despite all the change, we have only touched the surface of what is required if we are to decarbonise our energy supply –Scotland is transforming its electricity supply but we are only at the starter’s gun as far as decarbonising transport and heat are concerned.

“Perhaps the most important aspect of the draft Energy Strategy is that it signals that heat will now be the focus of Scotland’s decarbonising efforts. Again, the draft strategy does not say how heat will be decarbonised, but climate change targets published around the same time imply that Scotland’s domestic and commercial heat supply will be approaching carbon free supply by 2032. Even if Scotland does not hit this target, it promises a truly transformative future for Scotland’s heat supply.”

To read the full report on the survey’s findings, visit http://brodi.es/allenergy17.

A new UK Government will herald new opportunities for it to work more closely and effectively with Scotland’s businesses; and Scottish Chambers of Commerce has called for a renewed role for the Scotland Office in generating new partnerships to help grow Scotland’s economy. Liz Cameron, Chief Executive of Scottish Chambers of Commerce, said:

“While an unexpected General Election adds further to the compounded uncertainty generated by recent elections and referendums, it also presents an opportunity for the next UK Government to take a fresh look at its strategy, and in particular how it engages with Scotland’s businesses. The UK Government has a key role to play in supporting Scottish firms to grow and to take advantage of the opportunities that the UK’s changing international relationships will bring.

“That is why the UK Government in Scotland must become as open and accessible as the Scottish Government already is. The Scotland Office must transform its perception and its operation in order to become a functional hub for UK Government services in Scotland, fully aligned and in tune with Scottish business needs. As part of this, the new Department for International Trade must formulate a new partnership with Scottish business that will help to encourage more of our businesses to export and which will harness the international connectivity of the UK Government alongside the deep-rooted business to business links that organisations such as Chambers of Commerce can bring to the table.

“Whatever the composition of the new UK Government following next month’s elections, there will be a clear opportunity for it to deliver closer connections with Scotland’s businesses, to reinvent the nature of its activity in Scotland and to play a key role alongside the Scottish Government in working to build on the huge potential for success across Scottish business; in particular, helping our small and medium sized businesses to succeed in exporting.”