The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in November 2017 was £145,992 – an increase of 3.6 per cent on November in the previous year and an increase of 1.1 per cent when compared to the previous month.

This compares to a UK average of £226,071, which was an increase of 5.1 per cent on November in the previous year and an increase of 0.1 per cent when compared to the previous month.

The volume of residential sales in Scotland in September 2017. was 9,323 – a decrease of 2.5 per cent on September 2016 and a decrease of 0.5 per cent on the previous month. This compares with annual decreases in sales volumes of 14.8 per cent in England, 6.6 per cent in Wales and 8.6 per cent in Northern Ireland (Quarter 3 – 2017).

Registers of Scotland Business Development and Information Director Kenny Crawford said: “Average prices in Scotland continued their upward trend in November with an increase of 3.6 per cent when compared to November 2016. Average prices have been steadily increasing each month since March 2016, when compared with the same month of the previous year.

“Residential sales volumes decreased in September. The annual decrease of 2.5 per cent when compared with September 2016 in Scotland is in the context of greater decreases across the rest of the UK. The cumulative volume of sales. for Scotland for the financial year to date – from April to September 2017 – was 54,893. This is an increase of 9.1 per cent on the equivalent year to date position for September 2016.”

The top five local authorities in terms of September sales volumes were the City of Edinburgh (1,124 sales), Glasgow City (1,067 sales), Fife (706 sales), South Lanarkshire (595 sales) and North Lanarkshire (451 sales).

Average price increases were recorded in three quarters (24) of all local authorities in November 2017, when comparing prices with the previous year. The biggest price increases were in West Dunbartonshire, East Lothian and the City of Edinburgh, where the average prices increased by 10.3 per cent to £106,216, 8.1 per cent to £217,106 and 8.0 per cent to £246,508 respectively. The biggest decreases were recorded in Aberdeen City and Argyll and Bute where prices fell by 4.2 per cent to £163,489 and 3.9 per cent to £127,373 respectively.

Across Scotland, most property types showed an increase in average price in November 2017 when compared with the same month in the previous year. Flat or maisonette properties showed the biggest increase, rising by 7.2 per cent to £108,881. The average price of detached properties showed a decrease of 3.6 per cent to £235,744.

The average price in November 2017 for a property purchased by a first time buyer was £121,574 – an increase of 6.5 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £169,670 – an increase of 0.7 per cent on the previous year.

The average price for a cash sale was £135,641 – an increase of 4.0 per cent on the previous year – while the average price for property purchased with a mortgage was £150,733 – an increase of 3.5 per cent on the previous year.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in October 2017 was £143,544 – an increase of 2.8 per cent on October in the previous year and a decrease of 0.7 per cent when compared to the previous month.

This compares to a UK average of £223,807, which was an increase of 4.5 per cent compared to October in the previous year and a decrease of 0.5 per cent when compared to the previous month.

The volume of residential sales in Scotland in August 2017 was 9,282 – an increase of 7.4 per cent on August 2016 and an increase of 5.3 per cent on the previous month. This compares with annual decreases in sales volumes of 12.0 per cent in England, 3.4 per cent in Wales and 8.6 per cent in Northern Ireland (Quarter 3 – 2017).

Registers of Scotland Operations Director and Accountable Officer Janet Egdell said: “Average prices in Scotland continued their upward trend in October with an increase of 2.8 per cent when compared to October 2016. Average prices have been steadily increasing each month since March 2016, when compared with the same month of the previous year.

“Residential sales volumes increased in August. The annual increase of 7.4 per cent when compared with August 2016 in Scotland compares to decreases across the rest of the UK. The cumulative volume of sales for Scotland for the financial year to date – from April to August 2017 – was 45,152. This is an increase of 9.9 per cent on the equivalent year to date position for August 2016.”

The top five local authorities in terms of August sales volumes were the City of Edinburgh (1,190 sales), Glasgow City (1,109 sales), Fife (632 sales), South Lanarkshire (553 sales) and North Lanarkshire (448 sales).

Average price increases were recorded in 29 out of 32 local authorities in October 2017, when comparing prices with the previous year. The biggest price increases were in Dumfries and Galloway and City of Edinburgh, where the average prices increased by 10.5 per cent to £129,885 and 8.5 per cent to £247,568 respectively. The biggest decreases were recorded in Inverclyde and Aberdeen City where prices fell by 4.0 per cent for both to £94,985 and £164,655 respectively.

Across Scotland, all property types showed an increase in average price in October 2017 when compared with the same month in the previous year. Semi-detached properties showed the biggest increase, rising by 4.2 per cent to £151,131. The average price of detached properties showed the smallest increase, 0.9 per cent to £248,482.

The average price in October 2017 for a property purchased by a first time buyer was £116,042 – an increase of 3.4 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £172,056 – an increase of 2.3 per cent on the previous year.

The average price for a cash sale was £132,489 – an increase of 2.9 per cent on the previous year – while the average price for property purchased with a mortgage was £148,669 – an increase of 2.8 per cent on the previous year.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in April 2017 was £145,734 – an increase of 6.8 per cent on April in the previous year and an increase of 5.4 per cent when compared to the previous month.

This compares to a UK average of £220,094, which was an increase of 5.6 per cent compared to April in the previous year and an increase of 1.6 per cent when compared to the previous month.

Registers of Scotland corporate director John King said: “This release marks the one-year anniversary of the first publication of the UK HPI. During this time, the HPI has been well received and we have been liaising with users around its ongoing development. Feedback has already resulted in a number of enhancements, details of which are outlined in the anniversary news release, published on behalf of the HPI working group by our partner HM Land Registry.

“Average prices this April showed the highest year-on-year increase since March 2015, when the average price increased by 10.4 per cent compared to the year before, and there have been increases in every month since March 2016 when compared with the same month of the previous year.”

The volume of residential sales in Scotland in February 2017 was 5,662 – an increase of 2.8 per cent on February 2016 but a decrease of 10.2 per cent on the previous month. This compares with annual decreases in sales volumes of 18.2 per cent in England, 8.8 per cent in Wales and 28.5 per cent in Northern Ireland. This is the third consecutive month in which Scotland volumes figures, when compared with the same month of the previous year, have shown an increase while volumes in the rest of the UK have decreased.

Mr King added: “Sales volumes figures for February 2017 showed an increase in Scotland of 2.8% when compared with February 2016. This is also up by 10.7 per cent when compared with February 2015 and up by 32.1 per cent when compared with February 2013, but down by 1.3 per cent when compared with February 2014.”

The top five local authorities in terms of sales volumes were Glasgow City (722 sales), the City of Edinburgh (562 sales), Fife (356 sales), North Lanarkshire (351 sales) and South Lanarkshire (313 sales).

The biggest price increase when comparing April 2017 with April 2016 was in East Dunbartonshire where the average price increased by 11.2 per cent to £202,466. The biggest decrease was again in the City of Aberdeen, where prices fell by 4.3 per cent to £167,630.

Across Scotland, all property types showed an increase in average price in April 2017 when compared with the same month in the previous year. Detached properties showed the biggest increase, rising by 8.0 per cent to £252,492.

The average price in April 2017 for property purchased by a first time buyer was £117,556 – an increase of 5.9 per cent compared to the same month in the previous year. The average price for a property purchased by a former owner occupier was £174,848 – an increase of 7.5 per cent on the previous year.

The average price for a cash sale was £138,425 – an increase of 10.6 per cent on the previous year – while the average price for property purchased with a mortgage was £150,688 – an increase of 6.4 per cent on the previous year.

Report ranked five Scottish markets on key points for investors

Report ranked five Scottish markets on key points for investors

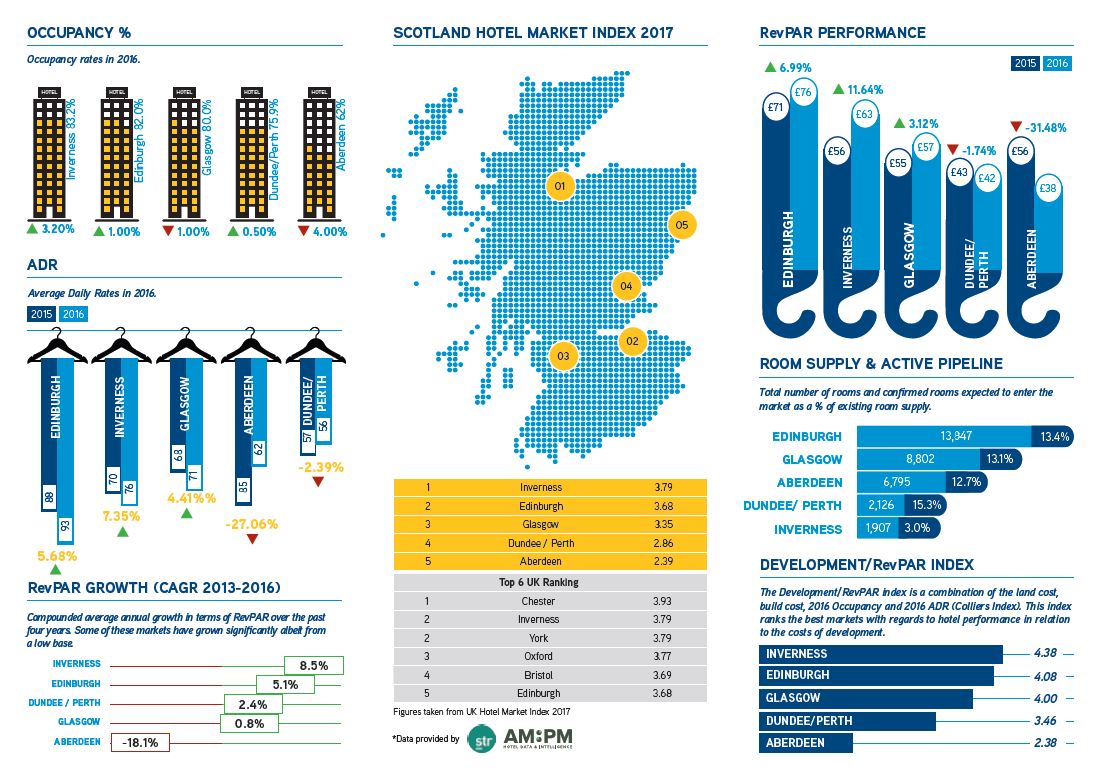

Inverness has emerged as the surprise leader in Colliers International’s inaugural Scottish Hotel Index, as a combination of strong levels of demand; rising Average Daily Rates (ADR); a low active pipeline; relatively low development costs and high occupancy levels, allowed it to beat Edinburgh into second place.

Colliers’ Scottish Hotel Index involves the analysis of five locations across Scotland and ranks them according to nine key indicators, to determine the ‘hot spots’ for hotel development and acquisition across the country. It has found that Inverness is the most attractive market for investors, followed by Edinburgh and then Glasgow, Perth and Dundee, and Aberdeen.

Marc Finney, Head of Hotels & Resorts Consulting at Colliers International, said: “Our Scottish Hotels Market Index shows the changes taking place in the sector. The study in particular, highlights that Inverness is not necessarily the best hotel market north of the border, but it is currently providing the best opportunities in Scotland. Inverness has recorded high levels of demand of around 80% over the past four years, which has enabled ADR to rise by 22% between 2013 and 2016. It is cheap to acquire hotel sites there, providing investors with much better value for money than, say, Edinburgh.”

Alistair Letham, the Scottish director in the UK Hotels Agency team at Colliers International, added: “Crucially the index shows that hotel performance is on an upward trend in Inverness, and there is little new stock of guest rooms in development. Despite being expensive, Edinburgh is also on an upward trend and has one of the highest ADR in Scotland and the UK at £93 at the end of 2016. So the capital rightly deserves its position in the UK top ten.”

Highlights

Inverness scored highly and with an overall rating of 3.79, which would put it joint second in the UK, alongside York and behind Chester. Edinburgh is in 5th place in the UK Index.

Inverness led the way in the RevPAR trend, with growth of 8.5%, and also had the highest occupancy rate in the Scottish market with 83.2%.

The city also had some of the cheapest land, alongside Dundee and Perth, and Aberdeen, the smallest active pipeline at under 3% of current room supply, and relatively modest build costs. This allowed Inverness to top the table despite being rated as having only ‘moderate investor appeal’.

Due to data limitations, Dundee and Perth have been analysed as one city, and ranked fourth.

Edinburgh was second with the highest hotel KPIs in Scotland and a ‘very sought after’ investment location, helping it beat Glasgow into third. But its high land price, considerable active pipeline and lower RevPar trend kept it below Inverness for overall investment appeal.

Aberdeen was rated the lowest in Scotland with occupancy rate of 62% and a negative RevPar trend weighing against the Granite City. This is mainly due to the collapse of the oil prices and a large number of new hotel projects.

Mr Finney concluded: “Aberdeen was once the most thriving hotel market in Scotland and the UK but the downturn in oil prices and subsequent offshore activity has hit it hard. It is therefore suffering from a degree of oversupply and tough comparators from previous years. However, that is not to say that it does not have appeal to investors given the market’s potential to improve along with the fortunes of the city’s biggest industry.”

TOP SIX Scottish Hot Spots For Hotel Investment and Development:

1. Inverness

2. Edinburgh

3. Glasgow

4. Dundee/Perth

5. Aberdeen

Methodology

Colliers’ Scottish Hotel Index uses nine Key Performance Indicators (KPIs) to score each of the locations a figure from one to five (one being the lowest and five being the highest). The determining indices include land site prices; build costs; market appetite; valuation exit yields; room occupancy; average daily rate; room occupancy rates; four-year revenue per available room trend (RevPAR); active pipeline as a percentage of current supply and construction costs. The ratings are then consolidated into a single figure and ranked to show the markets that are ‘hot’ and those that are not, in terms of a desirable location for investors to acquire an existing hotel or develop a new one.

The latest publication of the monthly UK House Price Index (UK HPI) shows that the average price of a property in Scotland in March 2017 was £137,139 – an increase of 0.7 per cent on March in the previous year but a decrease of 1.0 per cent when compared to the previous month. This compares to a UK average of £215,848, which was an increase of 4.1 per cent compared to March in the previous year and a decrease of 0.6 per cent when compared to the previous month.

The volume of residential sales in Scotland in January 2017 was 6,239 – an increase of 2.0 per cent on January 2016 but a decrease of 25.4 per cent on the previous month. This compares with annual decreases in sales volumes of 16.6 per cent in England, 2.3 per cent in Wales and 28.5 per cent in Northern Ireland.

Registers of Scotland business development and information director Kenny Crawford said: “Average prices this March showed a modest increase when compared to March 2016 and there have been increases in every month since March 2016 when compared with the same month of the previous year.

“Sales volumes figures for January 2017 showed an increase in Scotland of 2.0% when compared with January 2016. This is also up by 0.8 per cent when compared with January 2015 and up by 34.1 per cent when compared with January 2013, but down by 3.9 per cent when compared with January 2014.”

The top five local authorities in terms of sales volumes were Edinburgh City (764 sales), Glasgow City (700 sales), South Lanarkshire (396 sales), Fife (391 sales) and North Lanarkshire (305 sales).

The biggest price increase when comparing March 2017 with March 2016 was in East Dunbartonshire where the average price increased by 10.7 per cent to £196,332. The biggest decrease was again in Aberdeen City, where prices fell by 6.3 per cent to £163,050.

Across Scotland, all property types except flats showed an increase in average price in March 2017 when compared with the same month in the previous year. Semi-detached properties showed the biggest increase, rising by 2.3 per cent to £144,261, while flats decreased by 0.1 per cent to £98,012.

The average price in March 2017 for a property purchased by a non first time buyer was £164,434 – an increase of 0.6 per cent compared to the same month in the previous year. The average price for property purchased by a first time buyer was £110,789 – an increase of 0.8 per cent on the previous year.

The average price for a cash sale was £126,030 – an increase of 0.1 per cent on the previous year – while the average price for property purchased with a mortgage was £141,899 – an increase of 0.6 per cent on the previous year.