Digital repository solutions are becoming increasingly popular within organisations but when talking about these solutions to people unfamiliar with the concept, there are often similar questions asked. We’ve listed a few of these to (hopefully) shed a bit of light on these.

What does it do?

Our repository system’s primary focus is storing, classifying and delivering organisational resources (media, documents, presentations, learning content etc.). Think of it as your organisations own personal library containing all your organisations content. The resources can be accessed through a friendly user interface by browsing and searching (including searching document content), and by a powerful suite of web services that link external or third-party systems. Content access, upload and download can all be controlled by user rights and quality assurance workflows are built in to ensure that the right content is uploaded.

What are the benefits to my organisation?

Think about all the information your organisation has collected and created and where it sits. This will often be in folders on servers, C drives and even in personal email inboxes. Now say you even have access to the right area where that information is held how do you know that the PDF entitled ‘X’ contains information relevant to the bid you are preparing or that the video file entitled ‘Y’ will be useful for the presentation you are creating. What if instead all this information could be stored, discovered and accessed through one system. No more recreating content that someone has created already, no more losing knowledge because an employee has left – everything becomes much more efficient.

Is this like SharePoint?

There are some similarities but SharePoint was not really designed to act as a library for discovering resources etc. (for example it can’t search the content of a document as a digital repository can). Its been designed more for sharing resources rather than searching and discovering them. SharePoint is very good at what it does but its a bit like comparing apples and oranges.

What are the main features?

There are many and these can be configured to suit the particular requirements but the list below covers the main ones:

– Keyword/phrase search

– Metadata search

– Store and retrieve named searches

– Resource content search

– Show similar resources

– Subscribe to RSS feeds

– Preview resources

– View full metadata record

– Export resources

– Comment on and rate resources

– User customisable resource tags

– Report problem/abuse

– Contribute resources

– Can handle any type of files

– Most commonly images, documents and audio-visual files

– Metadata creation and editing

– Resource review functionality

– Classification creation and editing

– PDF conversion for .doc resources

– Workflow editor

– Defining collections within the repository

– Set access permissions for specific groups of users

– Configurable System Roles

– Group Administration

– Various authentication options

– All functions accessed by web browser

– Metadata harvesting

– Search from learning management platforms

– Support for wide variety of Metadata and packaging specifications

If you’re interested in learning more please do not hesitate to get in touch to find out how a digital repository can help your organisation.

The Scottish Qualifications Authority has produced a series of short films showcasing the impact its portfolio of computing qualifications and awards is having on digital skills development in Scotland.

Produced to mark National Digital Learning Week, one of the films has been produced in partnership with CodeClan, Scotland’s first digital skills academy.

With training centres in Edinburgh and Glasgow offering students the opportunity to fast track their way into a career in technology, CodeClan worked with SQA to develop the Professional Development Award in Software Development.

Currently the only training provider in the UK offering the qualification, CodeClan delivers the 16-week course to students keen to make a head-start in a new career, equipping them with the skills needed to join the continually expanding digital sector.

Sara Dodd, Head of Curriculum and Accreditation at CodeClan, said: “Creating the Professional Development Award was really a collaborative effort, utilising our knowledge of the industry, and SQA’s specialist knowledge of assessment. It’s a testament to the quality of the course, that 84% of CodeClan graduates are hired once they complete their PDA. The course also helps to confirm Edinburgh’s growing reputation as a hub for digital innovation.”

Alastair MacGregor, Head of Science, Technology, Engineering and Maths at SQA, said: “Our CodeClan case study is an excellent example of how SQA’s digital skills qualifications are being developed, and delivered in exciting and innovative ways. By working together with the organisations delivering our courses, we are able to input valuable insights into the requirements of the qualifications, creating realistic and achievable pathways into the digital sector, and we are able to help give learners the skills they need to forge successful careers in this growing industry.”

CodeClan student Adam Leel, is currently working towards the PDA. Adam said: “I can see that the skills I’ve learned as part of the PDA course are really relevant. I’ve had the opportunity to meet with and talk to employers, so I could see that what we were learning was important to them and relevant to the workplace.”

PDA graduate Simon Douglas added: “The skills the PDA has helped me develop are really translating well in my new job. There’s a lot of emphasis on planning and testing as part of the course, and this is a key part of any software development role, and the PDA really enforces those good practices.”

The full SQA Digital Skills playlist, which alongside the case study from CodeClan, features testimonies from Dundee and Angus College, and Kyle Academy in Ayrshire, is on SQA’s YouTube channel.

For more information on SQA’s portfolio of digital skills, and computing qualifications, visit www.sqa.org.uk/computing.

National Digital Learning Week runs from Monday 15 to Friday 19 May.

Edinburgh outranks Glasgow to secure second place in Barclays Digital Safety Index

• Bank account fraud is the most common type of fraud in both cities

• Rural dwellers show greater levels of awareness and caution in how they behave online compared with those living in cities

• All regions outperformed London on the digital safety score

• Across the UK, only 17% of people can correctly identify basic digital safety threats such as social media messages intended to trick users into sharing personal details or downloading malware

• Barclays is spearheading a new £10m nationwide drive to increase the public’s awareness and is launching an online quiz to give everyone free digital safety scores and tips

• New debit card choices will allow customers to turn ‘on’ and ‘off ‘remote spending and change ATM limits at the touch of a button

Monday 8 May 2017: Edinburgh has outranked Glasgow to be named as one of the most ‘digitally safe’ cities in the UK, behind only Liverpool, according to a new study from Barclays which has scored the nation’s susceptibility to online scams and fraud.

Launched today, the Barclays Digital Safety Index score is based on the ability of 6,000 UK adults to protect data, devices, accounts, and to spot digital threats. Respondents in Edinburgh and Glasgow were asked to complete a digital safety test − similar to the hazard perception tests encountered by people taking driving theory exams − and answer questions about the steps they take to protect their devices from online threats.

On average, people from Edinburgh scored 6.25 in the test, lower than the national average score of 6.27, but higher than Glasgow which scored 6.05. With scores ranging from 1-10, (10 being the maximum safety score), there is plenty Scots could be doing to improve their digital safety.

DIGITAL SAFETY SCORE BY UK REGION

(scores from 1-10)

East Midlands – 6.46

Yorkshire & Humber – 6.39

North West England – 6.35

South West England – 6.33

East of England – 6.33

South East England – 6.33

Scotland – 6.29

Wales – 6.28

UK – 6.27

West Midlands – 6.22

North East England – 6.16

Northern Ireland – 6.12

London – 5.85

DIGITAL SAFETY SCORE BY UK CITY

(scores from 1-10)

Liverpool – 6.31

UK – 6.27

Edinburgh – 6.25

Sheffield – 6.21

Manchester – 6.21

Leeds – 6.14

Glasgow – 6.05

All major cities – 6.02

Birmingham – 5.85

London – 5.85

Bristol – 5.83

In Edinburgh, 12% of respondents had experienced bank account fraud, one in ten had been a victim of a purchase scam and just under 10% had fallen foul of a safe account scam where fraudsters claiming to be from their bank call and advise them to move their cash because of an issue with their account.

In Glasgow, bank account fraud again topped the poll with more than one in ten people affected. 11% of respondents had experienced scams in relation to an online shopping account while 10% has been targeted through payment accounts.

Overall, city dwellers are more at risk of cybercrime than those living in the country, 20% of rural residents claim to have experienced an online scam or fraud in the past three years, compared with a UK average of 25%. Behaviour also plays a key role. Rural dwellers in general show more awareness and caution in how they behave online, scoring more highly in our Digital Safety Index as well – averaging a 6.49 score compared with city average score of 6.02.

Across the UK as a whole, digital familiarity may be fueling online complacency, with the survey also revealing a generational ‘digital safety gap’ between younger and older respondents. On average, people scored 6.27 in the test, but digital awareness scores for the oldest age bracket (over 65s) were some 25% higher than the youngest age group tested (18-24 year olds), putting to bed the notion that older people are more at risk of being “duped” by cyber criminals. Furthermore, only 17% of all respondents were able to score full marks in the question asking them to correctly identify digital safety hazards: from online pop-ups and games, spam or “phishing” emails and “smishing” texts or social media messages that trick users into sharing personal details or downloading malware that leave devices vulnerable to hackers.

To encourage the nation to consider its own digital vulnerability, Barclays is calling for the public, police and businesses across the UK to unite and tackle this growing issue of public concern and has today launched a multi-million pound Digital Safety drive.

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

“The Barclays Digital Safety Index identifies the UK’s most vulnerable to cybercrime for the first time.

“With Scotland lagging behind in the Digital Safety Index and residents most commonly falling victim to bank account fraud, it’s evident that more needs to be done to improve awareness of both cybercrime and cybersecurity in this area.

“This is why we are encouraging everyone, even the most confident of digital users, to take our test and learn how they can stay safe in our digital age.”

Under the new Digital Safety drive:

• In a UK high street bank first, Barclays is giving customers new levels of control over when, where and how their debit card works, offering customers the choice to instantly turn ‘on’ and ‘off’ whether their card can be used to make remote purchases, and even set their own daily ATM withdrawal limits on their Barclays Mobile Banking app.

• A new online quiz is available to everyone in the UK from today. By answering simple questions people can assess their own digital safety level, and receive useful tips on how to strengthen their defences at barclays.co.uk/security. Barclays aims to help at least 3 million people to boost their digital safety levels by using the test.

• A new £10m national advertising campaign is being launched across national TV, print, online and billboards. It will alert people to the risk of fraud unless they take proper precautions, and will include content targeted towards younger people and those in urban areas.

• Barclays will be hosting regular fraud awareness takeovers on its online and mobile banking sites, prioritising fraud prevention over products.

• Barclays’ nationwide force of 17,000 Digital Eagles will provide digital safety teach-ins to people, and free support clinics for the 1 million UK SMEs we serve. Barclays LifeSkills is also launching new Digital Safety learning content specifically designed for younger people.

• Barclays is also leading industry efforts to prevent instances where customers are duped into withdrawing all their cash from branches and handing it to a scammer posing as a trusted person, through a new police hotline for branch colleagues to call.

Barclays estimates that if people implemented these three top tips we could help to cut levels of fraud by up to 75 per cent.

1. Never give out your full Online Banking PIN, Passcode or Password to anyone, even a caller claiming to be from the police or your bank.

2. Do not click on any link or open an attachment on any e-mail you receive which is unsolicited.

3. Avoid letting someone you do not know have access to your computer, especially remotely.

To find out how digitally safe you are, take the new quiz at the Barclays Digital Safety Hub www.barclays.co.uk/security or simply search for “Barclays Digital Safety”.

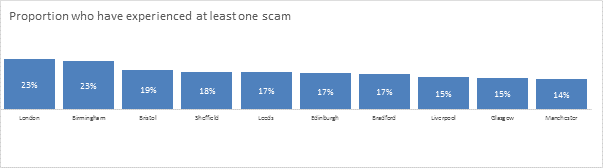

City rankings by proportion of residents to have suffered from scams in the past 3 years:

A report from August 2016 stated that 76 per cent of IT practitioners had reported that their organisation has experienced loss or theft of company data over the past two years.

Does this figure reflect that data theft is simply now commonplace? Or does it highlight the need for companies to do more to minimise the risk of data breaches?

Upon reflection, I think it’s a mix of both. Minimising risk – especially from data breaches – is now a board-level concern, although it is far more difficult to establish to what extent it now filters down into proactive measures to protect against data breaches.

We live in an era where security is a dynamic risk and one that’s constantly evolving, so companies will always need to do more to keep ahead of the curve. Sadly, there is no magic strategy to end all security risks and it’s a job that requires constant attention, not least because cyber criminals are relentless in their efforts to capture confidential and valuable information.

Print infrastructure is, more often than not, one of the weak links in the security chain. Too often it is overlooked by IT professionals, resulting in networked devices being deployed and used without proper safeguards in place. An unsecure print infrastructure is vulnerable to both internal and external risks.

Internally, devices that do not have any secure print measures in place can give rise to situations where confidential documents are printed and left unclaimed on a device. In those scenarios, it’s all too easy for documents to be picked up by those unauthorised to view them. This can be particularly harmful; for instance, a HR team may print a confidential spreadsheet that shows employee salaries and leave it unclaimed on a device used by the sales team. Alternatively, a hospital department could print a patient record and leave it unclaimed on a device that’s accessible to the public, resulting in a serious breach of patient confidentiality.

To prevent such scenarios, we offer a range of Intelligent Print Management solutions that make print more transparent and accountable. Equitrac Print Management– among its many other features – offers access control by adding authentication at the printer to protect devices from unauthorised use of print, scan and fax functionalities. It also provides confidential printing with its authorised user-only, Follow-You print feature, which ensures that prints are only delivered into the right hands and negates the risk that confidential documents could go missing.

Many of our private sector clients, in industries such as financial services, are also required to honour specific regulation and compliance criteria around their customer data, meaning that they must consider their responsibilities in the context of their device and print security policies. The Information Commissioner’s Office applies pressure on companies to do so by imposing hefty fines to public and private sector organisations that have failed in their data privacy duties.

For more information about how to improve your document and data security, contact your local account manager on 0750 000 4563 or visit https://r1.dotmailer-pages.com/p/1HI3-3NL/why-document-security-is-important.