Blackadders Solicitor Samera Ali talks about the differences in Scottish & Islamic Inheritance Law in her first Vlog.

Click here to watch the full video: https://lnkd.in/e-Jx95G

For more information on Wills and setting one up please contact our Private Client team by visiting www.blackadders.co.uk

In short the answer is NO.

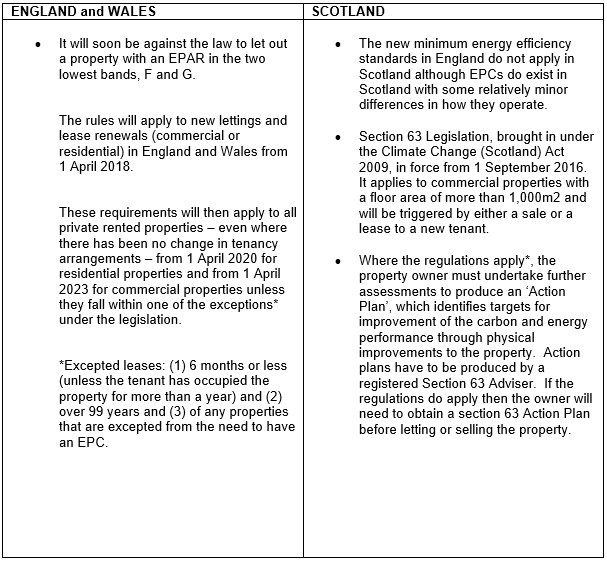

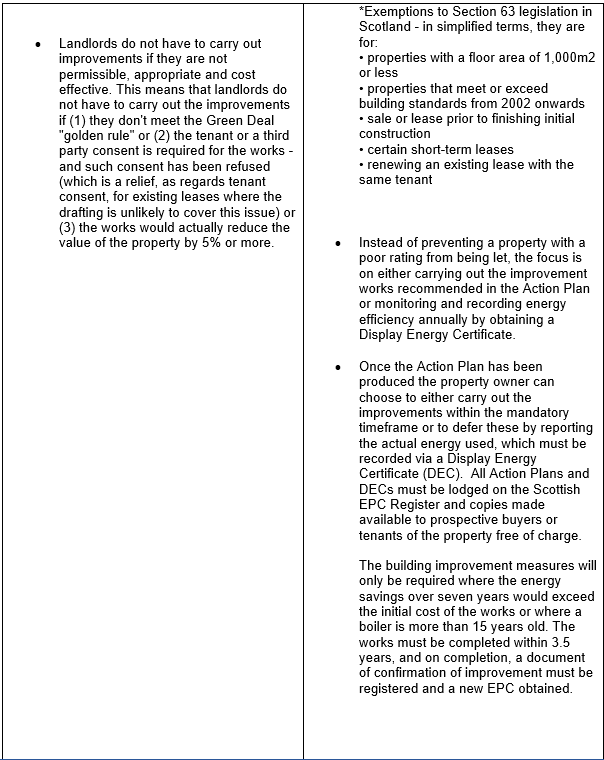

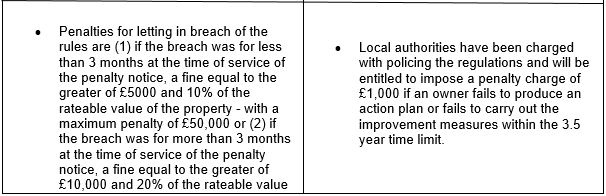

In England and Wales, regulations which are due to come into force on 1 April 2018 will potentially affect the ability to let out properties and the market value (and marketability) of those properties. The regulations will prevent private Landlords from letting either residential or commercial properties with an Energy Performance Asset Rating (EPAR) lower than E (unless they can point to a specific exemption).

The equivalent regulations for buildings in Scotland do not impose a minimum EPC rating requirement but other measures apply that are already in force for commercial properties.

Landlords, investors, developers and lenders should take note of the differences and not assume energy efficiency policies are the same throughout the UK.

*Non Domestic EPC Register for England and Wales

*EPC Register for Scotland

Registers can be searched using the property’s postcode so the easiest way to determine whether or not a valid EPC exists for your property is to check online: Non Domestic EPC Register for England and Wales or EPC Register for Scotland.

If you have any queries regarding energy efficiency requirements for properties, please get in touch with your usual contact in the Property team at Blackadders.

Blackadders are delighted to announce a new display window within London Road, Edinburgh.

Blackadders are delighted to announce a new display window within London Road, Edinburgh.

Property Services Director, Martin Paterson commented: “This will be a great addition to Blackadders Estate Agency having a further display window within a main arterial route”.

Edinburgh Property Manager, Scott Whigham is optimistic about the year ahead: “The signs for the Edinburgh market are good in 2018. I am anticipating a similar year to last year where I think prices above Home Report value will be achieved on a regular basis. This is undoubtedly down to fewer houses being on the market and it really is about supply and demand at the moment. Over the past couple of years I have seen a change in the market from it being a buyer’s market to it now being very much in the seller’s favour.

Previously, when the stock levels were higher, buyers had their pick of properties and could, to a certain degree, dictate the price they were willing to pay. Closing dates are now being set on almost every property we sell and buyers are having to put their best offers in to secure the home they want.

To sum up, I believe 2018 will be a great year to maximise the full value of your home”.

If you would like to arrange a Free, No Obligation, Marketing Appraisal of your home please give our Property Sales Team a call on 0131 202 1868 (7 days).

Blackadders’ Employment Team has been nominated for the “Innovation in Practice Award” at the Scottish Legal Awards 2018.

Blackadders’ Employment Team has been nominated for the “Innovation in Practice Award” at the Scottish Legal Awards 2018.

The team has received recognition for their series of podcasts – Employment Lawyer In Your Pocket – which are available for free on both the website and on iTunes.

Simon Allison who heads up the Employment Team was also nominated for the “Lawyer of the Year Award”, unbeknown to him he was put forward for the award by fellow team member, Associate Solicitor, Jack Boyle. When asked why Jack nominated Simon he said; “That’s easy. Simon deserves this award because he has unparalleled success DESPITE having a stroke early last year. As Simon himself says, “When the going gets tough and I wonder why I am doing this, I remind myself, it’s because I can.”. Simon commented that it was “a lovely surprise to be nominated for the Lawyer of the Year Award and that he is truly honoured although he is also going to keep a closer eye on Jack in future”.

When asked about the team nomination Simon commented, “We are absolutely delighted to be nominated for this accolade. It is recognition of both the quality content and the hard work which the team has put into their podcasting journey. Both Blackadders and the Employment Team are flattered to be named as one of the finalists.”

The team commenced their podcasts in December 2016. Series one was entitled “Eight steps to conduct a fair dismissal”. Series two was entitled their “How To” series of podcasts where the team cover such topics as “How To Be A Good Witness”, “How To Deal With Stubble and Tattoos”, “How To Manage Your Apprentices” and “How To Appoint A Data Protection Officer”.

Simon commented, “Each podcast lasts for approximately 10 minutes. The rationale was that a ten minute podcast was longer than the length of time for Queen’s Bohemian Rhapsody and less than Meatloaf’s I Would Do Anything For Love (album version). Believe it or not, there is no actual script. And editing has been minimal to ensure that the natural flow of our friendships was not missed.”

The purpose of the podcasts was not to be the best podcasters in the world. Instead it was to raise the profile of the firm and to generate new business and new clients. We have been really successful in all of these criteria both locally and throughout the UK.

“We were advised that if we managed to get 150 listeners for each season, that would be a great result. By the end of season one, we had over 800 listeners. Season two ended in December and at the last count, there were over 3600 subscribed listeners.”

If you want to ask the team a question which may be featured in season three of their next series, you should tweet them using the #ELiYP hashtag.

Simon has promised the team that he will take them to watch a Real Madrid match if they win the award.

Let’s hope that, for Simon’s sake, the team will be dining on mince and tatties this summer as opposed to tortillas.

Welcome to the first property blog of 2018! Rest assured that this year will see more property blogs.

Welcome to the first property blog of 2018! Rest assured that this year will see more property blogs.

I predict that 2018 will be a very interesting year for the property market. Before I give you my predictions for 2018 though, how did I get on with my predictions for 2017?

Looking at my blog on the 9th of January last year I predicted a 5% decrease in market activity with a slight increase in house prices averaging around the 2% to 4% mark. Whilst I think I was correct in relation to the general road of travel, the decrease in activity in the property market (especially in the second half of the year) appears to have been steeper than even I had predicted.

As yet, I have not seen the final stats for 2017 and obviously there are geographical differences to take into account, but I would predict that Scotland overall would show a decrease of between 10% and 15% in relation to properties coming on to the market, with a perhaps more significant increase in average house prices, probably around 5%. There have been recent reports advising that November saw the sharpest drop in mortgage approvals for a number of years and as different areas start issuing their stats, I think this general downward trend will be repeated.

On to 2018 and I am actually looking at this year with more optimism than the last year. What is the reason for the optimism? Like a bottle of champagne being constantly shaken, the housing market, with its links to lifestyle choices, will eventually not be contained no matter what the economic background. I suspect that 2018 particularly the second half of the year will show this and although uncertainty around Brexit will continue it will become something that we live with. As economic uncertainty fades and as general lifestyle requirements kick in, I think we will see an increase in activity in the housing market.

I also think that developers sensing the lack of supply and price inflation, have now started to increase their build output. I believe that this will be the oil that greases the wheels of the property market especially if the developers offer part exchange and other incentives.

In relation to specific areas, I would comment as follows:-

- ABERDEEN & ABERDEENSHIRE– I am starting to see green shoots of activity coming through the Aberdeen property market and whilst it will take some time for the extra stock to clear, I do believe that Aberdeen is on the cusp of recovery. Although we will not get back to the highs of pre 2010, we will over the next 18 months move very quickly towards some form of normality and a free flowing market.

- DUNDEE– As the V&A moves towards its opening and Dundee Council carry on with their exciting plans for the development of the waterfront area and the city in general, I do think that Dundee is on the cusp of very exciting times in relation to the property market. In particular watch this space in relation to flats down at the waterfront which are looking very reasonably priced and very attractive for investors and also residents.

- ANGUS– The Angus market continues to prove robust and as Aberdeen continues to improve expect more of this heat to work its way down the coast, in particular Montrose, Brechin, Arbroath, etc.

- PERTH & PERTHSHIRE– This market is proving very difficult as its driver in the early 2000s was the heat from the Edinburgh market. Unfortunately, I cannot see a big increase in the Perth property market, although I do predict more stability and a slight increase in activity.

- FIFE– This also appears to be a difficult market, however with some hot spots, St Andrews in particular proving very popular and prices continuing to exceed expectations. Again, I predict a degree of stability in the Fife market.

- EDINBURGH– I see potential for further growth in the Edinburgh market. I think that the developers will continue to produce stock for this market and as such, I am anticipating some significant growth, both in terms of activity and prices in 2018.

- GLASGOW & the WEST– Again, I am seeing positive signs and think that in particular the second half of 2018 will show significant increases in activity in the Glasgow market fuelled by a mixture of newbuild development.

Overall, I am predicting a slightly quiet first three months for 2018 with a steady increase in activity for the remainder of the year culminating in activity levels being up by 10% and prices increasing by 5%. As always, watch out for the first quarter figures as this will be a good indication. The phrase “more optimistic than last year” probably sums up my feelings.

I will continue to provide blogs on aspects of the property market and also watch out for some interesting additions, including “dinners for winners” – my take on the late, Michael Winner’s weekly column in the Sunday Times.

Finally, I would wish all readers a happy and prosperous 2018.

With the warmth of Christmas behind us and January now upon us, many of us will be setting aside the turkey sandwiches & mulled wine and thinking of resolutions for the year ahead.

With the warmth of Christmas behind us and January now upon us, many of us will be setting aside the turkey sandwiches & mulled wine and thinking of resolutions for the year ahead.

As a private client lawyer, it is too easy for me to say “make a Will!” and leave it at that -though if you do not have a Will, then what better time to get it done? Instead, in the spirit of Yuletide reflection, I want to encourage those who already have a Will to go back and review their plans. An old Will is not necessarily a bad Will, but life never stands still. In certain situations, a neglected Will can sometimes be worse than no Will at all! It is therefore essential that you take time to ensure that your Will keeps pace as you go through life.

There are a lot of things that can change over the years that would require you to take a fresh look at your Will. For now, we will look at changes in (1) your family, and (2) your estate.

1. Families: hatches, matches & dispatches

If there have been changes in your family since you last did your Will, then you need to make sure your plans are up to date. Here are just a few questions to ask yourself:

Have you had children since you made your Will?

A lot of people make their first Will when they buy their first house. Great idea, but if you later have children, then they may not be included in the Will. Some Wills are ‘future-proofed’ with wording that covers children who are not yet born, but some Wills are not. Scottish law has some surprising pit-falls in this area, so it is much better to review things afresh if you now have children of your own. If your children are still under 16, you also need to consider the issue of who would be their guardian in the event if your death – which can be addressed within the Will.

Have your children gotten married or had children of their own?

A larger family means more people to consider. Do you now want to leave some of your estate directly to your grandchildren? Younger beneficiaries also bring other questions: does their inheritance need to be placed into trust until they reach a certain age? Do they have lifelong disabilities that will require special planning and consideration? Do they need extra support to help them on their career path or to get onto the housing ladder?

Has anyone (including you) separated or gotten divorced?

If there has been a divorce or separation within your family, then you need to urgently review your plans in order to make sure that the person who has ‘exited’ your family is not accidentally left in the Will. Recent changes in the law have made this point a little easier in some situations – namely where you are the one who has gotten divorced – but those changes do nothing if you have merely separated from your partner or if you were never married to begin with, and they do nothing where it is someone else in your family who has gotten divorced. If you are not careful, your former partner or your former in-laws may still stand to inherit from you when you die.

Has anyone died?

If one of your beneficiaries has died, you need to consider what should happen to that person’s inheritance: should it go to that person’s own children, or to other beneficiaries already named in the Will, or to someone else entirely? The Will needs to provide the answer. On a more technical level, it is also essential that you review who your executors are to be – as this is easily overlooked and can cause real problems where e.g. the only named executors have died or become mentally incapable.

2. Estates: through thick & thin

Fundamentally, your Will is all about managing and distributing your estate after your death. So if your estate has changed, then your Will may also need to change. A few more questions to ask:

Have you moved house?

If your Will leaves your house to someone, but you later move house, then that legacy may fail unless the Will is carefully worded so that the legacy covers the ‘new house’ as well. Similarly, if you have sold your house without buying a replacement – perhaps if you have moved in with someone or if you have gone into sheltered housing – then the legacy may fail if there is simply ‘no house’ left to leave. In those cases, you may wish to consider amending your Will to include a cash alternative, so that your beneficiary does not lose out entirely.

The same principle applies to all legacies involving specific assets or items. If you do not own that asset any more, then you cannot give it away under your Will!

Are you more wealthy or less wealthy than before?

If your finances have significantly changed since you did your Will, you should take a fresh look at things. You have been perfectly happy with a certain split between your beneficiaries when you did not have much money, but you may be less happy with it if you now have a house and savings. You may want to adjust what share each person receives, or add new people or charities to the list.

If your estate has shrunk then you may decide to focus more on your ‘preferred’ beneficiaries, rather than slicing the pie too thinly among a large number of people. If your Will contains legacies of large sums of money or assets, then it may even be that your estate can no longer afford to pay those legacies.

Have you started, joined or left a business?

Business-owners do not necessarily have to have more complicated Wills, but there is certainly more to consider: there may the question as to what happens to the business after you die. If it is a family business, then it is important for the Will to address the question of which member of the family is to inherit e.g. your shares in the company, and on what terms. Slack planning can have disastrous consequences in this area!

On the other hand, if you have retired or sold your business, then you can probably afford to have a more straightforward Will, and to remove clauses about shareholdings etc. Though of course you may then have a larger lump sum of cash to plan with, so the fun never stops!

The solicitors in the Private Client department of Blackadders are vastly experienced in dealing with Wills of all shapes and sizes. Don’t let January beat you this time, get in touch to make an appointment with a solicitor at your nearest office.

Christmas is a time for giving and there are several ways to make over cash or assets to someone as efficiently as possible when it comes to inheritance tax (IHT).

Christmas is a time for giving and there are several ways to make over cash or assets to someone as efficiently as possible when it comes to inheritance tax (IHT).

IHT is only currently payable on any portion of your estate that is above a threshold of £325,000, and is charged at 40%, however this is reduced to 36% if you donate 10% or more of your estate to charity. If you are thinking of gifting assets or cash as presents this year, then read on to ensure that your gifts do not fall foul of IHT.

1. Small gifts

If you are in a position to do so, get Christmas covered by making use of the small gifts exemption. You can gift up to £250 each year to as many different people as you like in any one tax year (6 April to the following 5 April) without being liable for IHT.

2. Annual allowance

Over and above the small gifts exemption you can gift up to £3,000 in each tax year without paying IHT. You can carry forward all or any part of the £3,000 exemption you don’t use to the next year but no further. This means you could give away up to £6,000 in any one year if you haven’t used any of your exemption from the year before.

3. Gifts out of regular income

A less well known but very useful relief is the gifts out of income relief. Any gifts you make from surplus income as opposed to capital are free from IHT if they are part of your regular expenditure. There is no limit on the sums gifted provided the gifts do not impact on your normal living standards in that the funds used to make the gift are indeed surplus. This means that you could make regular monthly or annual gifts of the difference between your income for the year and your expenses for the year without them falling into your estate, but you do need to document the intention to provide HMRC after your death if your estate is liable for IHT. If for example, your income is £150,000 p.a but you only spend £100,000, then you could give away the remaining £50,000 without it counting as a gift for IHT purposes.

4. Gifts to exempt beneficiaries

(a) Spouses: If you are married or in a civil partnership, you can give anything you own to your spouse or civil partner if their permanent home is in the UK so your estate won’t have to pay IHT on what the gift is worth. Gifts to an unmarried partner, will not benefit from this exemption.

(b) Charities: A lot of us gift to charity at this time of year so remember any donations to charities based in the UK are exempt from IHT. If you use the gift aid scheme you can also save on income tax.

(c) National institutions, such as museums, universities and the National Trust as well as UK political parties are exempt.

5. Weddings

The festive season often means a family wedding and gifts in contemplation of marriage are exempt from Inheritance

Tax up to certain amounts:

• parents can each give £5,000

• grandparents and other relatives can each give £2,500

• anyone else can give £1,000

You have to make the gift on or shortly before the date of the wedding or civil partnership ceremony.

You can still make gifts that do not fall into any of the above groups. These gifts will be treated as potentially exempt transfers (PETS). On the basis you do not benefit from these gifts and provided you live for at least 7 years, such gifts should be free of IHT.

So with Christmas fast approaching, enjoy stress free gifting without worrying about IHT this festive season.

For more information please contact the Blackadders Executries team.

Living Wills are not yet legally binding in Scotland, however a recent case in England shows that medical staff are putting greater emphasis on respecting the wishes of patients.

Living Wills are not yet legally binding in Scotland, however a recent case in England shows that medical staff are putting greater emphasis on respecting the wishes of patients.

A Living Will, also known as an Advance Directive, is a document that allows you to declare your views on receiving life-prolonging medical treatment should you become seriously ill and are no longer able to make decisions on your own health care. A Living Will can set out your wishes in general terms or it can detail your prospective refusal of any specific procedures or treatments that are aimed at prolonging your life. Such treatments could include cardiopulmonary resuscitation, artificial ventilation, invasive surgery or blood transfusion.

In the recent case of Brenda Grant, from Warwickshire, medical staff had misplaced her Living Will which resulted in her receiving life-prolonging treatment for almost two years following a stroke, contrary to her written wishes. Unfortunately, Mrs Grant had not made her family aware of her wishes or the existence of the Living Will and it was only once her GP discovered the document within her medical notes that the medical treatment was stopped. In an out-of-court settlement, the George Eliot Hospital Trust admitted liability and agreed to pay £45,000 in damages to Mrs Grant’s family.

Creating a Living Will allows you to formally express your wishes so that they may be given effect when you are no longer able to make decisions regarding your health or welfare. The aim of the medical profession has historically been to prolong life but as the number of suffers of age related conditions grow, it is essential that consideration is also given to the views of the patient. Many of us will now have experienced family members who have suffered from the indignity of their degradation and would not wish to have the same experience. The hospital trust’s admission that they acted improperly in not ensuring that their patient’s wishes were followed shows that the medical profession understand that there is now a balance to be found.

If you create a Living Will, we always recommend that you let your family and friends know that you have done so to ensure that it is not mislaid within your medical notes. We would also provide you with a copy of the Living Will for your personal papers and your doctor with a copy for their file. For more information on Living Wills please contact Blackadders.

It was announced yesterday that Prince Harry has become engaged to US actress and star of TV show Suits (Rachel Zane), Meghan Markle.

With the wedding predicted to take place in May 2018, there is much speculation about whether Prince Harry and Meghan Markle would or should enter into a pre-nuptial agreement prior to their marriage.

Currently around 50% of marriages end in divorce.

What is a pre-nuptial agreement?

A pre-nuptial agreement is a contract. It can be used to regulate the division of assets upon divorce or death.

Are pre-nuptial agreements enforceable in Scotland?

Although pre-nuptial agreements are untested in the Scottish courts, Scotland has long recognised that people should be able to enter into contracts as they wish. Pre-nuptial agreements are therefore valid in Scotland and the courts may take one into account provided that it was fair and reasonable at the time it was entered in to.

Why have a pre-nuptial agreement?

The most common desire is to protect assets owned prior to a marriage; or assets that are inherited or gifted to one party so that they remain the property of that person and do not go into the matrimonial pot for division. The division of such assets are often the subject of contentious and bitter arguments in a divorce, with much time and money being spent arguing about how these assets should be divided fairly. A pre-nuptial agreement can exclude such assets from the equation. They provide a degree of certainty. Without a pre-nuptial agreement, the statutory provisions apply leaving scope for parties and lawyers to argue about it.

Should they or shouldn’t they?

Pre-nuptial agreements often criticised as being unromantic or as being indicative that one does not love or trust their partner enough. In my opinion, pre-nuptial agreements encourage a couple to be honest and upfront with one another about their financial situation and their expectations for the marriage in a responsible and realistic way.

“You mean more to me than anything in the world and I need you to believe me…” Rachel Zane, Suits.

Not just where marriage is in contemplation…

With cohabiting couples now having limited rights to make a financial claim when the cohabitation comes to an end, a pre-cohabitation agreement can be entered into in the same way as a pre-nuptial agreement. For more information on pre-nuptial agreements please contact Blackadders Family Law team.

Those Christmas parties are coming up and if you are an employer or manager you will definitely want to listen to this beforehand!

Those Christmas parties are coming up and if you are an employer or manager you will definitely want to listen to this beforehand!

The FINALE to season two sees the Employment Lawyers answer a tweet from Vital Hike Ltd – How to keep control over your employees?

Click here to listen to the full podcast: http://bit.ly/2AhfARN

For more information on Employment Law please visit the Blackadders website.