Edinburgh outranks Glasgow to secure second place in Barclays Digital Safety Index

• Bank account fraud is the most common type of fraud in both cities

• Rural dwellers show greater levels of awareness and caution in how they behave online compared with those living in cities

• All regions outperformed London on the digital safety score

• Across the UK, only 17% of people can correctly identify basic digital safety threats such as social media messages intended to trick users into sharing personal details or downloading malware

• Barclays is spearheading a new £10m nationwide drive to increase the public’s awareness and is launching an online quiz to give everyone free digital safety scores and tips

• New debit card choices will allow customers to turn ‘on’ and ‘off ‘remote spending and change ATM limits at the touch of a button

Monday 8 May 2017: Edinburgh has outranked Glasgow to be named as one of the most ‘digitally safe’ cities in the UK, behind only Liverpool, according to a new study from Barclays which has scored the nation’s susceptibility to online scams and fraud.

Launched today, the Barclays Digital Safety Index score is based on the ability of 6,000 UK adults to protect data, devices, accounts, and to spot digital threats. Respondents in Edinburgh and Glasgow were asked to complete a digital safety test − similar to the hazard perception tests encountered by people taking driving theory exams − and answer questions about the steps they take to protect their devices from online threats.

On average, people from Edinburgh scored 6.25 in the test, lower than the national average score of 6.27, but higher than Glasgow which scored 6.05. With scores ranging from 1-10, (10 being the maximum safety score), there is plenty Scots could be doing to improve their digital safety.

DIGITAL SAFETY SCORE BY UK REGION

(scores from 1-10)

East Midlands – 6.46

Yorkshire & Humber – 6.39

North West England – 6.35

South West England – 6.33

East of England – 6.33

South East England – 6.33

Scotland – 6.29

Wales – 6.28

UK – 6.27

West Midlands – 6.22

North East England – 6.16

Northern Ireland – 6.12

London – 5.85

DIGITAL SAFETY SCORE BY UK CITY

(scores from 1-10)

Liverpool – 6.31

UK – 6.27

Edinburgh – 6.25

Sheffield – 6.21

Manchester – 6.21

Leeds – 6.14

Glasgow – 6.05

All major cities – 6.02

Birmingham – 5.85

London – 5.85

Bristol – 5.83

In Edinburgh, 12% of respondents had experienced bank account fraud, one in ten had been a victim of a purchase scam and just under 10% had fallen foul of a safe account scam where fraudsters claiming to be from their bank call and advise them to move their cash because of an issue with their account.

In Glasgow, bank account fraud again topped the poll with more than one in ten people affected. 11% of respondents had experienced scams in relation to an online shopping account while 10% has been targeted through payment accounts.

Overall, city dwellers are more at risk of cybercrime than those living in the country, 20% of rural residents claim to have experienced an online scam or fraud in the past three years, compared with a UK average of 25%. Behaviour also plays a key role. Rural dwellers in general show more awareness and caution in how they behave online, scoring more highly in our Digital Safety Index as well – averaging a 6.49 score compared with city average score of 6.02.

Across the UK as a whole, digital familiarity may be fueling online complacency, with the survey also revealing a generational ‘digital safety gap’ between younger and older respondents. On average, people scored 6.27 in the test, but digital awareness scores for the oldest age bracket (over 65s) were some 25% higher than the youngest age group tested (18-24 year olds), putting to bed the notion that older people are more at risk of being “duped” by cyber criminals. Furthermore, only 17% of all respondents were able to score full marks in the question asking them to correctly identify digital safety hazards: from online pop-ups and games, spam or “phishing” emails and “smishing” texts or social media messages that trick users into sharing personal details or downloading malware that leave devices vulnerable to hackers.

To encourage the nation to consider its own digital vulnerability, Barclays is calling for the public, police and businesses across the UK to unite and tackle this growing issue of public concern and has today launched a multi-million pound Digital Safety drive.

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

Jamie Grant, Head of Business and Corporate Banking at Barclays, said:

“The Barclays Digital Safety Index identifies the UK’s most vulnerable to cybercrime for the first time.

“With Scotland lagging behind in the Digital Safety Index and residents most commonly falling victim to bank account fraud, it’s evident that more needs to be done to improve awareness of both cybercrime and cybersecurity in this area.

“This is why we are encouraging everyone, even the most confident of digital users, to take our test and learn how they can stay safe in our digital age.”

Under the new Digital Safety drive:

• In a UK high street bank first, Barclays is giving customers new levels of control over when, where and how their debit card works, offering customers the choice to instantly turn ‘on’ and ‘off’ whether their card can be used to make remote purchases, and even set their own daily ATM withdrawal limits on their Barclays Mobile Banking app.

• A new online quiz is available to everyone in the UK from today. By answering simple questions people can assess their own digital safety level, and receive useful tips on how to strengthen their defences at barclays.co.uk/security. Barclays aims to help at least 3 million people to boost their digital safety levels by using the test.

• A new £10m national advertising campaign is being launched across national TV, print, online and billboards. It will alert people to the risk of fraud unless they take proper precautions, and will include content targeted towards younger people and those in urban areas.

• Barclays will be hosting regular fraud awareness takeovers on its online and mobile banking sites, prioritising fraud prevention over products.

• Barclays’ nationwide force of 17,000 Digital Eagles will provide digital safety teach-ins to people, and free support clinics for the 1 million UK SMEs we serve. Barclays LifeSkills is also launching new Digital Safety learning content specifically designed for younger people.

• Barclays is also leading industry efforts to prevent instances where customers are duped into withdrawing all their cash from branches and handing it to a scammer posing as a trusted person, through a new police hotline for branch colleagues to call.

Barclays estimates that if people implemented these three top tips we could help to cut levels of fraud by up to 75 per cent.

1. Never give out your full Online Banking PIN, Passcode or Password to anyone, even a caller claiming to be from the police or your bank.

2. Do not click on any link or open an attachment on any e-mail you receive which is unsolicited.

3. Avoid letting someone you do not know have access to your computer, especially remotely.

To find out how digitally safe you are, take the new quiz at the Barclays Digital Safety Hub www.barclays.co.uk/security or simply search for “Barclays Digital Safety”.

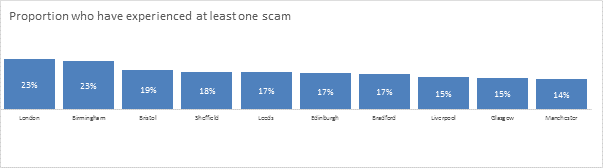

City rankings by proportion of residents to have suffered from scams in the past 3 years:

Barclays has supported leading bar and club operator Attraction Inns Limited with a £1.05m funding package. The deal will consolidate the company’s position in the marketplace and provide capital expenditure to support acquisitions and future growth.

Barclays has supported leading bar and club operator Attraction Inns Limited with a £1.05m funding package. The deal will consolidate the company’s position in the marketplace and provide capital expenditure to support acquisitions and future growth.

Attraction Inns owns some of the best known bars and clubs in east and central Scotland, including Movement, Opium, Pilgrim and Silk in Edinburgh and Dusk in Stirling, many of which it has operated for more than 20 years. Run by husband and wife team Robert and Michelle Orr, the company employs 150 staff across five venues.

The deal team at Barclays was led by Corporate Development Directors Malcolm Crawford supported by Lesley Barnwell and Relationship Director Gillian Lambert.

Robert Orr, Managing Director of Attraction Inns, commented: “The hospitality and leisure industry has undergone a dramatic change in the past decade but there are lots of opportunities for forward looking businesses and the banks willing to support them. We were aware of Barclays’ proactiveness in the sector and attracted by their positive approach.

“I’ve been in the business for 27 years and what has been key to this long term success is evolving with our consumers. We are moving away from the more traditional night club format to chameleon venues – those which work just as well as an eatery during the day then an after work drinks spot and a pre-club bar. Barclays shared our progressive vision.”

Jamie Grant, Head of Corporate Banking for Barclays in Scotland, said: “We have an appetite to lend to the hospitality and leisure industry which is evidenced by our strong track record of funding deals in recent years. The sector is operating in a challenging market at the moment but Scotland has a diverse H&L landscape and a burgeoning tourism industry helping drive long term success.

“Attraction Inns is a well-established business and the management team has a clear plan for continued growth which we were keen to support. We took time to understand their individual needs so that we could provide a flexible solution that worked for them and their ambitions.”

Barclays’ Scottish SME fund was launched in June 2016 to address gaps in the supply of finance for businesses in Scotland. It provides access to funding for companies across all sectors with turnover up to £25m.

Crude oil’s precipitous decline since the end of June is important for many reasons, but not necessarily the ones that some market observers are currently fretting over. Commodities in general have been poor this year, but oil has been particularly weak since the summer, with Brent Crude falling over 20%. Many suspect that commodity markets ‘know something’ about global growth that bond markets have long hinted at and equity markets are only just waking up to. We suspect this view risks underplaying the effects of a rising US dollar on an asset class predominately quoted in dollars, but, more importantly, the fact that prices are not just a function of demand, but also supply.

Crude oil’s precipitous decline since the end of June is important for many reasons, but not necessarily the ones that some market observers are currently fretting over. Commodities in general have been poor this year, but oil has been particularly weak since the summer, with Brent Crude falling over 20%. Many suspect that commodity markets ‘know something’ about global growth that bond markets have long hinted at and equity markets are only just waking up to. We suspect this view risks underplaying the effects of a rising US dollar on an asset class predominately quoted in dollars, but, more importantly, the fact that prices are not just a function of demand, but also supply.

With regard to oil in particular, figures released last Friday showed OPEC lifted output in September by the largest amount in almost three years. The US supply story is also no doubt instrumental in oil’s continued retreat, as are continued efficiencies with regards to utilisation. In the words of the famous former Saudi oil minister, Sheikh Zaki Yamani “the stone age didn’t end for lack of stone…”

Even if we do not see the recent decline in the oil price as particularly sinister with regard to the prospects for global growth, it does have important ramifications for equity markets. Companies reliant on energy prices rises for revenue growth tend to outweigh those either agnostic to, or benefiting from, falling oil prices in most equity indices. With oil prices now moving towards widely suspected thresholds for Saudi Arabia’s fiscal balance, we suspect further downside should be capped given the kingdom’s role as the marginal supplier in a global oil market.

What about the rising dollar…?

Amidst all the concerns about the likely affect of a rising dollar on the prospects for the US economy, one often neglected point is its historic influence on the amount that investors are willing to pay for a dollar, euro or pound of quoted corporate sector earnings. There is a strong relationship between a rising dollar and the price earnings ratio of US and global ex-US equity indices.

Intuitively this makes sense. More often than not a rising US dollar is a symptom of robust health in the world’s largest and most important capitalist economy. Most of the time, this suggests that the prospects for global growth will, in varying lags, follow suit. In such an environment, investors should be willing to pay more for the earnings of the quoted corporate sector.

For a long time, those looking to understand the future trajectory of the world’s economy and capital markets have been well-served by looking at data coming out of its largest economy.

For a long time, those looking to understand the future trajectory of the world’s economy and capital markets have been well-served by looking at data coming out of its largest economy.

While the US consumer’s grip on the global economy is slipping, US indicators, such as the ISM and retail sales, are still proving a much more important story for the world’s economy and capital markets than either Europe’s existential crisis or China’s ongoing economic slowdown.

With this in mind, recent data has been particularly important. The US ISM manufacturing survey, the longest-running and most-trusted of cyclical lead indicators is, again, telling us that brighter times lie ahead for the US and, therefore, the world economy. The outlook for private sector demand in the US also remains encouraging. Real disposable income grew close to 4% in the first half of the year, while the employment backdrop continues to improve as evidenced by July numbers.

The Federal Reserve is still suggesting that interest rates are unlikely to rise until at least the second half of 2015, although it could easily be hustled into an earlier rate rise if the economic data continue to point in one direction. It is this scenario that we still think has the most potential to upset capital markets in the short term.

Investors will worry that the US economy – for so long a patient in need of monetary A&E – will struggle to digest tighter monetary policy. Such fears could prompt profit taking and swings in risk appetite.

We do not see interest rate rises as meaningfully altering the trajectory of the economic recovery just yet, since we think both the UK and the US have long been capable of digesting tighter monetary policy. However, we do expect a little returning strife in capital markets as investors grapple with the implications of an end to emergency level monetary policy.

While we think equities should bounce back from any weakness relatively rapidly as growth continues, the likely weakness in much of the fixed income space could be more permanent.

As a result we are advising diversification, both at the asset class and sub-asset class level, as an investor’s best defence against the unknowns of the future. Within this diversified portfolio, we are still urging clients to position themselves for further upside in equity markets and a potentially torrid time for much of the bond complex in the months and years ahead.

After a weak start to the year, the economic picture is improving in the US as we move into the second half. There is a positive outlook for equities over the medium term, as softer data from the first quarter has been replaced with a clutch of figures that indicate an accelerating economy, although this does bode poorly for bonds.

After a weak start to the year, the economic picture is improving in the US as we move into the second half. There is a positive outlook for equities over the medium term, as softer data from the first quarter has been replaced with a clutch of figures that indicate an accelerating economy, although this does bode poorly for bonds.

This confluence of positive developments, though constructive for equities, is quite the opposite for bonds, as it increases the likelihood of a rate rise. The Federal Reserve (Fed) is already tapering its asset purchases, with the latest edition of quantitative easing drawing to a close in late October/early November. As this date approaches, a more natural supply/demand dynamic should take hold, and interest rates again will be determined by market participants rather than by a buyer with a printing press. Additionally, the cost of living continues to increase: US inflation climbed by 0.3% for the month of June, in line with the consensus forecast, bringing the gauge up 2.1% year-over-year. This marks the second consecutive month in which inflation has been higher than the Fed’s target of 2.0%. The combination of strengthening economic data and above-target inflation increases the probability of rising interest rates, perhaps even sooner than the Federal Reserve currently contemplates.

Interest rate increases will put downward pressure on the prices of fixed income securities, leading to mark-to-market losses for bond portfolios. We have expressed concern about rising rates for some time, and have advised clients to shorten portfolio duration, rotate from fixed-rate to floating-rate debt, and from public to private markets. We have been focused on taking credit risk (rather than duration risk), allowing us to remain comfortable with an overweight in high yield bonds for much of 2014, though recent developments warrant a reassessment of this positioning.

Absolute yields and credit spreads for the high yield complex have fallen to levels that suggest an increasingly asymmetric risk-return profile for the asset class. The deterioration in credit underwriting standards for the leveraged loan market is also troubling. This is a trend that has been a focus of our concern for some time now, and recently has been highlighted by the Federal Reserve as a source of potential problems if it continues unabated.

Given these concerns, we have taken the decision to lock-in profits in high yield bonds and leveraged loans, and rotate the proceeds into cash, for the short term. This brings our high yield allocation to a neutral stance in portfolios, and a strongly underweight position at the broader asset class level (high yield and emerging markets bonds). We expect the overweight cash position to be a temporary one, and will redeploy funds as assets are re-valued in light of rising interest rates.