Barclays has opened the doors to Scotland’s first Eagle Lab, in Edinburgh, in partnership with CodeBase.

Barclays has opened the doors to Scotland’s first Eagle Lab, in Edinburgh, in partnership with CodeBase.

The investment will provide a new space for businesses and communities to learn about innovative technologies and boost digital skills, while supporting job creation in the local economy.

The tech-infused space is packed full of cutting-edge equipment for digital fabrication, 3D printing and laser cutting, providing businesses with access to the tools they need to rapidly produce and test prototypes without having to import them from overseas. Some of the entrepreneurial companies who will be using the facilities include Machines with Vision, whose localisation mapping technology can be used to position and guide self-driving vehicles, and Holixica, specialists in 3D visualisation technologies including digital holograms and holographic video displays.

The lab is the 14th Eagle Lab launched by Barclays in the UK, following successful sites in locations including London, Liverpool, Cambridge and Cardiff. It will operate within the existing CodeBase business incubator and co-working facility, helping digitally empower Scottish businesses while supporting improved productivity and economic growth.

It will also offer resources including expert mentoring and workshops for Scotland’s start-up and scale-up businesses to complement CodeBase’s existing incubator services.

Commenting on the news, Keith Brown MSP, Cabinet Secretary for Economy, Jobs and Fair Work, said: “This is a great new resource providing Scottish businesses with access to a range of experts, workshops and advice to help our workforces become equipped with the necessary skills to embrace the opportunities of digital technology.

“The Scottish Government is committed to promoting a CAN DO culture of entrepreneurship across all industry sectors. This is important so that the most talented entrepreneurs, from Scotland and elsewhere, can develop their ideas and create the successful new companies we need for our economy to continue to grow.”

The new Eagle Lab is a significant milestone in the development of Barclays’ High Growth & Entrepreneur proposition in Scotland. It will help ambitious high-growth businesses during the scale-up journey, and members of the public and local community groups as they seek to improve their digital skills.

Stuart Brown, Head of SME Scotland, Barclays, commented: “With Scotland focused on becoming a major digital player, it is vital our SMEs and entrepreneurs are equipped with the skills and tools they need to thrive in today’s ever-changing and dynamic economy.

“Whether you’re an inventor, innovator or mentor, our Eagle Lab is the perfect space to digitally empower your business, supporting scale-up opportunities, collaboration and innovation.

“The lab also forms part of our wider growth strategy in Scotland. We are committed to helping ambitious businesses and entrepreneurs flourish, contributing to improved economic prosperity and productivity.”

As the UK’s largest technology incubator, CodeBase Edinburgh is the centre of the tech scene in Scotland’s capital city. It is home to over 100 companies and already offers operator-led scale-up education, flexible office and co-working spaces, mentoring and networking events.

Stephen Coleman, CEO at CodeBase, added: “We are seeing an increase in the numbers of hybrid tech companies mixing hardware and software across a range of sectors, from self driving cars to environmental sensors and medical devices. The Eagle Lab will help us to support many more of these sorts of companies, while driving high-growth business potential.”

For more information on Barclays’ Eagle Labs: https://labs.uk.barclays/

Pictured: (L-R) Keith Brown MSP, Cabinet Secretary for Economy, Jobs and Fair Work, Stuart Brown, Head of SME Scotland, Barclays, and Stephen Coleman, CEO at CodeBase

Rising inflation and cybersecurity are the most common fears among British SMEs for 2018, according to new research from Barclays Business Banking.1

SMEs believe these issues are most likely to negatively impact their growth in 2018, while consumer demand is most widely expected to have a positive impact.

Inflation, cyberattacks, and state of the UK economy more widely feared than Brexit

According to Barclays’ annual SME Hopes and Fears Index1, which asks decision makers at UK SMEs which factors they expect to help or hinder their business growth in 2018, inflation is most cited as a fear (by 43%). It can increase costs for a business, and also impact the wider economy, with 36% fearing the effects of prices rising faster than wages, which could put pressure on consumers.

Inflation is followed by the risk of cyberattacks (41%) and the state of the UK economy (40%). These factors are followed by fraudsters targeting small businesses (39%), and Brexit and UK politics (35% each), which rank sixth.

Top 5 SME fears for 2018:

| Factors SMEs expect to hinder business growth in 2018 | Ranking |

| Inflation | 1 (43%) |

| Cyberattacks | 2 (41%) |

| State of the UK economy | 3 (40%) |

| Fraudsters targeting my business | 4 (39%) |

| Price inflation outpacing wage rises | 5 (36%) |

In May 2017, Barclays launched a major engagement campaign, Barclays DigiSafe, to raise awareness of cyberattacks, fraud and scams. It includes a £10m national advertising campaign, and provides customers with additional tools to protect themselves. Dedicated support for the bank’s one million SME clients has included free support clinics.

SMEs have high hopes for consumer demand and are more positive about technology

When it comes to the factors business owners expect to positively impact their business growth, consumer demand is most widely tipped to have a positive impact, with 50% expecting it to do so. This is a change from last year’s results2 when just 22% expected it to have a positive impact.

SMEs have become more positive about technology, with 48% expecting that availability of better technology will have a positive impact on their business (37% last year), and 42% expecting e-commerce/digital presence to do so (23% last year).

Top 5 SME hopes for 2018:

| Factors SMEs believe will have a positive impact on business growth in 2018 | Ranking |

| Consumer demand | 1 (50%) |

| Availability of better technology | 2 (48%) |

| E-commerce/ digital presence | 3 (42%) |

| Investment in the local area | 4 (34%) |

| International marketing opportunities | 5 (28%) |

Reflecting the uncertain times, there is a near even split among SMEs about the outlook for 2018, with 46% believing it will be a year of opportunities, and 49% predicting a year of challenges.

Most SMEs plan to maintain the same level of investment (65%) and employee numbers (68%) as for 2017. However, those making changes are generally positive, with 21% planning to increase the number of employees, compared with 5% planning a decrease, and 20% planning an increase in investment, compared with 8% planning a decrease.

Stuart Brown, Head of SME Scotland at Barclays Business Banking, commented: “The research reflects small businesses being empowered by new technology and e-commerce. Compared with a year ago, more think these developments will have a positive impact on their business. From our work with small companies, we see them making more use of data and online services, including our own, that help them manage their marketing and finances more easily and effectively. By making the most of these opportunities, SMEs can increase sales, cut costs and save time, strengthening their business.

“Inflation is clearly a worry, and in particular the potential for prices to rise faster than wages. Business owners are clearly taking a prudent and cautious approach to the year ahead. However, there are positive signs of SMEs investing more and hiring more staff.”

¹ 2017 research (looking at 2018 hopes and fears) was conducted by Opinium on behalf of Barclays, 500 online interviews with UK senior decision makers/business owners in SMEs defined as having 250 or less employees, between 9th– 16th November 2017.

2 2016 research (looking at 2017 hopes and fears) was conducted by OnePoll on behalf of Barclays, 500 online interviews with UK senior decision makers/business owners in SMEs defined as having 250 or less employees, between 12th– 19th December 2016

Barclays Corporate Banking yesterday announced the launch of a suite of Green Finance products, designed to help the bank’s clients fund more sustainable projects in the UK and around the world.

By accessing specific products aimed at encouraging investment in sustainable activity, Barclays’ clients will be able to accelerate their investment in green initiatives and support the transition to a low-carbon and sustainable economy.

Recognising the need to support companies of all sizes and across a breadth of sectors to fulfil their green ambitions, Barclays has created a range of tailored products, which represent real innovation in the evolving green finance market. These are:

• Green Loans, targeting larger clients who need loans of more than £3m across the UK

• International Green Loans, helping international clients invest in green projects around the world

• Green Asset Finance, allowing clients to access more flexible ways of financing assets that support green initiatives

• Green Innovation Finance, backed by the European Investment Fund, aimed at providing funding for SME clients

• Green Deposits, allowing Barclays’ largest clients to earmark funds they deposit against Barclays’ investments in Green Bonds

There is increasing appetite for more financial support for green initiatives, as businesses recognise the commercial benefits, through reduced costs and increased revenue potential; anticipate increasing regulatory requirements, with governments and regulators urging companies to take action to help deliver the Paris Climate Agreement goals; and respond to the reputational impact, as customers expect businesses to be able to demonstrate their environmental credentials.

Jamie Grant, Head of Corporate Banking for Barclays in Scotland, said: “We’re seeing a step-change in how businesses approach sustainable investment. For too long, green projects have been viewed as an added extra, but what we’re increasingly hearing from our clients is a shift in mindset, with sustainability becoming more central to their overall investment strategy.

“We share that view at Barclays and know that unless sustainability is at the heart of how companies conduct their operations, they will fall behind. As always, we want to help our clients stay ahead in an evolving world, which is why we’re proud to be the first major UK bank to devise a range of products targeted exclusively at funding green Corporate Banking investment activity, that will help promote growth now and contribute towards a better, greener, future for all.”

Rhian-Mari Thomas, Chair, Barclays Green Banking Council, added: “Barclays, like so many of our clients, recognises that addressing environmental challenges is not only a necessity but a compelling economic opportunity. We already have an established presence in the green bond market as a successful lead arranger, investor and now issuer so we are delighted to be able to build on our expertise by launching new, innovative green products to help meet the booming demand for green finance from a broader cross-section of our clients. We’re excited to be at the forefront of something so game-changing.”

To help guarantee the integrity of this drive to support green activity, through market-leading green product development efforts, Barclays worked with Sustainalytics, a global provider of environmental, social and corporate governance research and ratings to develop a Green Product Framework. The bank will use the Framework to identify appropriate projects that will have a positive environmental impact and will therefore qualify for support through one of the new products.

Bob Mann, President at Sustainalytics, said: “We are delighted Barclays chose to work with Sustainalytics in the development of their Green Product Framework. The number of new green finance products is surging globally given positive drivers such as market regulations and increased client demand to create more sustainable products and services. Green Product Frameworks, such as Barclays’, offer assurance and transparency to the market that financing is being directed towards environmentally impactful activities that align with best practices.”

• Two thirds (65 per cent) of parents in the UK would use unfamiliar sites to get the most in-demand toys

• Lego Star Wars BB8 is the most in-demand present for children this Christmas (16 per cent), followed by the Paw Patrol Sea Patroller (13 per cent)

• Almost two thirds (63 per cent) of Scots feel under pressure when buying Christmas presents for friends and family

• More than half (61 per cent) of scam victims in Scotland were targeted when buying for someone else

Christmas gift giving pressure is causing Brits to drop their guard and increasing their chance of being targeted by seasonal online scams, according to new data from Barclays¹.

A new study has found that two thirds (65 per cent) of UK parents would use an unfamiliar site to find the must have toys of the year, with 16 per cent saying that the Lego Star Wars BB8 is the most in-demand present for children this Christmas. The Paw Patrol Sea Patroller (13 per cent) and LOL BIG Surprise Doll (12 per cent) follow close behind on their children’s wish lists.

In Scotland, almost two thirds (63 per cent) of respondents say they feel under pressure when buying gifts for their loved ones at Christmas, with one in five (20 per cent) of these shoppers admitting to ‘panic buying’ presents as a result. A similar proportion (21 per cent) visit websites they wouldn’t normally buy from in order to find the right gift.

This stress and panic creates the ideal opportunity for fraudsters to strike; one in five (20 per cent) Scottish gift givers would be willing to register and save their personal details on an unfamiliar website, while 14 per cent would buy from a website without thinking whether their payment is secure in pursuit of the perfect present.

Don’t let the fraudsters win

With nearly one in three (29 per cent) Scots considering present buying to be one of the most stressful aspects of the festive season, second only to battling crowded shopping centres and busy high streets (47 per cent), it’s important that online safety is not overlooked.

Worryingly, just four per cent of Scots shoppers identified the possibility of buying from a fraudulent website as a festive stress trigger, despite the fact that the average victim in the UK loses £893. Instead, people are nearly six times as likely to worry about seasonal overspending (23 per cent), with one in four (31 per cent) resorting to buying their loved one’s gift from whichever website offers the cheapest price to save on cost.

‘Tis the season to be wary

With almost a fifth (17 per cent) of Scottish scam victims having been scammed over the Christmas period, Barclays is warning everyone to stay vigilant when shopping online this December. More than half (61 per cent) of former victims of online scams were buying for someone else when they were targeted, with one in seven (15 per cent) admitting to being more preoccupied with finding the right gift than checking the legitimacy of the website.

In Scotland, clothing topped the list of gifts most likely to get you scammed, affecting 18 per cent of former fraud victims. Electronics (14 per cent) took second place, with health and beauty products (8 per cent), household items (8 per cent) and digital content such as movies, music and computer games (8 per cent) sharing joint third place.

This coincides with some of the most popular gifts on Scottish Christmas shoppers’ lists. Clothing, beauty products and jewellery topped the list of items to buy a spouse or partner, games and clothing took the top spot for sons, clothing and health and beauty products for daughters, and food and drink was the most popular choice for dads.

Samantha White, who leads Barclays’ work to keep customers safe from fraudsters, said:

“Scouring the internet for the perfect Christmas gift can be stressful, but if you lose sight of digital safety and just focus on the price, you could fall prey to festive fraudsters. Look out for ‘too-good-to-be-true’ deals, and always take the time to check that the website you’re buying from is legitimate.”

1 The research was carried out online by Opinium across a total of 2,006 nationally representative adults in September 2017. An additional survey was carried out across a total of 1,700 people who have been scammed, to supplement the national research. Moreover, a survey of 369 UK parents with primary school children was carried out between 24th and 27th September 2017.

Scottish entrepreneurs have benefited from a modest uplift in funding for new businesses, according to the Barclays Entrepreneurs Index, which tracks the UK entrepreneurial lifecycle.

It shows that the level of venture capital (VC) available in 2016 increased 9% on the previous 12 months from £11m to £12m, however this followed a major dip from 2014’s £53m funding boost. The number of enterprises receiving VC funding has fallen slightly from 27 to 25.

The number of companies receiving expansion funding fell by 37%, with the totals dropping from £96m to £68m.

While Scotland is still a strong performer for start-ups, it struggles to maintain high growth companies with only 171 in 2016 compared to 221 in the previous year, accounting for a 4% share of companies UK wide.

Scotland is currently home to 58 private equity-backed companies. While this number is down from 72 year-on-year, it compares well with other parts of the UK in terms of the ratio of private-equity backed companies per 1,000. At 0.27, Scotland is behind only Wales (0.41) and London (0.38).

The national picture

Scotland’s figures reflect national trends, as the number of companies receiving VC and expansion funding are both down year-on-year at a UK level. Growth levels among young enterprises are also down with the number of high-growth companies hitting an all-time low, 33% lower than its peak in 2013, and the number of companies receiving venture capital investment is the lowest it has been in the report’s history.

However, with mergers and acquisitions at an all-time high as well as the number of new enterprises being created 8% higher than the previous year, they’ve helped the Entrepreneurs Index see the strongest levels of entrepreneurial outputs since the annual research began in 2011.

John Godfrey, Director, Barclays, Wealth & Investments, Scotland, said: “Scotland has always had a strong start-up culture, even in this challenging environment for Scottish entrepreneurs.

“It’s positive to see funding in our region has picked up on last year, however despite this uplift, investment is down on previous years and the number of high-growth companies has fallen.

“At Barclays, we are continuously looking at ways to help support the UK’s entrepreneurial community, from our Innovation Finance loans to our venture debt funds. We want to ensure enterprises have the tools and resources they need to go on to expand and grow winning businesses that triumph in their industries.”

• Record levels of cybercrime and growth of festive e-commerce set to create unprecedented levels of fraud for Christmas 2017

• Almost two thirds (60 per cent) of Scots worry about their credit or debit card details being stolen whilst shopping online

• A third (36 per cent) of online shoppers in Scotland either don’t know, or aren’t sure, how to identify a secure website when shopping online

• The average online scam costs Edinburgh shoppers £394 compared to £331 for Glaswegians

• Festive fraud victims across the UK estimated to lose around £1.3bn¹ in total this year

This Christmas looks set to be one of the most fraudulent ever for online shoppers in Scotland, according to new data from Barclays¹. With fraud and scams becoming increasingly sophisticated, and with record numbers getting ready to do their Christmas shopping online, Barclays is warning of a perfect storm for seasonal online theft.

The research found that almost two thirds (60 per cent) of Scots worry about their credit or debit card details being stolen, whilst a similar number (59 per cent) have concerns over their bank account being hacked whilst Christmas shopping online.

More than a quarter (26 per cent) of online scams in the UK happen over the Christmas period, costing victims on average £893² – over twice the average Christmas budget for presents, food, drink and entertainment³ and equating to an eye-watering £1.3bn across the country.

Christmas is coming early for fraudsters taking advantage of low cybercrime awareness and lack of confidence

Scots are in danger of losing the war with fraudsters this Christmas, because they don’t know how to protect their data and stay safe online. A third (36 per cent) of online shoppers across Scotland told Barclays researchers they either don’t know, or aren’t sure, how to identify a secure website when shopping online.

A fifth of Scots (21 per cent) admitted to having fallen victim to an online scam or fraud. Of those, almost a third (31 per cent) were buying from a website that is well-known, and over a fifth (22 per cent) ordered from a website that they regularly purchase from, highlighting the need to be vigilant at all times.

A quarter (26 per cent) of fraud victims felt that it was just ‘bad luck’ that they were caught out, yet only 24 per cent were aware that they should check for the padlock authentication symbol on the payment page. Just one fifth (22 per cent) knew to ensure that the web address started with ‘https’.

With the average scam costing Edinburgh shoppers £394, over £60 more (£331) than their Glaswegian neighbours, Scots need to ensure they are aware of the warning signs if they don’t want to be out of pocket this Christmas.

Top tips to stay safe online this Christmas

As record numbers of gift buyers get set to purchase online, the #BarclaysDigiSafe team has provided the following tips to avoid being fleeced by festive fraudsters:

1. Look out for the padlock symbol and ‘https’ in the address bar on retailers’ websites

2. Watch out for deals that look too good to be true

3. Never use public Wi-Fi to purchase Christmas shopping online

4. Never give out your PIN or online banking password – legitimate websites won’t ask for it.

5. Keep an eye on your bank balance so that you can spot and report fraudulent transactions quickly

Fear of fraud hits online businesses hardest

Shoppers aren’t the only ones being stung by festive fraudsters. With one in 20 (5 per cent) UK shoppers who have fallen victim to a scam stopping shopping online altogether, online retailers could be losing out on up to £72m4 worth of lost revenue.

Samantha White, who leads Barclays’ work to keep customers safe from fraudsters, said:

“While families across the UK are preparing to enjoy the festive season, criminals are getting ready to pounce on anyone who lets their guard down. Buying your gifts online may be more convenient, but with Christmas 2017 set to be the most fraudulent on record, online shoppers must be more vigilant than ever. Beat the fraudsters by looking out for the typical warning signs such as the padlock symbol on retailers’ websites.”

1 The research was carried out online by Opinium across a total of 2,006 nationally representative adults in September 2017. An additional survey was carried out across a total of 1,700 people who have been scammed, to supplement the national research.

2 This Barclays research showed that the average scam over the Christmas period costs victims an average £893. This number has been multiplied by the estimated amount of Brits who have already been targeted at Christmas (1.5 million).

3 This Barclays research highlights that people plan to spend £422 on presents, food, drink and entertainment this Christmas

4 This Barclays research has been combined with retail sales trend data to derive an overall estimate of online sales that do not occur because of the fear of being defrauded.

New research from Barclays Corporate Banking shows 76% of manufacturers in Scotland are confident about Britain’s ability to compete in the international marketplace over the next five years, mirroring the findings of the Made Smarter report published earlier this month.

New research from Barclays Corporate Banking shows 76% of manufacturers in Scotland are confident about Britain’s ability to compete in the international marketplace over the next five years, mirroring the findings of the Made Smarter report published earlier this month.

42% of manufacturers in Scotland attribute their confidence to ‘fourth industrial revolution’ (4IR) technologies, such as machine learning, sensors and big data, which they believe will boost the productivity of their business.

Confidence isn’t translating into investment

Of those that have already invested, 54% of manufacturers in Scotland report that the adoption of 4IR technologies has freed up staff to concentrate on more highly skilled work, while 51% have seen improved productivity. Yet, there is still resistance to investing in the very latest innovations. The Barclays Corporate Banking Manufacturing Report, Intelligent manufacturing: an industrial revolution for the digital age, is based on the views of over 500 manufacturing industry decision makers. It found that, while basic forms of automation, like robotics, have a high rate of adoption (76%), 16% of manufacturers in Scotland are yet to invest in 4IR technologies like artificial intelligence (AI).

Yet economic modelling included within the report predicts that manufacturers could boost the sector by an additional £102bn per year by 2026, provided 4IR sees greater adoption and investment over the coming years. The study also shows that the industrial heartlands would benefit most from investment in 4IR technologies, such as sensors, big data, energy self-generation and machine learning. The West Midlands (14,000), North West (13,000), Yorkshire & Humber (11,000), and East Midlands (also 11,000) all set to see a big hike in employment.

Jamie Grant, Head of Corporate Banking for Barclays in Scotland, said:

“Our research shows that manufacturers see the benefits of this cutting-edge technology, and many have started to match their intentions with investment. However, we are at a watershed. While the outlay may seem expensive for many at a time of uncertainty, the industry needs to raise its levels of investment in the skills and infrastructure needed to harness these new technologies and keep us more productive than other international manufacturing hubs. Businesses that make the leap will be rewarded.

“British manufacturing is going through another industrial revolution but confidence alone does not translate into success and benefit. With sterling currently weaker and a robust appetite from domestic and international markets for British goods, the industry is in a strong position to take advantage of the opportunities investing in fourth industrial revolution technologies can bring.”

Weighing up the benefits

Contrary to popular perceptions about the impact of AI, investment in 4IR technologies has the potential to create jobs for Britain. Barclays has found that 101,000 jobs would be created in the next 10 years if manufacturers invest in smart factory technologies, and textiles and clothing (12.6%), pharmaceuticals (8.3%), wood, paper and printing (6.9%), and fuels (6.7%) would benefit the most.

As well as creating jobs, investment in technologies like AI were also understood to have a positive impact on the quality of work people experienced. Of the manufacturers that have already invested, 32% of said it freed up staff to concentrate on more highly skilled work.

Tackling barriers to investment

The skills gap is a major barrier, as highlighted by the Made Smarter review. Barclays’ research further reveals the scale of the problem faced by the industry. One in five (21%) manufacturers cited a lack of skilled workers as the reason for putting off investment in 4IR. Additionally, of those that aren’t confident about the UK’s ability to keep its competitive edge internationally, 40% attributed their pessimism to difficulties around recruitment due to a skills shortage.

With the research reporting that 19% of manufacturers believe the Government’s industrial strategy will have no impact on their business, it is clear that more targeted communication is needed to underscore the potential of 4IR. The Made Smarter review recommended strong leadership and better branding to make a difference. Survey findings show that 36% are not aware of the strategy at all, underlining the point made by more than a third (35%) of manufacturers, that more education and information on the tangible benefits of 4IR technologies would encourage them to invest.

Although manufacturers have been slow to act, this is not to say that they don’t have plans to do so in the future. 78% of manufacturers have committed to investing in automation over the next five years: over two-thirds see more potential in sensors, big data, energy self-generation and machine learning. And just over half predict more use of 3D printing over this period. This suggests that the industry has confidence in its ability to transcend these barriers, and propel Britain forward into a new industrial age and on a global stage but timing will be key.

Barclays has announced two key appointments to its Scotland agricultural team as it continues to extend its on-the-ground support for the Scottish agriculture sector and invest in the future of farming.

Donna Buchanan and Jennifer Adams have been recruited as dedicated Relationship Managers for Barclays Agriculture – working across the whole of Scotland.

Donna will join existing Relationship Directors Graeme McNaughton and Scot Howie to manage a portfolio of clients in agriculture, landed estates and agri-business with borrowing requirements of £1m and above. A graduate of the Scottish Agricultural College, she started her career with Barclays as a Business Manager in 2006, where she gained experience across a variety of sectors before beginning her specialism in agriculture in 2012. She has joined the Scotland agriculture team from her current Business Development Role.

Jennifer joined Barclays as a Business Manager in 2009, after more than 20 years in roles with a number of leading banks. Her new role will see her provide specialist support to agri-businesses, farmers and landowners with borrowing requirements up to £1m, alongside existing Agriculture Business Manager Steven Reid.

Stuart Brown, Head of SME Scotland, Barclays, who is leading the bank’s drive to expand its agri-business market share in Scotland, commented: “We’ve supported the agricultural industry for over 270 years, and we’re committed to helping the sector grow – evidenced through our decision to bolster our on-the-ground team and local representation, supported by our UK national team.

“We now have a six-strong specialist agri-team that has insight into the challenges facing the sector, from weather concerns to skilled labour shortages. We have the capabilities to support individual farm owners up to private estates, and will be showcasing our range of services at the upcoming AgriScot event in Edinburgh.”

The appointments form part of Barclays’ ongoing investment in servicing the agri-sector, and follow the launch of its first agriculture apprentice programme in banking and £100m dedicated UK agriculture loan fund.

Barclays supports over 20,000 UK farmers and, with a team of over 120 Agriculture Managers across the UK, has one of the biggest Agriculture banking team’s in the UK making it Britain’s leading agricultural bank. For more information on the Barclays Agriculture visit: www.barclays.co.uk/business-banking/sectors/agri-business/

Barclays has announced key appointments across its Aberdeen, Inverness, Edinburgh and Glasgow Business Banking teams as the bank continues to extend its on-the-ground support across the regions for Scottish SMEs and scale-up businesses.

Hunter Inkster has joined the bank as a Relationship Director for the North of Scotland, based in Aberdeen, following a period of sustained growth and business activity in the area. With good knowledge of the North of Scotland including Shetland & Orkney from previous roles in the area, he will be responsible for managing and growing a portfolio of high-growth SME companies with up to £6.5m turnover to help deliver the bank’s ambitious growth strategy in the North East.

Hunter joins Barclays from corporate finance advisor Rickitt Mitchell & Partners having previously held roles with Lloyds Banking Group.

Barclays has also appointed David Loughlin as a dedicated SME Relationship Manager for the Inverness area who will support businesses and help to drive Barclays’ business in the Highlands. His new position comes after seven years’ experience in the bank’s Edinburgh office supporting businesses in the local community.

The bank has also made three further Relationship Manager appointments. In the Glasgow team, Tom Every will look after SMEs from £1m-£5m turnover, and Michael Barclay will oversee SME’s up to £1m turnover. Daniel Farquhar will be responsible for SMEs up to £1m in the Edinburgh office.

The team will report into Stuart Brown, Head of SME who is leading the bank’s drive to expand its SME and high-growth business market share in Scotland.

Stuart Brown, Head of SME Scotland, Barclays commented: “Following a successful period for business in Scotland, the time was right to expand our team on the ground and specifically in these regions, as more businesses are choosing to bank with Barclays.

Stuart Brown, Head of SME Scotland, Barclays commented: “Following a successful period for business in Scotland, the time was right to expand our team on the ground and specifically in these regions, as more businesses are choosing to bank with Barclays.

“The expansion of our Aberdeen team with its first dedicated SME Relationship Director is a result of this growth and also demonstrates our commitment to support businesses in the North East. Hunter brings a wealth of experience while our Relationship Managers are passionate about ensuring our clients receive the best service.

“Following the launch of our £500m SME fund last year, we’re committed to delivering the right financial support for Scotland’s business community. The skills and experience of our new appointments will allow us to further strengthen our relationships regionally with existing and new customers.”

Barclays’ Scottish SME fund was launched in June 2016 to provide access to funding for businesses across all sectors with turnover up to £25m. It forms part of a wider commitment by Barclays to support fast-growing companies with its High Growth & Entrepreneurs programme. The programme offers locally delivered financial advice, business skills development, networking opportunities at a local, national and international level and access to Eagle Labs and RISE accelerators. The Bank also provides a unique Innovation Finance Venture Debt product via an additional £200m fund.

• Scotland scores in the top four of all UK regions in an assessment of nationwide digital skills

• Scotland scores in the top four of all UK regions in an assessment of nationwide digital skills

• 60% of Scots have ‘above-basic’ digital skills, meeting current demand from employers

• Scottish digital workers have the best problem solving skills in the UK

• Edinburgh performing better than Glasgow for digital skills and safety

• Scottish workers with ‘expert’ digital skills can earn £9,029 more a year

New research from Barclays reveals that employees in Scotland score among the highest of all UK regions for their digital skills and are currently meeting the digital skills demand from employers.

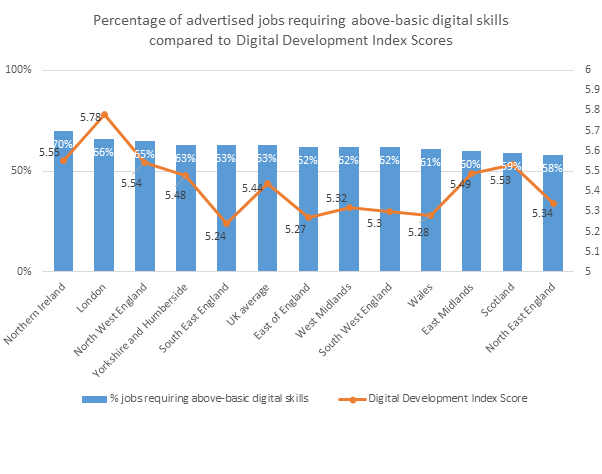

The Barclays Digital Development Index 2017, which analysed 88,000 UK job adverts and 6,000 adults, found that Scotland ranks in 4th place overall for digital skills – following London, Northern Ireland and North West England. With 3 in 5 (60 per cent) of Scots boasting ‘above-basic’¹ digital skills, it seems demand (59 per cent) from employers is being met.

In the UK, Scots topped the poll for ‘solving problems’ scoring 6.70 out of 10 in The Index (0.22 above the UK average). However, although Scotland is above the UK average for 5 out of 6 of the digital skills categories², the region is below the UK average for ‘content creation and coding’ skills (3.42 vs UK average of 3.44).

When comparing cities, it’s no surprise that Edinburgh – which has long been considered as Scotland’s digital hub – is significantly outperforming the friendly city. The capital scored 5.90 out of 10 for digital skills and 6.25 out of 10 for digital safety (versus Glasgow’s scores of 5.51 and 6.05).

If workers are willing to up-skill and become digital ‘experts’, they could earn more money as Scottish employers will pay a premium of £9,029 a year for digital skills that include programming and software design. Earnings boosts of more than £7,000 a year are also up for grabs for those with graphic design, data and 3D modelling skills – a significantly higher premium than the UK average (£3,000 a year), demonstrating Scotland’s demand for graphic design, data and 3D modelling skills.

The nationwide picture

Unlike in Scotland, digital skills across the UK are not keeping pace with demand. The Barclays Index finds that 63 per cent of UK jobs require digital skills such as word-processing, database spreadsheet or social media management skills, but only 57 per cent of the workforce has these capabilities. This mismatch will worsen as digital skills become even more vital to British businesses.

And although they have up to 30 years left in their working lives, it seems Generation X (35-54 year olds) is being left behind. Those aged 35-44 are 11 per cent less likely than their millennial colleagues to say they are very confident about their digital skills. Generation X workers are also more worried about their ability to keep their skills up-to-date (21.5 per cent have confidence in their ability to do so, versus 28 per cent for millennials).

Education also boosts digital scores; Masters Graduates score 35 per cent higher than those who leave school without any qualifications. And those in management positions score far better in the tests than those in junior positions, and 20 per cent above the UK average.

Jamie Grant, Head of Corporate Banking for Barclays in Scotland, said: “In recent years, we’ve seen a movement across Scotland to tackle digital exclusion and with improved digital skills returning a range of social, cultural and economic benefits it is clear why it is of such importance.

“With this come the issues of cybersecurity and cybercrime. Digital safety has never been more important but with Scotland sitting at the half way point of the UK Digital Safety Index, it’s evident that more can be done to upweight our ability to deal with these issues as well as improving skills.

“In direct response to this, we launched a multi-million pound #digisafe campaign earlier this year, the centrepiece of which is a new online digital safety quiz – a great starting point for anyone looking to develop their knowledge.”

To find out how digitally safe you are, take the new quiz at the Barclays Digital Safety Hub www.barclays.co.uk/security or simply search for “Barclays Digital Safety”.

¹ ‘Above-basic’ digital skills include proficiency with word processing, database spreadsheet and social media management. ‘Basic’ digital skills include the ability to send and receive emails and search online.

² Digital skill categories include: Researching and evaluating information; communicating and collaborating; protecting data and devices; content creation and coding; solving problems; knowledge and attitude.