Scotland has £32BN in hidden cash that could be used to fund growth

- Scottish businesses have £32.2bn tied up in excess working capital

- Firms in the region have the equivalent of 11 per cent of total revenues tied up

- This puts pressure on cash flow and makes it harder for firms to deal with any unforeseen challenges or opportunities

- The trend is driven by a combination of business growth and falling efficiency in managing customer payments and stock

Businesses across Scotland have around £32 billion tied up in working capital, according to new analysis of more than 5,000 UK businesses from Bank of Scotland Commercial Banking.

Working capital is the amount of money that a company ties up in the day-to-day costs of doing business and tends to increase as businesses grow or as efficiency falls.

The fact that the amount of money tied up in things like inventory or unpaid invoices increased by two per cent in the past year could be a positive sign for the Scottish economy.

But tying up too much money in day-to-day costs puts pressure on cash flow and experts fear that the fact that working capital now accounts for 11.4 per cent of Scottish firms’ revenues could leave many firms ill-prepared to respond to change.

Across the UK, the amount of money tied up in working capital leapt 37 per cent in the past 12 months to £680 billion. This was caused partly by the fact businesses were growing, but also by the fact firms – and particularly smaller ones – were becoming less efficient at collecting cash from customers.

Simon Quin, area director for Global Transaction Banking at the Bank of Scotland, said: “Revenue growth is good news for any business, but to improve efficiency is going to take investment and that requires cash flow.

“Small firms in particular are taking even longer to free up cash from things like inventory and unpaid invoices. The longer that money remains unavailable, the less firms can invest in growth, new machinery or pay down debts.

“Companies that manage their working capital well can generate healthy cash flow and will be best placed to invest in their businesses and take advantage of new trading opportunities

“Those who don’t may find it difficult to deal with a potential rise in interest rates later this year, or to take on the opportunities and challenges created by Brexit.”

The report also found that, across the UK, revenue growth nearly quadrupled during 2017 to 8.3 per cent, from 2.1 per cent in 2016.

At the same time, firms’ inventory levels increased by 10.6 per cent, while outstanding invoices increased 10.3 per cent.

To deal with the extra working capital, 13 per cent of large firms lengthened the time they took to pay suppliers, compared with just four per cent of small firms.

Payment terms was the second biggest concern affecting firms’ working capital and cash flow, cited by 16 per cent of businesses nationwide, behind demand uncertainty (31 per cent) and ahead of rising costs (13 per cent).

Regional variations

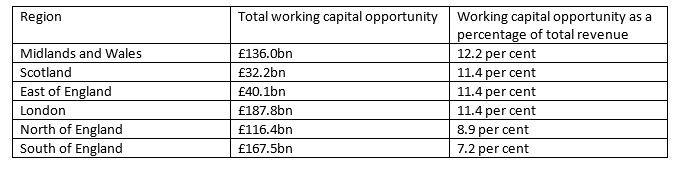

Elsewhere in the UK, firms in the Midlands and Wales have the greatest opportunity to free up cash, with 12.2 per cent of total revenue currently tied up in working capital.

The opportunity is smallest in the South of England, where firms tie up only 7.2 of total revenue tied up in working capital.

For more information about the Lloyds Bank Working Capital Index, visit www.lloydsbank.com/workingcapital